- Price continues to range between $33k-$45k in 2022

- Institutions have heavily accumulated Bitcoin since November 2021

- Futures market volume has picked up in the last week

- Liquid supply continues to decline increasing the likelihood of a supply shock

Weekly Price Action

- Started the week at the high at $43.9k before dropping to a low of $37.2k before recovering rapidly to $42.1k and then erasing these gains by closing at $39.2k

- Bitcoin lost all the gains made the previous week as prices dropped to $37.2k

- These lost gains were recovered this week as news of friendly US Crypto regulation caused $47.45 million short positions to be squeezed and pushed prices back above $40k

- This recovery was shortlived as prices dropped to close the week at $39.2k

Price Structure

- Bitcoin's price has been bouncing off of the lows between $33k-$35k and rebounding from the highs between $42k-$45k so far in 2022

- This range has primarily been driven by macro-events such as speculation over Fed interest rate hikes and the outcome of the war in Ukraine

- A long-term directional trend will be established once price breaks out of this range

- Price has tested the upper resistance on four occasions compared to two tests of the lower support level

- With rising institutional demand in 2022, it is possible that price is more likely to break the upper range limit than the lower

Rising Institutional Demand

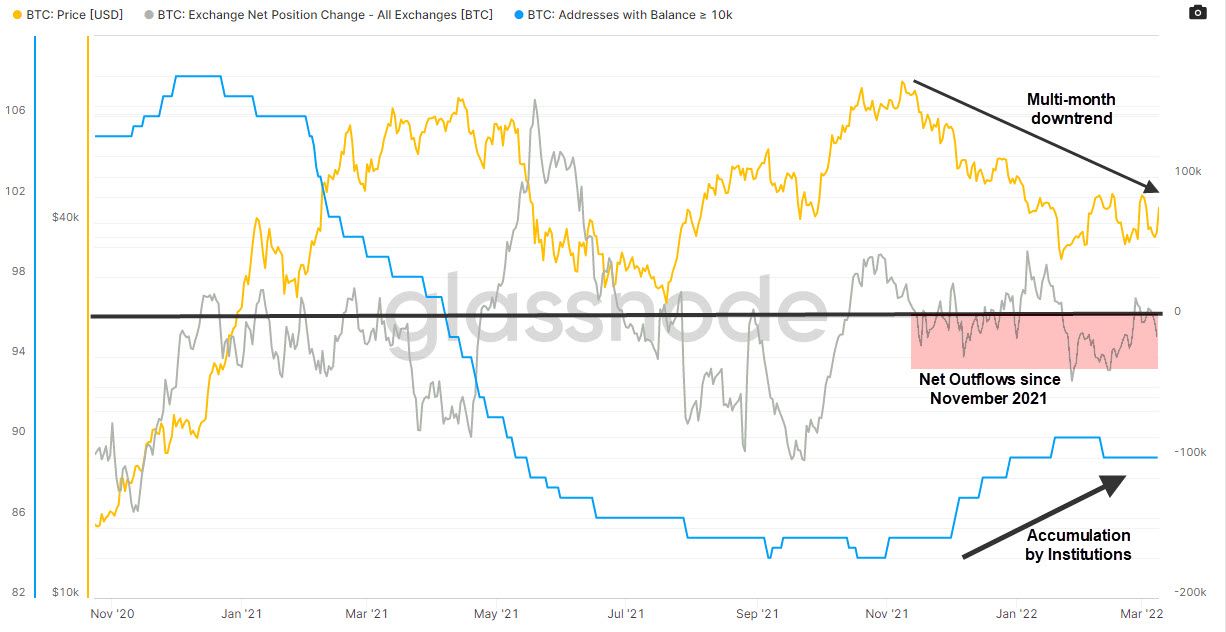

It has become evident that a new player has been driving the Bitcoin market in the last year. There was a rise in the amount of addresses holding + 10k Bitcoin since November of 2021.

This increase has interestingly coincided with a regime of net outflows of Bitcoin from exchanges. This suggests that this new player has been removing their Bitcoin after purchase from exchanges to store them for the long-term.

This new player is likely to be established institutions that have accumulated Bitcoin as its price declined since November 2021.

