Summary

- SVB the 16th largest US bank, is the most important bank failure since 2008 financial crisis.

- In the wake of SVB, Signature and Silvergate banks, the 2 largest banks operating as the "backbone" of the crypto industry in US went to bankruptcy also.

- Stablecoin USDC has de-pegged during the week-end due to the $3.3bn Circle deposits uncertainty at SVB.

- Moody’s Downgrades the Entire U.S. Banking System.

- US clients & crypto firms seek Swiss banking partners amid banking meltdown.

- President Biden said during his 4min speech that taxpayers will not be charged but instead the FDIC will fill the holes ($128bn insurance fund) and will increase the yearly banks contribution fees.

- New York Attorney General files action against crypto exchange Kucoin and takes position That ETH Is a Security.

- Justice Department, SEC Investigating Silicon Valley Bank’s Collapse.

- EU Parliament passes bill requiring Smart Contracts to include kill Switch.

- Crypto lending protocol Euler Finance suffered a loss of $199 million on the morning of March 13, following a flash-loan attack.

- Meta winds down support for NFTs on Instagram and Facebook.

- Biden budget proposes 30% tax on crypto mining electricity usage.

Business

Silicon Valley Bank (SBV) collapsed.

- Biggest U.S. bank to fail since the 2008 financial crisis.

- Dec 31st 2022 SVB had $173.1bn in deposits and only $74.3bn in loans, deposits had tripled in the last 2 years. According to PitchBook, 65,000 startups ( 50% of US VC-backed startups) for life science and tech were banking with SVB.

What was the reason of the collapse ?

Macro environment

- Volatile market conditions have severely impacted VC funding activity for tech start-ups. As they needed to withdraw cash faster than anticipated, it has led to recurrent withdraw to end up with massive bank run, $42 billion was withdrawn last Thursday.

- SVB rooted in treasury management with bad bets on rates with 10Y US T-Bills, capital was locked.

- Last Wednesday, the public announcement from CEO Greg Becker, to raise $2.25 billion in capital, has triggered the strongest (daily) bank run of the US history the following day.

- The liquidity crisis led to the sale of $21 billion in asset that sparked a $1.8 billion loss.

Previous to the fail

- CEO sold $3.57 million of stock within the last two weeks. Last month General Counsel, CFO, CMO sold respectively 19%, 32%, and 25% of their shares.

- The company didn't open for trading last Friday after its shares dropped by 62% premarket trading.

- SVB employees received bonuses hours before government takeover.

- SVB had no Chief Risk Officer for 9 months, from April 2022 until January 2023.

Silvergate bank went bankrupt.

- The Bank had $12 billion in deposits from 1,677 "Silvergate Exchange Network" (SEN) customers including all major cryptocurrency exchanges and over 1,000 institutional investors.

- The run was sparked by the erosion of trust across crypto after FTX's meltdown in November 22.

- Q4 2022 , the bank had $1 billion loss resulting in an $8.1 billion run on the bank: 60 percent of its deposits that walked out the door in just one quarter.

Uh-oh! The crypto collapse has reached the real financial system

Silvergate’s troubles may make it harder to get out of crypto and into dollars.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24476979/236558_Silvergate_Stablecoin_WJoel.jpg)

How Silvergate’s Crypto Collapse Differed From Silicon Valley Bank’s: No Bailout

A deep dive into regulatory filings shows how Silvergate Bank’s collapse was, in a strange way, the ideal scenario for a failing institution. Sure, shareholders got wiped out, but depositors are made whole and the Federal Deposit Insurance Corp. isn’t putting in a dime.

Signature Bank has followed.

- Signature Bank became the 3rd-largest bank failure in US history with $100 billion assets under management ($16.52 bn in Digital Assets).

- In the wake of SVB collapse and Silvergate, Signature Bank's clients withdrew more than $10 billion in deposits.

Signature Bank and former executives sued by shareholders for alleged fraud

The plaintiffs claimed that Signature Bank hid its susceptibility to a takeover by making false or misleading statements about its health.

StableCoin USDC has de-pegged this week-end

- Circle said in a tweet on Friday it has $3.3 billion of its $40 billion of USDC reserves at Silicon Valley Bank.

- USDC depegged to a low of $0.872 before recovering Tuesday after announcement of the FDIC which will cover SVB clients' deposits.

Curve Finance, Uniswap Trade Volumes Soared Amid USDC Depeg - Decrypt

As volumes soared across Curve and Uniswap amid USDC briefly losing its peg, liquidity providers have also raked in some serious cash.

U.S. crypto firms seek Swiss banking partners amid banking meltdown

U.S.-based crypto firms are trying to open Swiss bank accounts after the collapse of two U.S. crypto-focused banks made it harder for them to use lenders in the United States, but bankers said the Swiss firms may not take them.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VEMNAX3DIBMGZGCA5HIDFVEFVM.jpg)

Rani Jabban, Arab Bank Switzerland Managing Director, Head of Treasury express onboarding complexity with US citizen and entities

Entire US banking system downgraded after Silicon Valley Bank chaos - latest updates

The outlook for the US banking system is "negative" after a "rapid deterioration" in conditions for the institutions, Moody’s has warned.

DeFi Lender Euler Finance Drained of $197M In Flash Loan Exploit - Decrypt

Euler Finance suffered an exploit of at least $197 million. Reports indicate the attacker used flash loans to nab a variety of assets.

