Market Intelligence 22

- BTC price declines in 7 days and continues to trade within YTD range

- Low implied volatility and yields in derivatives markets

- NVT price model signals potential price bottom and reversal

- BTC-NASDAQ correlation remains very high

Weekly Price Action

Price: $38.7k

Week Open: $41.4k

Week High: $42.8k

Week Low: $37.8k

7-day return: - 6.6%

Low Yields & Volatility in Derivatives Markets

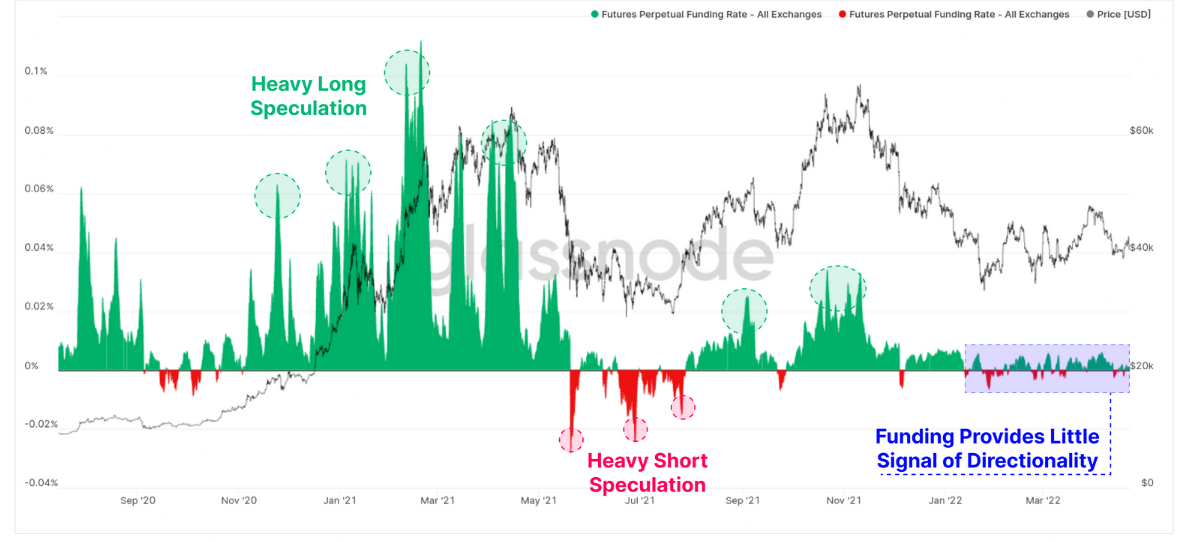

Futures Perpetual Funding Rate

- Funding rates enable the perpetual futures price to be pegged to the BTC spot price

- If funding rates are above 1.0 (green) than the market holds a net long bias and vice versa if funding is under 1.0 (red)

- The majority of 2022 has seen very low yields and little directional bias

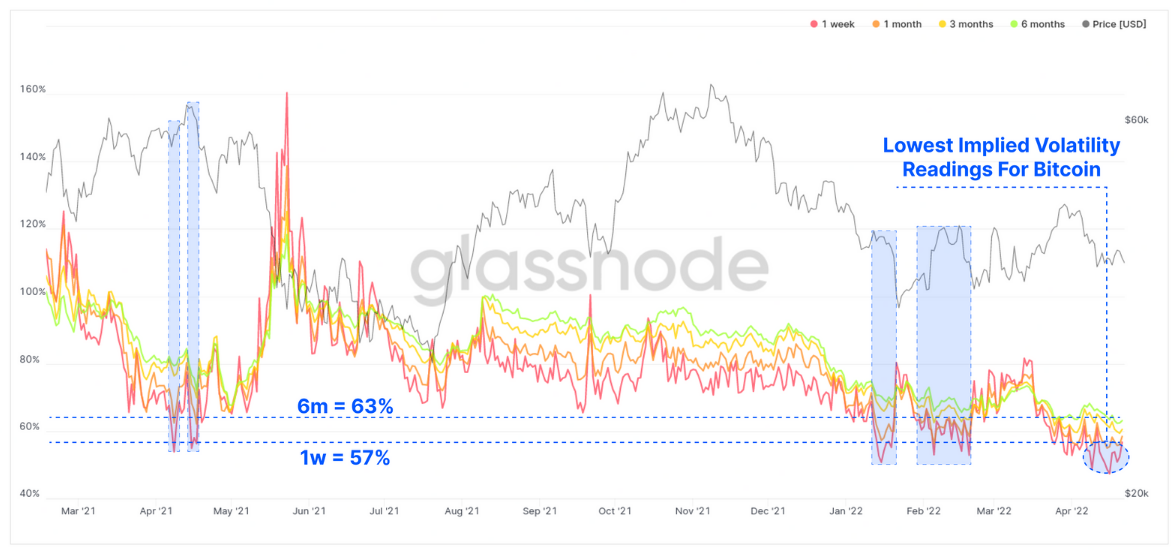

Options ATM Implied Volatility - Deribit

- This metric shows the ATM implied volatility (IV) for options contracts expiring 1 week, 1 month, 3 months, and 6 months from today

- The BTC options market is pricing historically low implied volatility, breaking below 60% over the past few weeks

- This has motivated some capital to leave the Bitcoin space in search of higher returns

- Periods of low IV followed by an increase in IV have lead to major price movements in the last year (May 2021 Crash, Oct. 2021 Bull run)

NVT Price Model

- The Network Value to Transactions (NVT) ratio is computed by dividing the market cap by the transferred on-chain volume measured in USD

- The NVT price models take the 2-year median of the NVT ratio, and multiplies it with a 28-day and a 90-day average of transaction volume to establish a fast and slow signal

- The 28-day signal has broken above the 90-day average, which has historically signalled positive upward momentum

- This signal requires a confirmation however to properly prove that positive momentum is in play

- This trend is worth keeping an eye on over the coming weeks to see if the model truly bottoms out and reverses

Correlation to US Equities

BTC-NASDAQ Correlation

-

The BTC-NASDAQ correlation is currently very high at 0.98

-

Given this high correlation and the unfavorable macro environment, BTC's short to medium-term outlook is grim

-

An uptrend in BTC price will occur if:

- Tech stocks push higher, correlating BTC higher

- The BTC & NASDAQ correlation breaks down

-

The breakdown in the BTC-NASDAQ correlation is likely to come from either

- Short-term idiosyncratic flows to BTC or

- The transfer of supply of BTC from correlated trading traditional finance entities to crypto natives and high-net worth, forward looking individuals