- Very bullish outlook for Bitcoin for Q4

- Bitcoin supply is very low

- Long-term holders are waiting for higher price rally

- Demand is steady and absorbing sell pressure

Long-Term Holder Cycle

Long-term holders or LTHs are categorized as investors who have held their bitcoins for more than 155 days. A LTHs' willingness to hold increases the longer he holds his bitcoins. We have observed a cycle in the behaviour of LTHs of bitcoins in the last decade. Understanding this cycle is crucial for making sense of the current market and where price will go. The cycle plays out as follows:

- Large accumulation of bitcoins occurs shortly after a price capitulation as investors have strong conviction for higher prices

- These new investors hold their bitcoins for several months, on wallets stored off-exchange

- This holding behaviour constricts the supply of bitcoins and eventually pushes prices higher

- After 155 days, the investors that had accumulated are considered LTHs and start selling with prices nearing a top

- When a majority of LTHs have sold, prices drop drastically

- Cycle restarts with a new batch of high-conviction investors looking to hold for the long-term

Where are we now ?

We are currently at the stage that precedes the large bull run that LTHs have accumulated for.

When prices dropped from the May 2021 all-time high, investors saw a good opportunity to accumulate bitcoins as prices bottomed to $30'000 in July. These investors have held strong and are now considered LTHs as 155 days have elapsed since the accumulation period in July. This holding behaviour has decreased the overall supply of bitcoins on exchanges.

As per the pattern, if the supply of bitcoins continues to decrease, we should expect prices to be pushed much higher. The metric below illustrates the current supply of bitcoins in the market.

Balance on All Exchanges

This metric describes the total amount of bitcoins available on all exchanges.

We can observe that the supply of bitcoin is very low at the moment. It is in fact the lowest it has been in three years.

The metric has significantly dropped since prices reached $30'000 in July. This confirms that investors have accumulated in recent months and stored their coins off-exchanges, which has now drastically decreased the overall supply of bitcoins on the market.

How much longer will LTHs hold their bitcoins for ?

As per the cycle, a low bitcoin supply caused by a long period of accumulation pushes prices higher eventually. Prices have indeed doubled since the July lows. It is now important to evaluate how much longer LTHs will hold their bitcoins before realizing profits and decreasing prices.

LTH Net Unrealized Profit / Loss

The LTH NUPL metric perfectly describes how willing LTHs are to keep holding their bitcoins as opposed to selling to realize profits.

The NUPL is a ratio between Relative LTH Unrealized Profit and Relative LTH Unrealized Loss.

It describes the total standing profit level of all entities that have been holding coins for at least 155 days.

We can observe that the LTH NUPL is currently at 0.71. This means that all LTHs on average have an unrealized gain of 71%.

Historically, LTHs have waited to reach NUPL levels of 0.9 levels to start realizing profits, much like in April 2021. As such, prices still have room to rally before LTHs feel inclined to sell their bitcoins.

Famous On-Chain Analyst Willy Woo expects LTHs to hold for much longer. He mentioned that

LTHs are now waiting for price to rally to 6 figures - Willy Woo

The reason why the NUPL is lower now than in April at the same price levels is because current LTHs accumulated their bitcoins at a higher price level compared to the LTHs that sold in May. The cycle therefore predicates that each new wave of LTHs will accumulate at higher prices, and push prices to new all-time highs.

Enough demand to push prices higher ?

We have established that the supply of bitcoin is very low, and that current LTHs are holding onto their bitcoins as they wait for higher prices. It is important to evaluate whether there is enough demand currently to push prices higher.

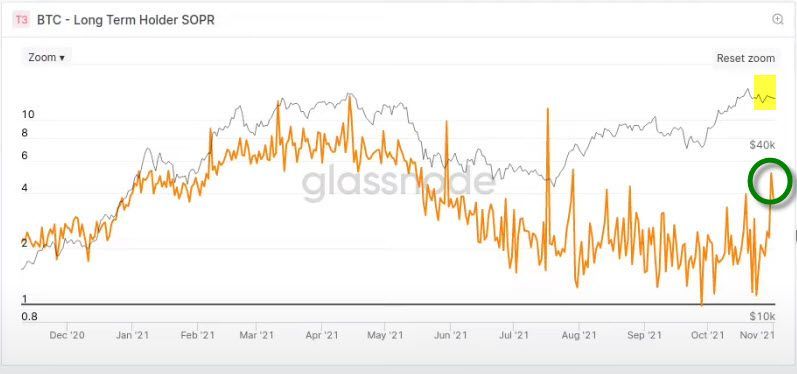

Long Term Holder Spent Output Profit Ratio (LTH SOPR)

This metric describes the profitability of spent Bitcoin relative to the realised value on a daily basis. In other words, it is the average realised profit level for LTHs and is a good gauge for demand levels when compared to price movement.

The LTH SOPR was high in April, as LTHs were realizing a lot of profits, which sent prices crashing as there wasn't enough demand to absorb the selling pressure.

Recently, the metric has exprienced a slight uptick as LTHs have started to realize profits. Prices however, have not declined like in May and instead moved sideways.

This is because there is enough demand in the market to absorb the selling pressure incurred by LTHs realizing profits.

Explosive Q4 ?

There is strong reason to believe that the 4th quarter of 2021 will be an extremely positive one for Bitcoin. The asset has become increasingly mature due to widespread institutional adoption. Additionally, on-chain metrics tell us that

- Bitcoin supply is very low

- LTHs are keen to keep holding their bitcoins

- There is enough demand in the market to absorb selling pressures

These are all very constructive factors for bitcoin's price moving forward.

Willy Woo expects a large price rally in Q4 that will extend into Q1 or even Q2 of 2022. He believes that we are currently very early in the LTH cycle, as prices just reached new all-time highs, and therefore can expect prices to go much higher from here.

He claims that investing in bitcoin now is

Not a risky call, as on-chain metrics indicate the factors on hand as well as an imminent price rally - Willy Woo

It will be interesting to keep these supply and demand dynamics in mind and to see whether prices do indeed rally much higher in the following months.