Summary

- FTX contagion still expanding, Digital Currency Group CEO, Barry Silbert, stated last Tuesday that DCG owes $575 million to Genesis Trading's crypto lending subsidiary, which has a debt revealed of $2 billion. Crypto community has concerns regarding the DCG financial solidity to cover the losses. Fear spread to the Grayscale Bitcoin Trust, the world's biggest trust with 635,235 Bitcoins, but possibility of liquididation seems highly improbable.

- FTX case raised multiple interrogation with political donations, media sponsoring, under the image of effective altruism, Sam Bankman-Fried has built a story that most of the people bought.

- FTX via its sister company Alameda Research has invested $11.5 million in one of the smallest bank of US (valuation at $115m for 10m AuM), where Deltec's bank chairman is also on the board. Deltec Bank is famous for being Tether's bank. The banking connection between Tether and FTX/Alameda became a concern for many in the crypto community, as Tether itself has long been under scrutiny for reserve audits.

- Ryan Pinder, Senator & Attorney General of the Bahamas who is leading the inquiry of FTX fraud, was previously Head of Wealth Management & Chief Legal Officer at Deltec Bank.

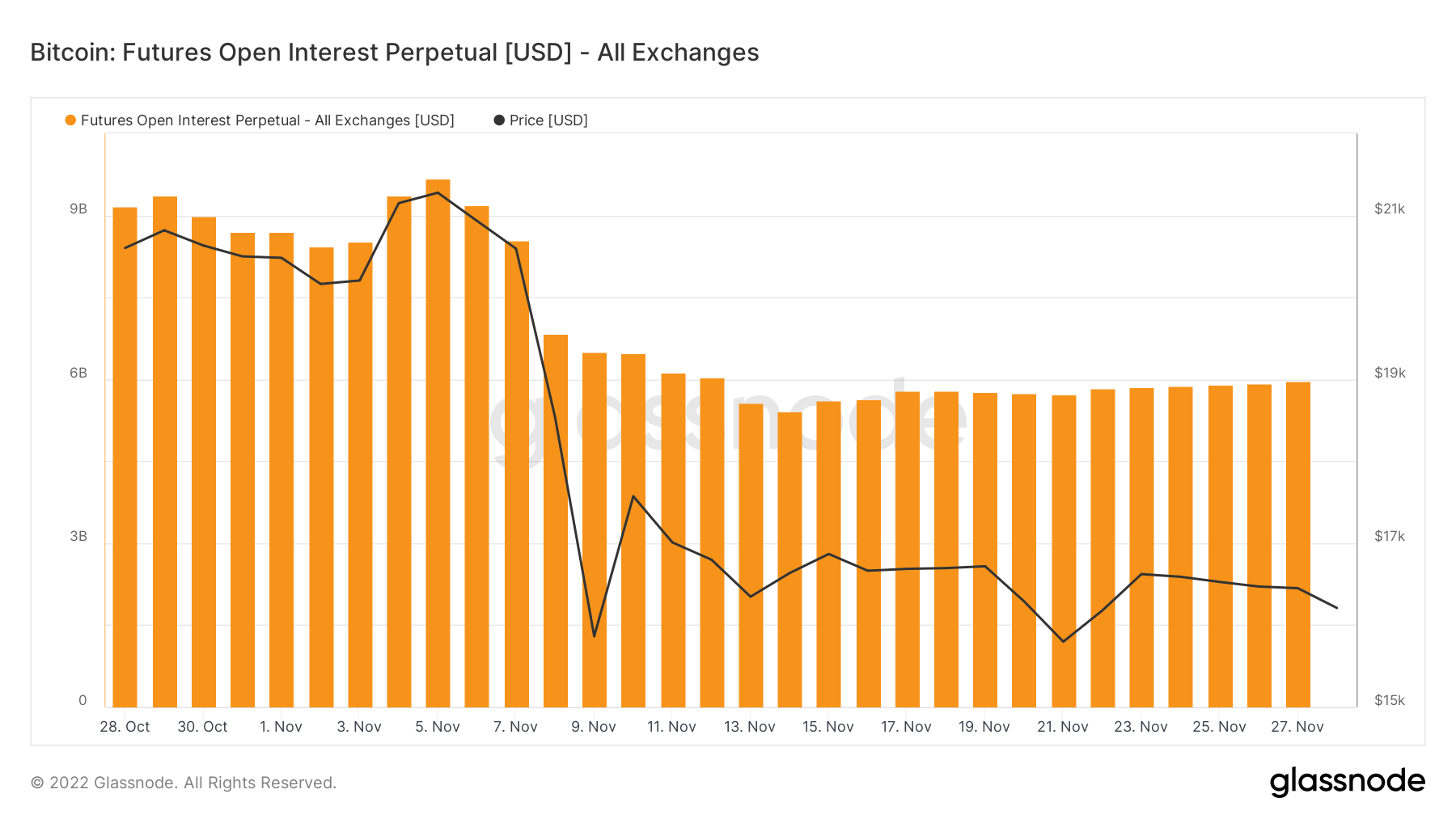

- Extreme fear index with key players like Genesis and unknown ramification yet who spread FUD on markets leads to important sales hard to defend for bulls.

To Watch this week

- Sam Bankman-Fried, ex CEO of FTX, is speaking at NYT Dealbook - Wednesday 30th

- U.S. GDP Growth Rate - Second Estimate (Q3 2022) - Wednesday 30th

- Real Consumer Spending - Quarterly Avg. (Q3 2022) - Wednesday 30th

- US Senate hearing FTX - Thursday, 1st

Business

Crypto lender BlockFi files for bankruptcy after FTX collapse

BlockFi announces Chapter 11 bankruptcy filing in US as fall of FTX continues to reverberate across industry

DCG’s Barry Silbert reveals crypto firm has $2 billion in debt as he tries to calm investors after FTX

Barry Silbert, the founder of crypto conglomerate DCG, said his company is on pace to generate $800 million in revenue this year as he tries to calm investors.

Controlling shareholders’ stakes in GBTC are ‘highly illiquid’: Report

The world’s largest Bitcoin trust is currently trading at a 40% discount to NAV.

Inside FTX Founder Sam Bankman-Fried’s Charmed Upbringing

The disgraced cryptocurrency CEO’s parents both teach at Stanford.

