Summary

Despite market turmoil, we saw a rebound that could be a bull trap but highly driven by strong long term sentiment of current BTC and ETH holders.

- Goldman Sachs sees crypto investment opportunities after FTX fiasco.

- Silvergate is under market scrutiny and stocks are stress tested following FTX and Blockfi collapse.

- Bybit, Kraken, Crypto.com, 30% in average around 1100 employees for Kraken, 1000 for crypto.com.

- Genesis owe $900m to Gemini exchange which are customers funds mainly.

- Bitcoin become a legal tender for payments in Brazil.

- Apple setup a tax on IOS app using peer to peer transfers, coinbase desactived NFT feature on its app after Apple claiming 30% of ethereum gas fees for NFT transfer.

- Crypto companies stop their IPO initiatives. Circle will not move as initially planned via a SPAC deal with Concord Acquisition. Prime Blockchain Corp. and eToro have also terminated their similar venture.

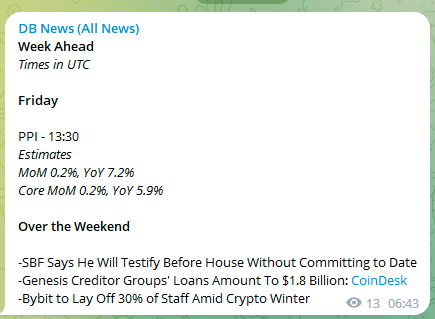

- Sam Bankman-Fried (SBF), "kindly" declined the CFTC chair woman invitation who stressed him later to join December 13th. Allison Alameda ex-CEO , a person who can shade lights on this affair, has been spotted in NYC last week-end while reported in HK. Speculation rise around prosecutors might preparing a case against Bankman-Fried.

- Ethereum foundation sold 100'000 ETH during the ATH in 2021.

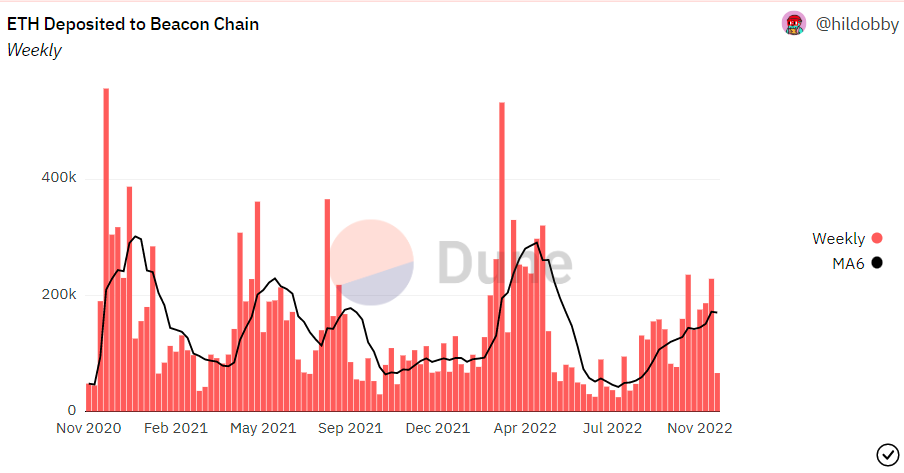

- Jump trading seems to dump 2'000'000 ETH per 20k ETH block / week based on onchain analysis ( probable TWAP ), markets did react pretty well so far, 170k ETH were locked last month in the beacon chain ( ETH2.0 staking).