DeFiance Capital completes first close of $100 million liquid token fund

DeFiance Capital, Arthur Cheong’s crypto investment firm, is back in the game after getting hit by the now-bankrupt crypto hedge fund Three Arrows Capital.

Meta Will End Support for NFTs on Instagram, Facebook

Meta’s Stephane Kasriel said on Twitter the decision is prompted by a desire “to focus on other ways to support creators, people, and businesses.”

Markets

Crypto Charts 102

Bitcoin Last time we said: We are now correcting in wave (ii) that might take us below last weeks stop levels. I would lower stop loss levels to below $18′900 and look to add to longs at $21′415, $20′283 and $19′200. Once this correction is complete I expect a sharp

Technical Analysis by Matthew Clark, Veteran Trader, Director of trading

- Despite Fed and FDIC have signaled that they'll backstop basically every bank's deposits, President Bidden last Monday did not win back market confidence in US banking industry. Bitcoin is up.

- Silicon Valley Bank collapse ‘could force central banks to stop interest rate rises’.

- February CPI shows inflation at 6.0%, in-line with expectations of 6.0%.

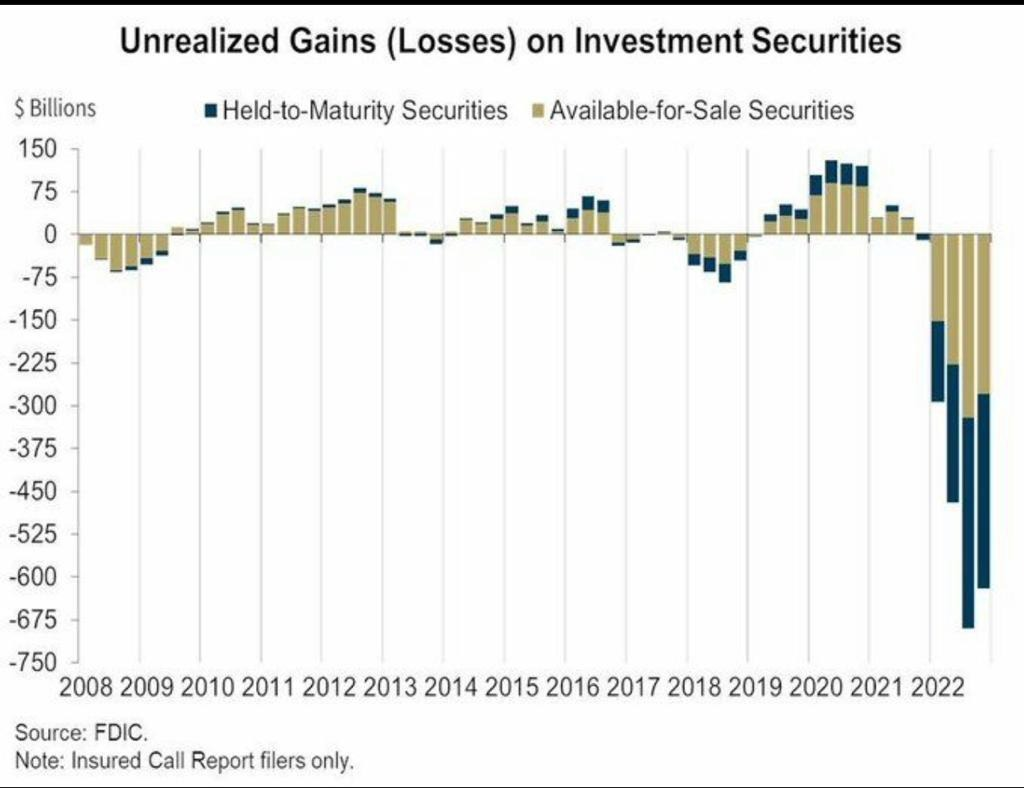

- US banks were sitting on $620 billion in unrealised losses (assets that have decreased in price but haven’t been sold yet) at the end of 2022, according to the FDIC.

Yesterday was the biggest one-day drop in the 2yr Treasury yield since 1982; today is set to be the biggest one-day rise in the 2yr yield since Sept 2008

— Michael Brown (@MrMBrown) March 14, 2023

Bitcoin Options Volume on Deribit Hits Highest Level in 22 Months as Bank Failures Breed Volatility

Traders seek options to hedge against market volatility as U.S. bank failures triggered sharp repricing of interest rate expectations.

US banks sitting on unrealized losses of $620 billion | CNN Business

Silicon Valley Bank’s collapse last week sent tingles of panic down investors’ spines as it highlighted a larger problem across the banking sector: The widening gap between the value large lenders place on the bonds they hold and what they’re actually worth on the market.

Bitcoin price breaks $26K as US inflation comes in at 6%

The CPI rose less than 0.5% last month, according to new United States Department of Labor data.

Opinions

The Banking Crisis Is Not Crypto’s Fault

Crypto might have a banking problem, but banks don’t have a crypto problem.

An interview with Cozomo de’ Medici, the ‘grand patron’ of the digital art renaissance | Christie’s

The pseudonymous digital art collector sat down with Christie’s to chat about the future of art on the blockchain

Regulations

WSJ News Exclusive | Justice Department, SEC Investigating Silicon Valley Bank’s Collapse

Probes include examining executives’ share sales before bank’s failure.

U.S. Treasury Department Proposes 30% Excise Tax on Crypto Mining Firms

President Joe Biden unveiled his 2023 budget proposal on Thursday.