The Digital Assets Report 96

Summary

FTX contagion turns to Genesis , rising fears with GBTC

FTX signed for Bankruptcy a week ago , evidence exposed:

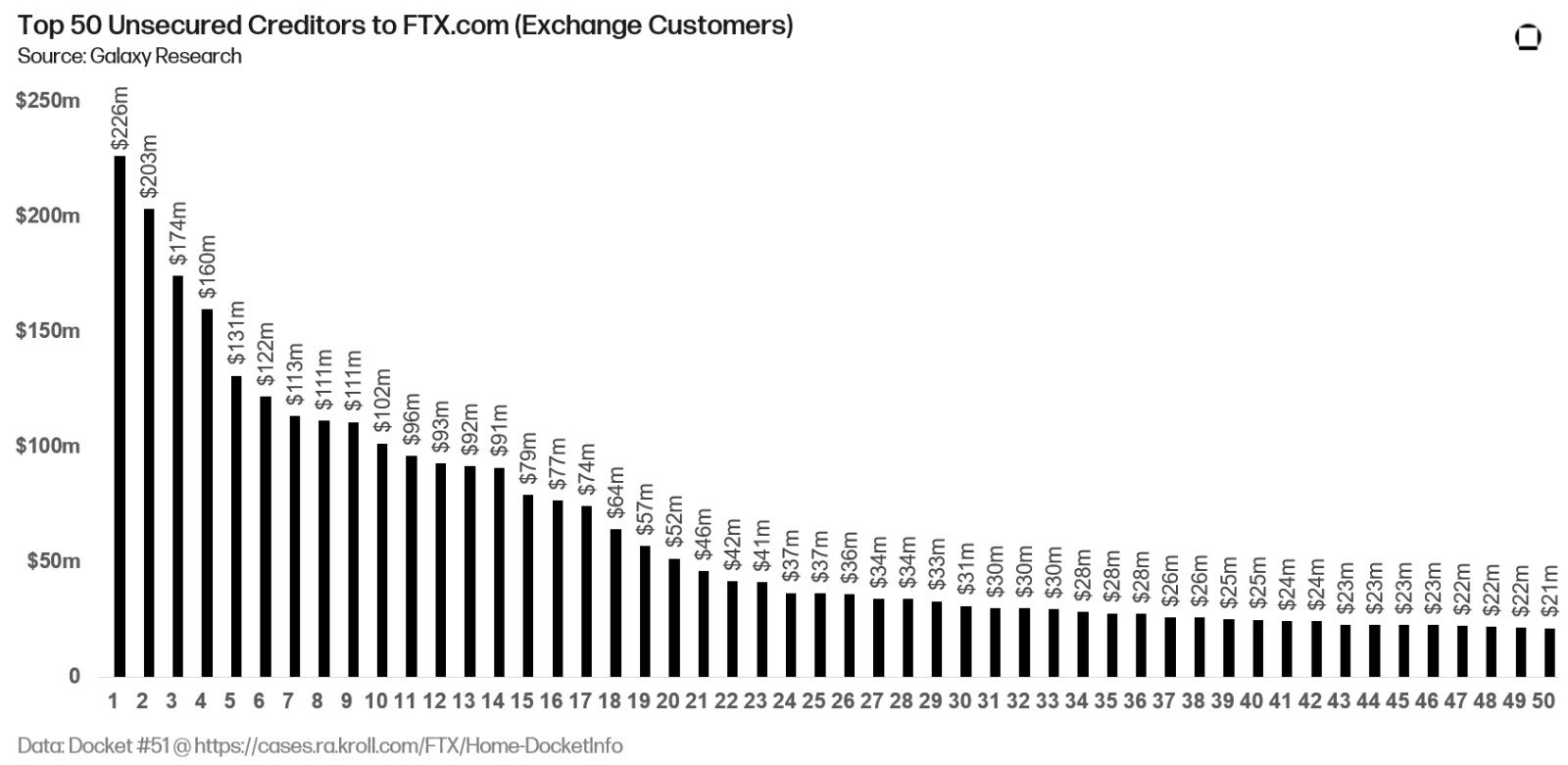

- FTX owes to its top 50 creditors more than $3 billion.

- FTX ex-CEO Sam Bankman-Fried (SBF) over $1 billion for personal use and $543 million to the Director of Engineering Nishad Singh.

- First audit revealed compromised systems integrity, faulty regulatory oversight abroad, inappropriate concentration of control, unaudited balance sheets, no accountant, no trace of business decisions as well as no staff details.

