- BTC's weekly range tightens further with price remaining largely unchanged week over week

- Volatility & yields in derivatives markets have continued to decline

- Institutions found value at current price levels and have accumulated heavily in recent weeks

- Long-term BTC price model suggests that a bottom zone has been established

Weekly Price Action

Price: $38.8k

Week Open: $38.1k

Week High: $40.2k

Week Low: $37.5k

7-day return: + 1.9%

- This week saw weakness across equity, bond & crypto markets with BTC trading to a new monthly low of $37.5k

- Bitcoin has remained relatively robust this week as prices continue to trade within its YTD range, whilst the Nasdaq & the S&P500 indexes traded to new local lows

- Correlations between Bitcoin & traditional markets remain near all-time highs however, as the broader perception of Bitcoin as a risk asset remains and is a significant risk to its short-term price action

Price Structure

- Bitcoin's price has primarily ranged between $37.5k - $44k in 2022

- Price has traded within a tight range of $38.5k - $42k in the last month

- The BTC trading channel has compressed further in the last week which has caused its realized volatility and 30d beta to decline to 62.82% and 1.0 respectively

Macro Events

There are two significant market events taking place this week:

- FOMC meeting on Wednesday May 4th

- April Non-Farm payroll report on May 6th

Given the high BTC-NASDAQ correlation (30d correlation, 0.73), these events can impact the digital assets market.

Markets have already priced in these events according to the following estimations:

- FOMC meeting: 0.5% hike

- Non-Farm Payrolls: 375'000 gain compared with an increase of 431'00 in March

Positive news will likely translate into a buy signal with the opposite leading to a sell signal.

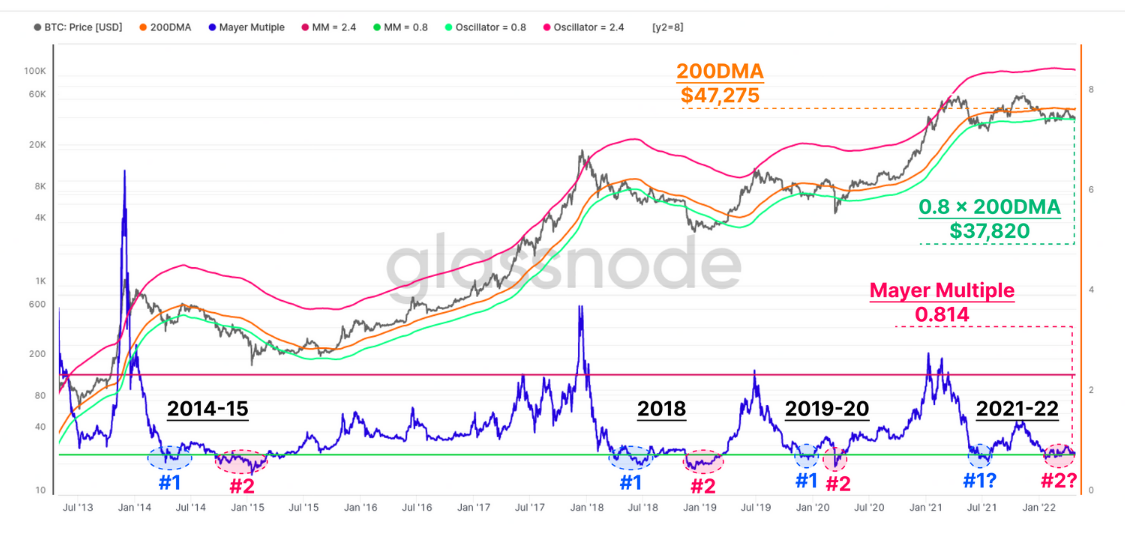

Mayer Multiple Model

- The Mayer Multiple (MM) is an oscillator calculated by taking the ratio between price & the 200d moving average, & has historically provided reliable long-term bottom & top signals for Bitcoin cycles

- The model is signalling that BTC is undervalued by - 20%, which is a level previously seen during late stage bear market floors

- This level is outlined below in green

- Bear markets of past cycles have tested the 0.8 bottom zone on two occasions before significant recoveries in price

