Bitcoin

Weekly Price Action

- Price of Bitcoin opened at $47.3k this week and closed at $48.8k for a weekly gain of approximately 3%

- Price ranged within a tight channel of $45.6k and $49k

- Second week of sideway price action for Bitcoin

Summary

- Macro Outlook remains healthy for Bitcoin price as Long-Term holders are holding

- Short-term Holders are continuing to drive price action and are realizing losses

- Social Sentiment remains muted

- Derivatives traders and Whales are remaining neutral

Long-Term Holders keep holding

The majority of the supply of Bitcoin today still remains in the control of Long-Term Holders (LTHs), in the custody of their cold wallets stored off-exchange. This cohort of investors therefore has the collective influence to determine the macro outlook of Bitcoin's price. It is therefore important to evaluate their current behaviour.

LTH Macro Cycle

It is important to consider the LTH Cycle to contextualize where we currently are:

- Accumulation / Holding Phase --> LTHs accumulate during market-bottoms and hold for higher prices

- Distribution Phase --> LTHs sell their coins as prices near their top, sending prices downward

- Re-Accumulation Phase --> A new batch of LTHs start accumulating Bitcoin as prices bottom-out

Currently:

Prices reached new all-time highs in Novemeber, before as signficant sell-off in early December. Prices have now moved sideways within a tight range, and are 25% down from the all-time high.

It is important to evaluate whether the price action in recent weeks is indicative of a transition from the Accumulation / Holding Phase to the Distribution Phase on a macro scale.

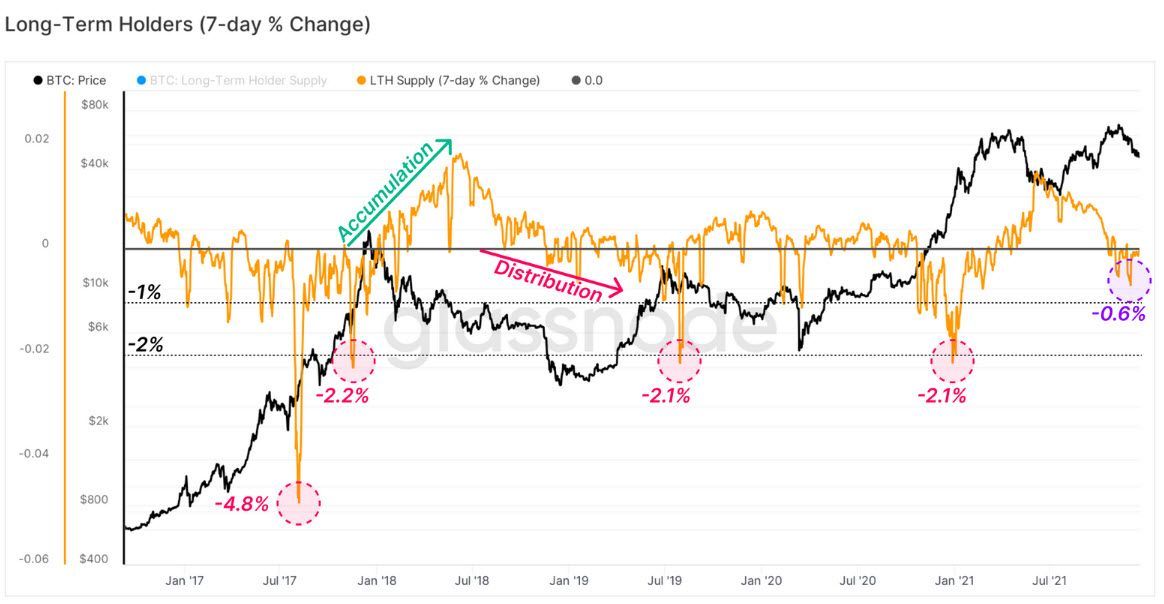

Long-Term Holders (7-day % change)

To gauge whether we've entered a new macro phase, we use the metric below. This metric visualizes the 7-day change in the supply of LTHs. Historically, distribution phases have seen a 2% or more decline in LTH supply as indicated in red.

In the recent price drawdown, only 0.6% of LTH supply was soldoff. This implies that we have yet to transition into the Distribution Phase, and that the recent price drawdown was a minor correction within the Macro Accumulation / Holding Phase.

The majority of the supply of Bitcoin is therefore largely unmoved as LTHs keep holding. As such, recent price action is primarily driven by short-term holders (STHs) and is an important cohort of investors to evaluate in order to gain clarity on short-term price action.

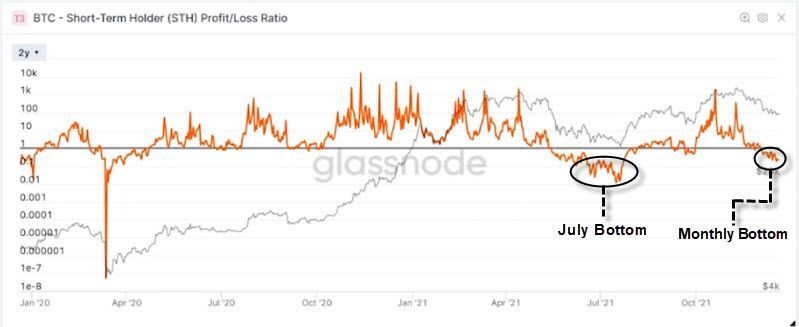

Short-Term Holder (STH) Profit/Loss Ratio

We can view the Profit / Loss ratio of STHs to determine the health of this cohort's supply and their expected behaviour moving forward. This ratio takes into account the unrealized profit or loss of all Bitcoins held by STHs.