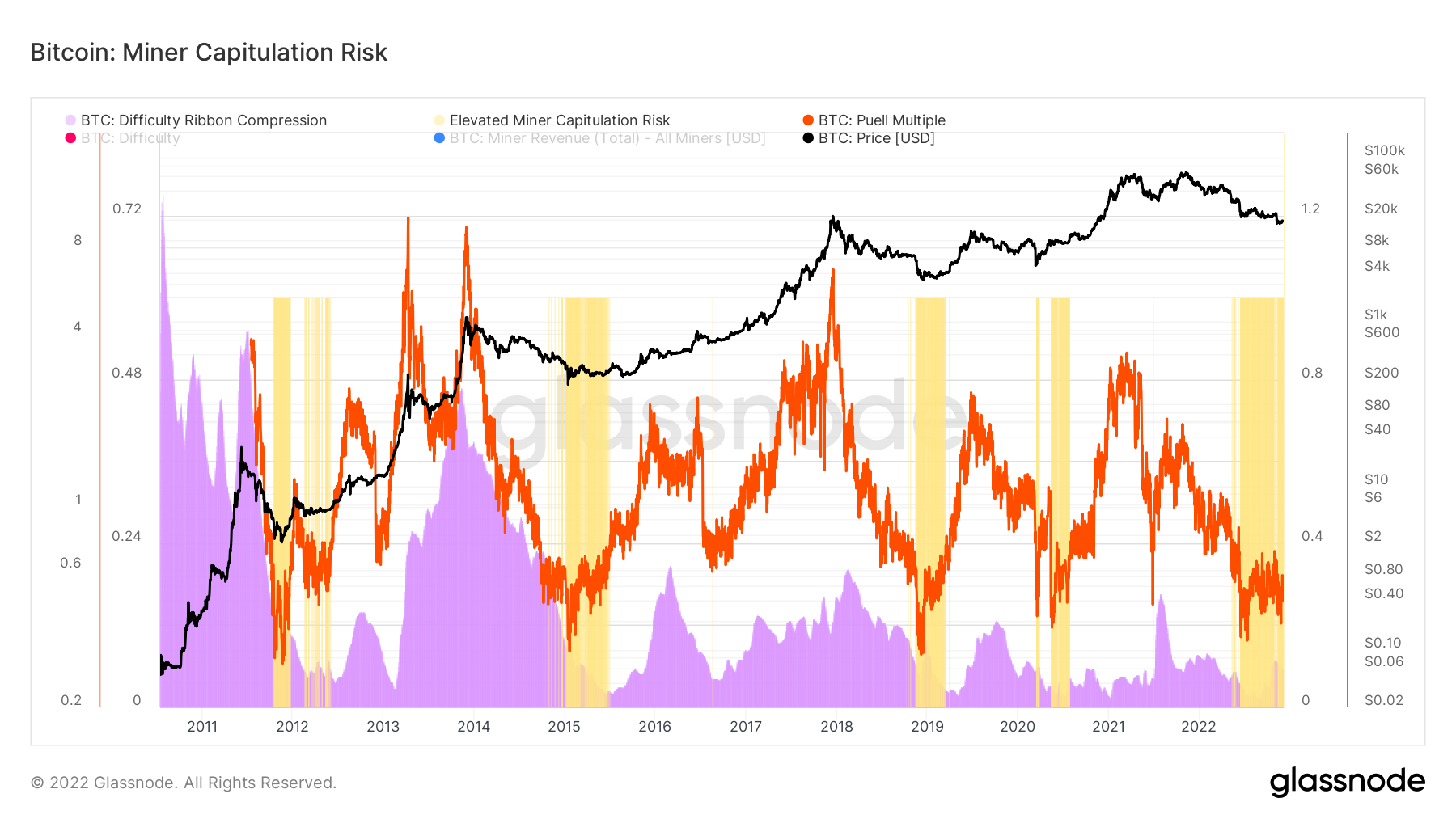

- BTC future volumes fall to lowest since 2 years, 3rd highest Bitcoin miner selling of all time after after 2011 and 2015.

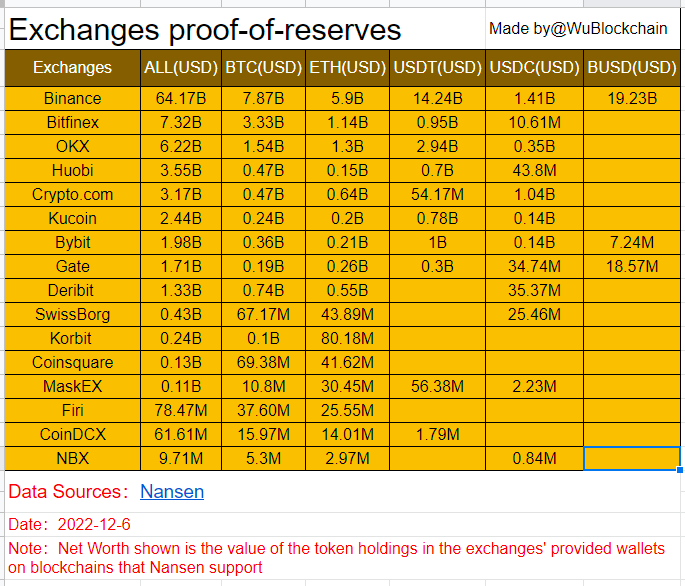

- Exchanges proof of reserves show very little BTC, ETH and cash balance, while their global assets valuation is higher, revealing balances are mainly altcoins based (and subject to high volatility).

- Deputy PM Wong says Singapore has no aspirations to become a crypto hub and seeks to be a ‘responsible and innovative digital asset player’.

- ANKR being exploited, attacker minted over 4 billion dollars of wrapped BNB

To watch this week

Business

It appears that Jump are selling their 2,000,000 ETH bag now

— Arad (@aradtski) December 1, 2022

At the current rate of 20,000 ETH/week (automated; look at the timestamps), it will take them 2 years to get rid of it all pic.twitter.com/es7Bu8SVyk

Markets

Technical analysis

BlockFi bankruptcy following FTX collapse is spreading to miners who have borrowed against their mining material during bull market. Many miners have been hit by skyrocketing energy prices and the rise of the Bitcoin difficulty, miners above $0.6 TW/H cost might capitulate soon, forced to sell their machines and bitcoin reserves.

Regulations

"It is imperative that you [Sam Bankman-Fried, FTX founder] attend our hearing on the 13th, and we are willing to schedule continued hearings if there is more information to be shared later” - Maxine Waters

Opinions

"I actually believe most of the companies are not going to be around."[...] the next generation for markets and next generation for securities will be tokenization of securities." - Lary Fink, Blackrock CEO.

It's stolen customer money used in his hedge fund, plain and simple.

— Brian Armstrong (@brian_armstrong) December 3, 2022

Reading / Podcasts