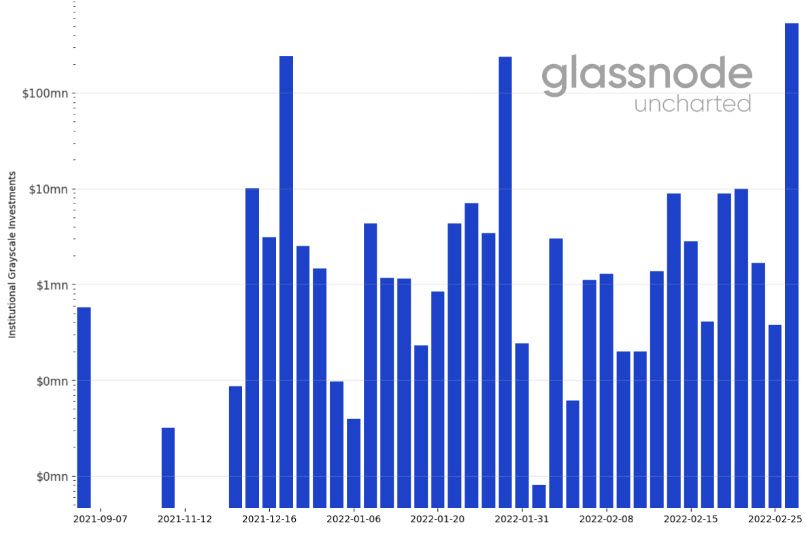

Institutions prefer using ETP & ETF products to gain exposure to Bitcoin such as the Bitcoin shares offered by Grayscale. These shares have received large amounts of flow in recent months as institutions have accumulated Bitcoin.

Institutional Grayscale Investment

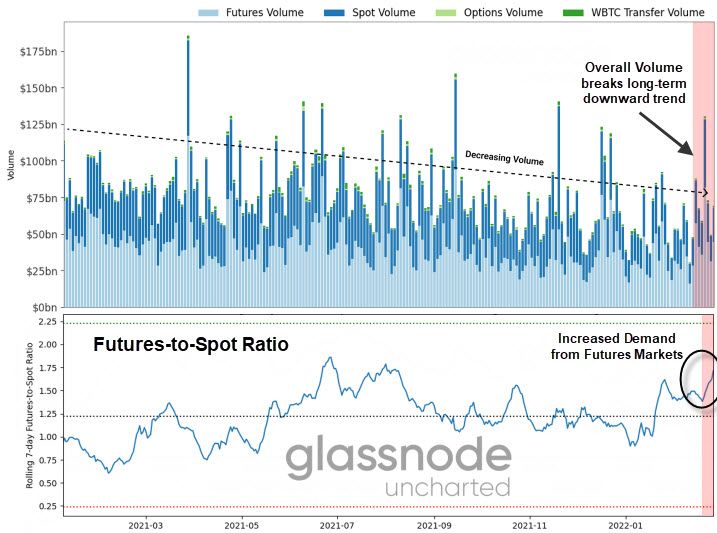

Increasing Demand in Futures markets

The overall traded volume of Bitcoin has been in a downtrend since October 2021. Last week however, volume broke out of the downtrend as it spiked notably on futures exchanges. We can confirm this by viewing the Futures-to-Spot ratio which also spiked in the last week.

Increased Speculative Bullish Demand

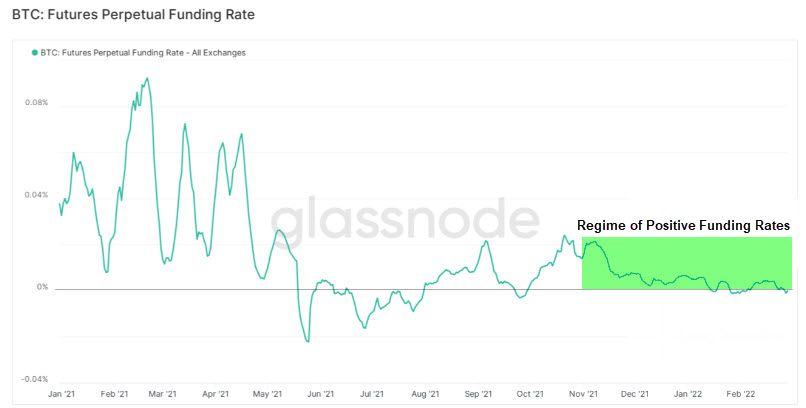

Funding rates have been positive since November 2021. This suggests a net long bias amongst investors in the Futures market.

Because of the recent increase in futures volume, it is clear that there is more leverage in the market. Given the net long bias in the market, we can infer bullish sentiment in the market.

This shift in positive sentiment is also reflected in the percent of crypto-margined futures open interest. This metric describes the percentage of futures positions margined in Bitcoin instead of USD.

The metric was in a downtrend since April 2021 as investors opted to margin with USD. This is because there is a risk of larger losses if a futures position is margined in the same currency as the underlying asset. The metric broke out of the downtrend last week which suggests a renewed confidence in Bitcoin by derivatives traders.