FTX’s Bahamas unit paid co-CEO’s MAGA Republican congressional candidate girlfriend $400,000

Michelle Bond, who is in a relationship with FTX’s Ryan Salame, earned hundreds of thousands as a consultant for the disgraced cryptocurrency company.

FTX stake in US bank raises concerns about banking loopholes

The chairman of the rural bank, Jean Chalopin, also happens to be the chairman of Deltec Bank, which has Tether and Alameda both on its client list.

Exclusive: Moonstone Bank further explains Gemini and Revolut ties

Alameda’s ties to rural Moonstone Bank had the internet enraptured over Thanksgiving. Protos re-interviewed a top exec to learn more.

Crypto Twitter calls for calm after wETH insolvency joke goes viral

Rumors of Wrapped Ethereum’s (wETH’s) insolvency gripped the crypto community over the weekend, but it has been revealed to be one big inside joke that went out of control.

Markets

Crypto Charts 89

Bitcoin I am showing the long term chart for BTC today. As mentioned last week: ’wave iv often appears as triangles with an impulsive break to the down side targeting $15′060 followed by $13′430. A move back above $18′140 would now be the first indication a low is in place

Regulations

The Bahamas’ Attorney General Defends Country’s Regulatory Regime Amid FTX ‘Debacle’

Ryan Pinder said The Bahamas would not share further information about his country’s investigations into FTX at this time.

"Instead of issuing a retail {central bank digital currency} , central banks could support stablecoins by allowing them to be backed one-for-one with balances in a central bank account,”

Antoine Martin, financial stability advisor at the Federal Reserve Bank of New York.

‘Blockchain, not Bitcoin’ is Dead? Australian Bourse Cans DLT Shift

The Australian Securities Exchange hoped to upgrade its aging settlement layer with a blockchain, but its DLT just wasn’t up to scratch

Russia intends to launch a ‘national crypto exchange’

“It makes no sense to deny the existence of cryptocurrencies,“ said one Duma official.

Bank of Japan to trial digital yen with three megabanks

Despite Japan’s uncertainty on whether to issue a central bank digital currency, the Bank of Japan continues experimenting with a potential digital yen.

Africa’s Growing Crypto Market Needs Better Regulations

Opinions

Opinion: FTX fall stresses centralization vs decentralization debate

While decentralization is one of crypto’s main tenets, it’s likely that more centralization could have stopped the fall of crypto giant FTX.