- Continued positive sentiment in the Crypto & BTC market this week

- BTC flips key resistance level of $45k to support

- BTC has outperformed all major asset classes since US interest rate hike

- The majority of BTC supply is held by high-conviction investors

Weekly Price Action

- BTC is trading at $45'814 (+ 4.2% in 6 days) at the time of writing

- Price spiked by 5.5% and broke out of the $45k resistance level its ranged within throughout 2022

- Price reached a yearly high of $48k before trading sideways at the $47k level and retracing back to the $45k level

- Upward momentum still exists however the resistance at $48k needs to be broken to start a significant uptrend

Positive Sentiment in the Crypto Market

The sentiment continues to be positive in the Crypto Space this week:

- Goldman Sachs traded an OTC non-deliverable BTC option as principal with Galaxy Digital

- The Luna foundation Guard announced plans to back Terra's stablecoin (UST) with BTC worth up to $3bn to make the US dollar peg more resilient

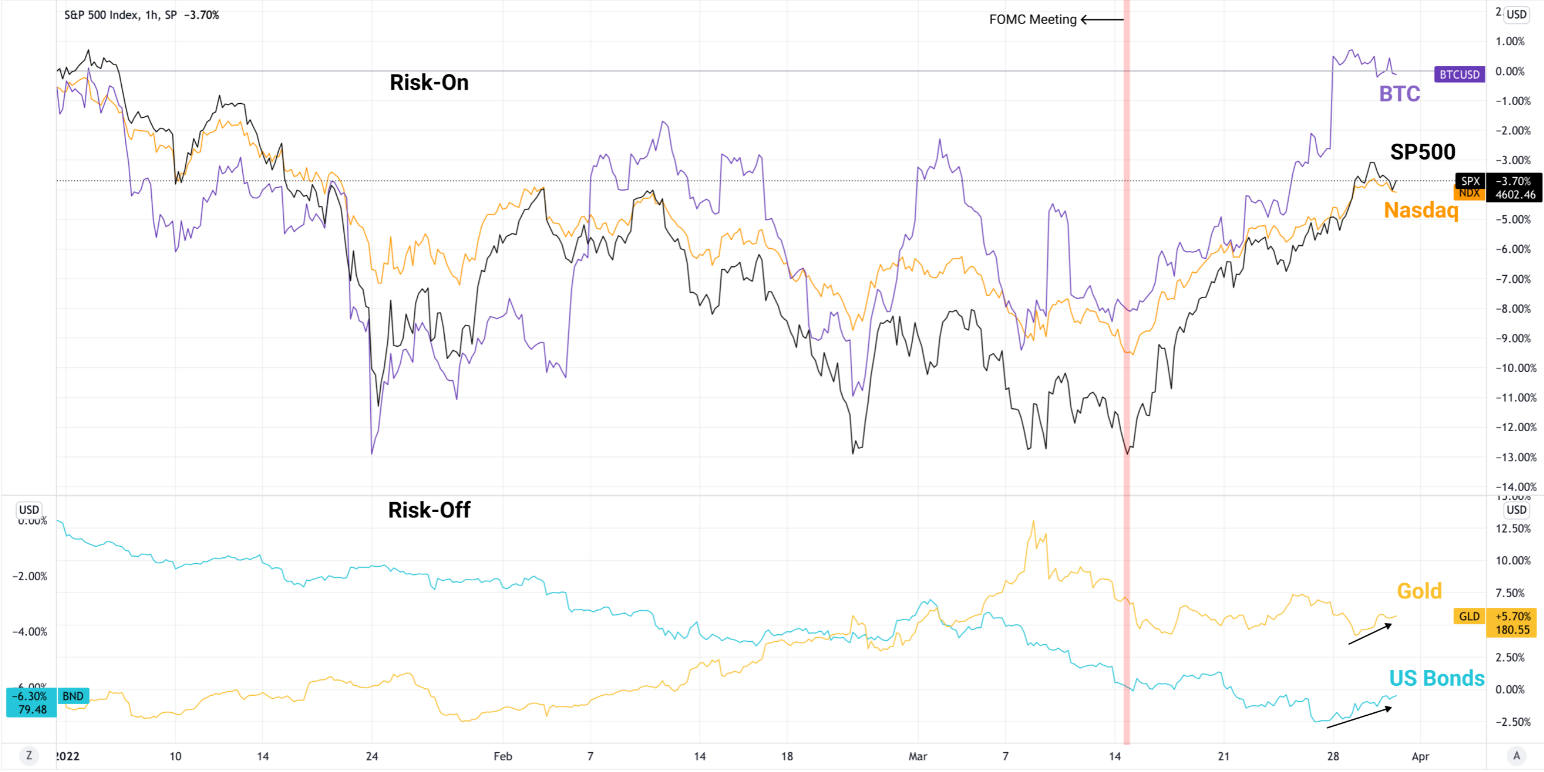

Bitcoin vs Traditional Assets since 0.25% rate hike

- Bitcoin has outperformed the Nasdaq and the SP-500 since the 0.25% increase in US interest rates two weeks ago

- Bitcoin and US equities have outperformed Gold and US bonds during the same period

- Safe-haven assets have picked up in the last week whilst US equities dropped and Bitcoin traded sideways

Price Structure for 2022

- BTC has finally broken above the $35k-$45k range it has been trading within in 2022

- The resistance level of $44k-$45k has flipped to support

- Price has fallen back and can be supported at the breakout level of $45k in the short-term which could represent a medium-term entry opportunity