STHs are currently at the lowest Profit / Loss ratio they have been since the market bottom in July. This is indicative of a potential local bottom where value is established by investors. It is important to note that a large reason for why the ratio is currently so low is because most STHs bought at the recent market top. It is therefore likely that these investors will remain patient and wait for their underwater investments to become profitable again.

Social Sentiment remains low

We noted last week that 'Social Sentiment' was very low due to the leverage flush that took place in early December, as well as the ensuing sideway action in Bitcoin's price.

Average Social Sentiment

Social sentiment has continued to remain low and has in fact reached a 30-day low. This partly explains Bitcoin's climb back up to $49k as low sentiment on social networks often provide fertile ground for price recovery.

'Buy the Dip' mentions

Another sign of low social sentiment can be viewed with the amount of 'Buy the Dip' mentions on Crypto social media. Since soaring immediately after the December crash, mentions of buying the dip have been muted. A pattern can be observed in the graph below as social media tends to prematurely suggest buying the dip, as Bitcoin's price often goes a further leg down.

We observed during May-June as well as in September that prices continue to drop until mentions of 'buying the dip' normalized. It was only after that Bitcoin prices started to chart an upward part.

Prices have in the past week reacted well to bearish social sentiment. It would be prudent to keep an eye on these levels if prices break above $50k, as a potential new wave of retail euphoria could signal another correction.

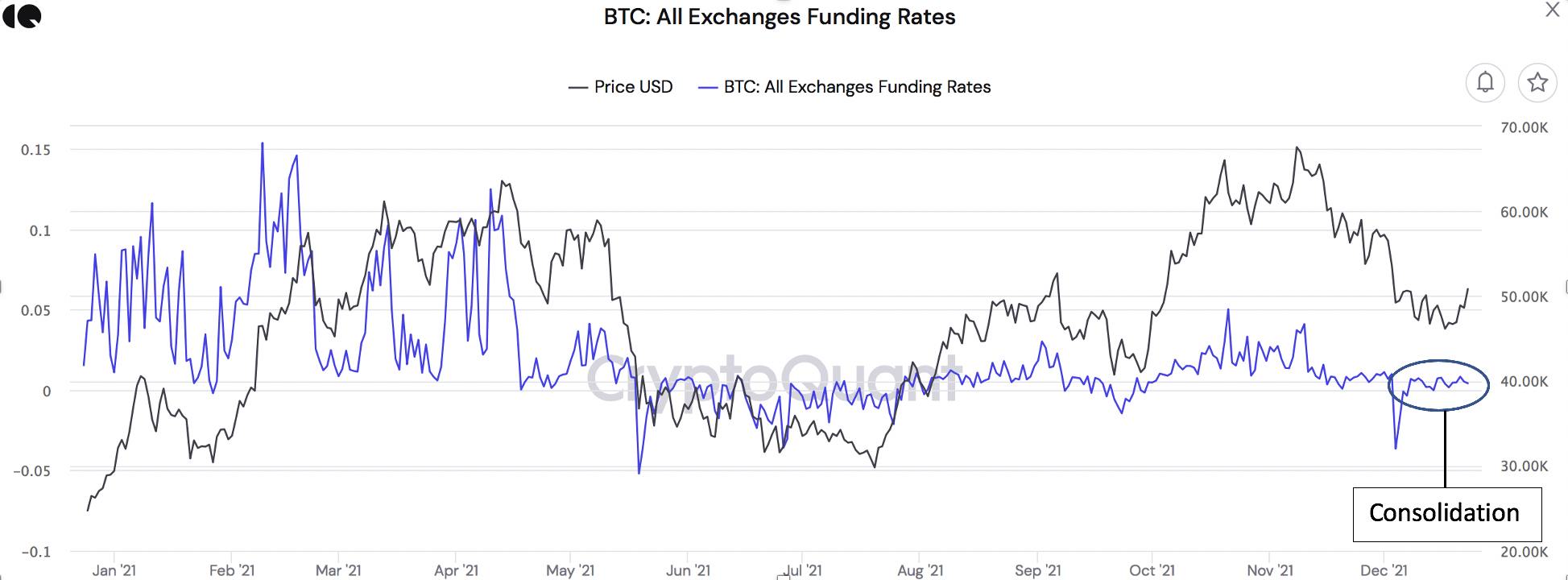

Funding Rates

Bitcoin Perpetual Futures funding rates have stablized in the + 0.005% range since the leverage flush in early December. Derivatives traders are remaining more cautious as a result, and are exhibiting a 'wait and see' behaviour.

It will be important to monitor these levels as prices evolve in order to evaluate the risk of another leverage flush.

Whale Activity

Bitcoin addresses holding between 100-10k Bitcoin have yet to show signs of renewed accumulation since the crash in early December 4th.

In the past seven days, combined balance of 100-10k Bitcoin declined by 10k Bitcoin, continuing in a fluctuating, see-saw pattern. Whales are still uncertain, which partly justifies the sideway action in Bitcoin's price.

Conclusion

-

On a macro basis, the market is still in the accumulation / holding phase as LTHs have barely touched their Bitcoins despite recent volatility

-

STHs are at a net loss on their investments as they primarily bought the November top and are now likely to hold onto their Bitcoins in the near term

-

Social Sentiment remains muted for a second consecutive week, providing constructive conditions for a price recovery

-

Positive Futures Funding rates have picked up but consolidated lower than highs established prior to the leverage flush

-

Whale activity has remained neutral in the last week, suggesting that wealthy investors are uncertain in Bitcoin's near term price action