- Wall Street Journal & New York Times released complaisant articles painting FTX ex-CEO as a great philanthropist who failed at his business, while never mentioning the misuse of customers funds and multiple lies, Twitter crowd protesting violently against "newspaper establishment complicity".

- The Bahamian regulators who first said they did not order to FTX the allowance of Bahamas-based customers to withdraw funds , Nov 12 have released a new statement Nov 17th., these regulators enforced moving the assets to a “digital wallet controlled by the Commission, for safekeeping.”

- Hacker(s) who stole around $477 million worth of cryptocurrency from FTX have started to launder the funds 200'000 Ethers into bitcoin.

- Crypto lender Genesis plagued by FTX contagion serving $2.8 billion in total active loans Q3 2022, has halted customer withdrawals. Genesis is seeking $1 billion liquidity injection until this Monday. BlockFi, Gemini earn, Coinhouse impacted, thousands of end users impacted.

- Grayscale Bitcoin Trust ($GBTC) discount at 45%, following lack of direct proof of reserves and hazardous justification brought fear to investors globally as well as Genesis Trading is linked with BGTC, both are subsidiaries of Digital Currency Group (DGC).

- Solana Developers changed Serum (Decentralised Exchange) to a new version because the previous one was controlled by someone at FTX and might be compromised, questioning the centralisation of Solana.

To watch this week :

- FTX Bankruptcy First Day Hearing - Tuesday 4pm

- FOMC Meeting Minutes - Wednesday 7pm

Business

FTX Owes Its 50 Biggest Unsecured Creditors More Than $3 Billion

Sam Bankman-Fried’s bankrupt crypto empire owes its 50 biggest unsecured creditors a total of $3.1 billion, new court papers show, with a pair of customers owed more than $200 million each.

Crypto lender Genesis suspends withdrawals as FTX fallout continues

Suspensions follow reports of BlockFi exploring possible bankruptcy

Grayscale refuses to share proof of reserves due to ‘security concerns’ as shares trade at a 45% discount to bitcoin

Grayscale won’t be sharing its proof of reserves with customers, citing “security concerns.”

Guy Linked to Huge Crypto Meltdown Says It’s Just a Coincidence That He’s Hanging Out in a Country With No Extradition to United States

As crypto exchange FTX continues its demise, 3AC’s Zhu Su and Kyle Davies have somewhat unexpectedly crawled out of the rubble.

Solana Loses $1 Billion in USDT to Ethereum in Tether Chain Swap - Decrypt

Tether has announced a $1 billion chain swap to convert USDT it had on Solana’s blockchain to Ethereum’s blockchain.

FTX-owned service being used to launder hundreds of millions ‘hacked’ from FTX, researchers say

Hackers who stole around $477 million worth of cryptocurrency from collapsed exchange FTX have started to launder the funds into bitcoin.

Solana Coin, Silvergate Plunge As FTX Contagion Spreads

Tokens associated with Bankman-Fried crash by double-digit percentages, Silvergate shares punished.

Businesses Can Now Accept USDC With Apple Pay - The Defiant

Circle’s Move Comes as Stablecoin Has Been Losing Market Share

Markets

Crypto Charts 88

Bitcoin As mentioned last week: ’I think we will continue to see BTC under pressure for a final push to new lows to complete 5 waves down. A move back above $19′400 will confirm a low is in place. Initial support comes in at $15′060 where wave (v) is equal

Regulations

Bank of England unconvinced DeFi can solve financial risk

The deputy governor of the Bank of England is not convinced DeFi protocols can mitigate risk in the manner claimed.

Opinions

Vitalik Buterin: Bitcoin Fans ‘Ignored’ El Salvador’s Undemocratic Government - Decrypt

The Ethereum creator took aim at members of the Bitcoin community who backed the “not very democratic” regime in El Salvador.

Subscribe to read | Financial Times

News, analysis and comment from the Financial Times, the worldʼs leading global business publication

Podcasts / Readings

Unchained - Jesse Powell and Kevin Zhou on How FTX and Alameda Lost $10 Billion - Ep. 423

Kevin Zhou, cofounder of Galois Capital, and Jesse Powell, cofounder of Kraken, talk about why FTX collapsed, the warning signs, and whether it’s a catalyst for self-custodial adoption. Show highlights: the root causes of the FTX collapse, according to Jesse and Kevin whether there were warning…