- The MM is currently consolidating within the green zone and is testing it for the second time during this bear market cycle (2021-22)

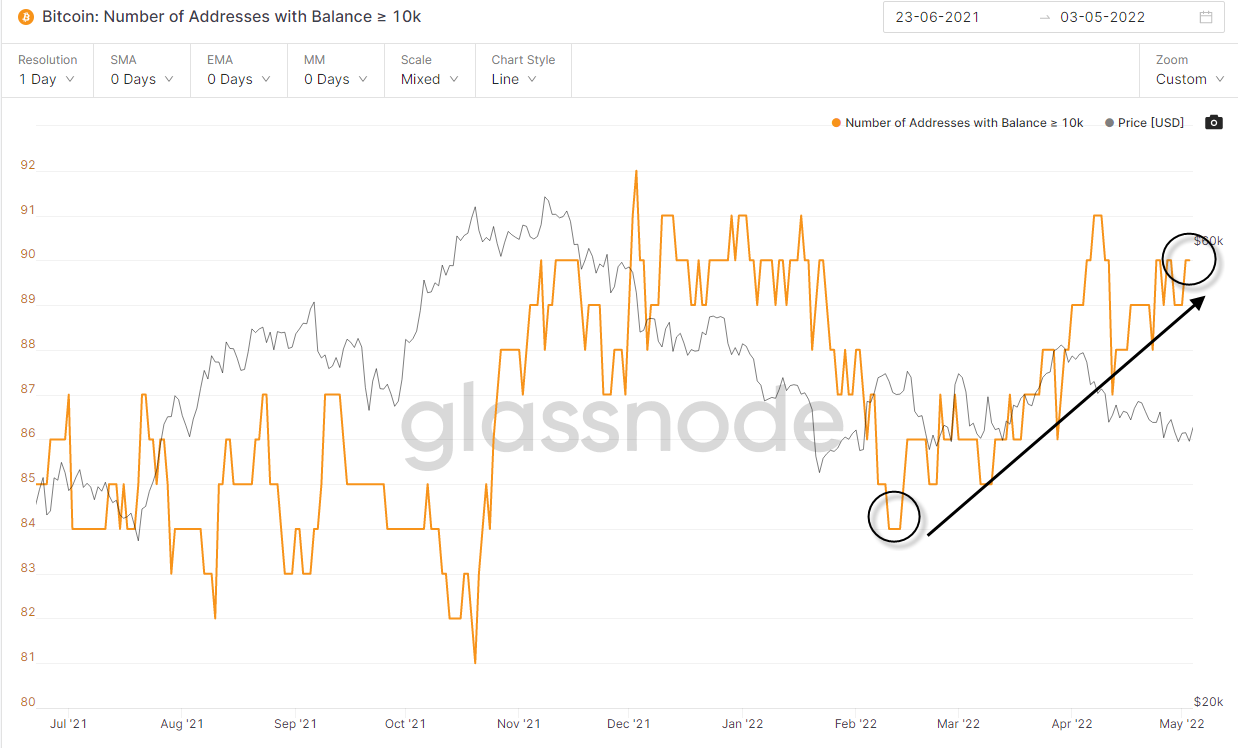

Number of Addresses with a Balance over 10k

- The number of addresses with a balance of over 10k BTC has steadily increased in the last three months, and rapidly in the last three weeks

- To be exact, six wallets have accumulated more than 10k BTC in the last three months which amounts to approximately $390 million USD worth of BTC per wallet

- In total, these wallets have accumulated a total of $2.34 billion USD worth of BTC since February

- Interestingly, prices have remained relatively unchanged during this period

- This suggests that institutions, whom are likely behind these wallets, view the current price range as a value zone and a good entry point into the market

Conclusion

- Bitcoin remains in its YTD range and has in the last few weeks compressed into a tight trading channel

- This coupled with declining volatility and yields in derivatives markets has created an attractive entry zone for institutional investors

- These sophisticated investors have in fact accumulated significantly in the last three months, especially in the last three weeks

- Institutions view current price levels as a value zone which aligns with the signal provided by long-term BTC price models, which indicate that BTC is currently undervalued and has established a bottom price