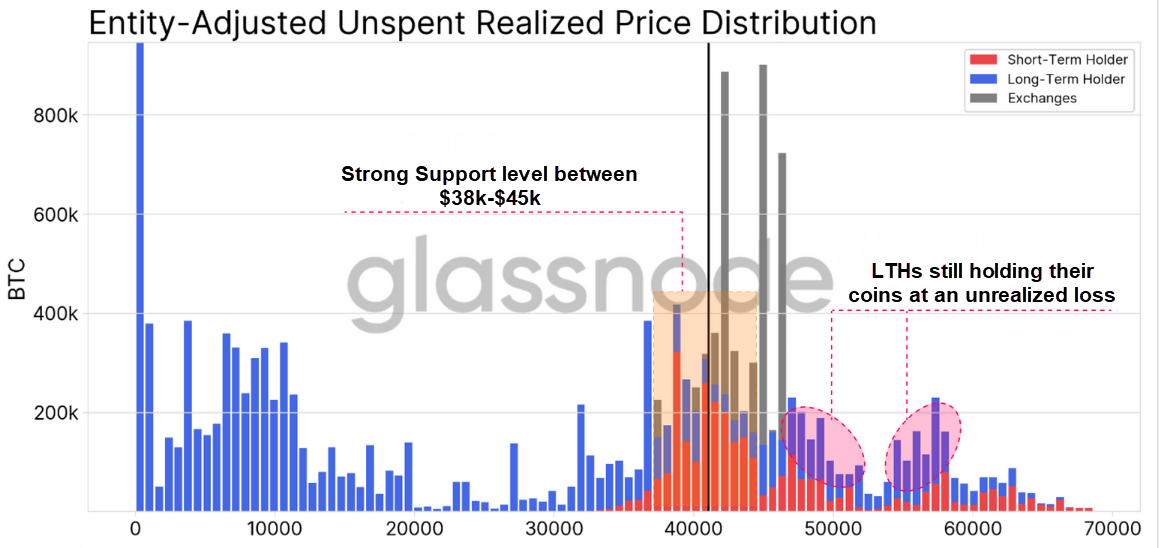

Constructive Support level at $38k-$45k

Entity-Adjusted Unspent Realized Price Distribution

- This metric illustrates the realized price distribution of the current supply of BTC, divided between long-term holders (LTHs) in blue and short-term holders (STHs) in red

- More simply, it illustrates the volume at which all Bitcoins have last been purchased for all price-levels

LTHs:

- LTHs hold a large proportion of supply acquired at prices higher than $45k

- These coins have been held at unrealized loss for several months

- The investors holding these coins have strong sentiment as they have yet to liquidate

STHs:

- STHs have accumulated a large portion of supply between $38k & $45k

- This supply is a value zone as it is held at an unrealized gain

- This range is similar to the $30k-$40k range observed in May-July 2021, a period that preceded an uptrend to a new all-time high

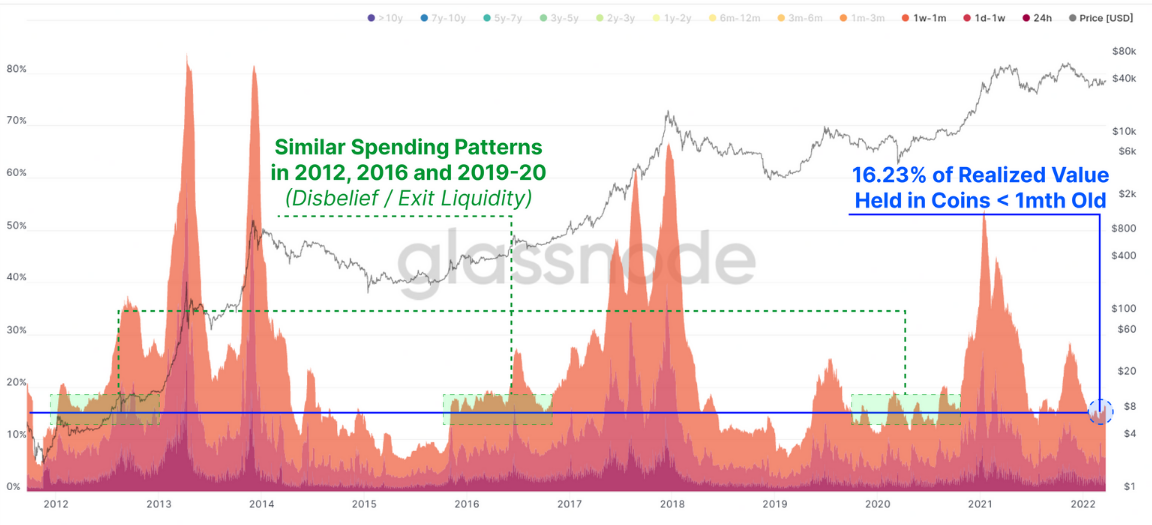

Only 'Hodlers' remain

Realized Cap HODL Waves (Coins younger than 1-month)

- This metric bundles all active supply age bands younger than 1 month, with each colored band showing the percentage of Bitcoin in existence that was last moved within the time period denoted in the legend, weighted by realised capitalization

- 16.23% of the total USD value of BTC is held in coins younger than 1 month, which signals an abundance of 'older coins'

This is a sign of market strength for the following reasons:

- The majority of the supply of BTC has been held despite the recent volatile price swings, signalling high investor conviction and future value expectations

- The liquid supply of BTC has continued to decline

- This level has historically coincided with late stage bear / early bull markets (2012,2016 & 2019-20)