Decreasing Liquid Supply

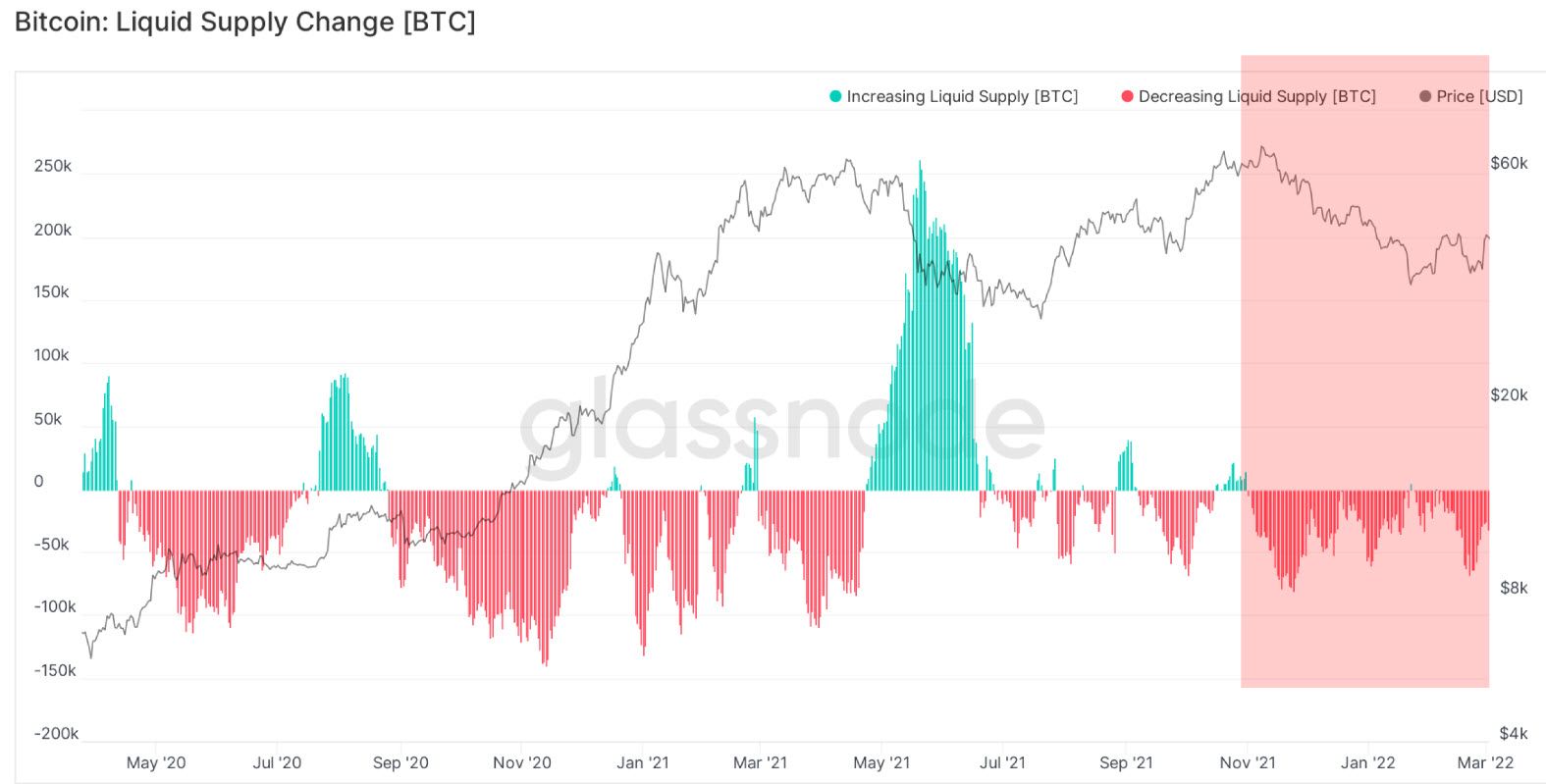

Liquid supply is the supply of Bitcoin available on exchanges or 'hot wallets' that can be transacted within a click. Liquid supply has been declining significantly since November 2021.

The recent increase in futures demand adds further pressure to the low liquid supply as more BTC will be 'locked up' as margin in futures contracts. With increasing demand and diminishing supply, the likelihood of a supply shock increases.

Fewer coins available to meet the increasing demand can eventually result in an upward price move which could trigger the restart of the long-term uptrend in Bitcoin.

Conclusion

Prices have continued to range in a volatile range in 2022. The macro environment remains uncertain which has prompted investors to remain conservative.

Bitcoin's long-term outlook remains encouraging. Institutions have accumulated heavily and futures traders have increased their long exposures and willingess to margin their positions in BTC. This along with the continued decline of Bitcoin's liquid supply has increased the likelihood of a supply shock that could prove to be a catalyst for a bullrun.

The market outlook remains uncertain in the near-term as the macro environment continues to drive price action and can potentially push prices further below. In light of this, investors will continue to be careful moving forward however, there is reason to believe that Bitcoin's inevitable uptrend will prevail in the long-run.