Global markets began the week on a cautious note as investors awaited developments from U.S.-China trade talks in London. The S&P 500 (+0.09%) and Nasdaq (+0.31%) edged higher, while the Dow remained flat. U.S. 10-year Treasury yields fell 4 bps to 4.47% after NY Fed data showed May inflation expectations eased to 3.20%, below forecasts. Bond markets are focused on upcoming Treasury auctions, with $10- and $30-year sales scheduled for Tuesday and Wednesday amid concerns over the widening U.S. fiscal deficit. In Europe, the Stoxx 600 (-0.07%) and FTSE 100 (-0.06%) drifted lower in thin trading, with ECB official Peter Kazimir signaling a potential pause in the central bank’s rate-cutting cycle pending further summer data. Commodity markets reflected cautious optimism: WTI crude rose 1.10% to $65.29 on trade hopes, copper added $100 to $9,793 despite weaker Chinese export and CPI data, and silver jumped 2.17% to a 14-year high of $36.75.

- The global crypto market cap increased 6.1% since thursday to $3.41tn. The total crypto market 24h volume is currently $131bn.

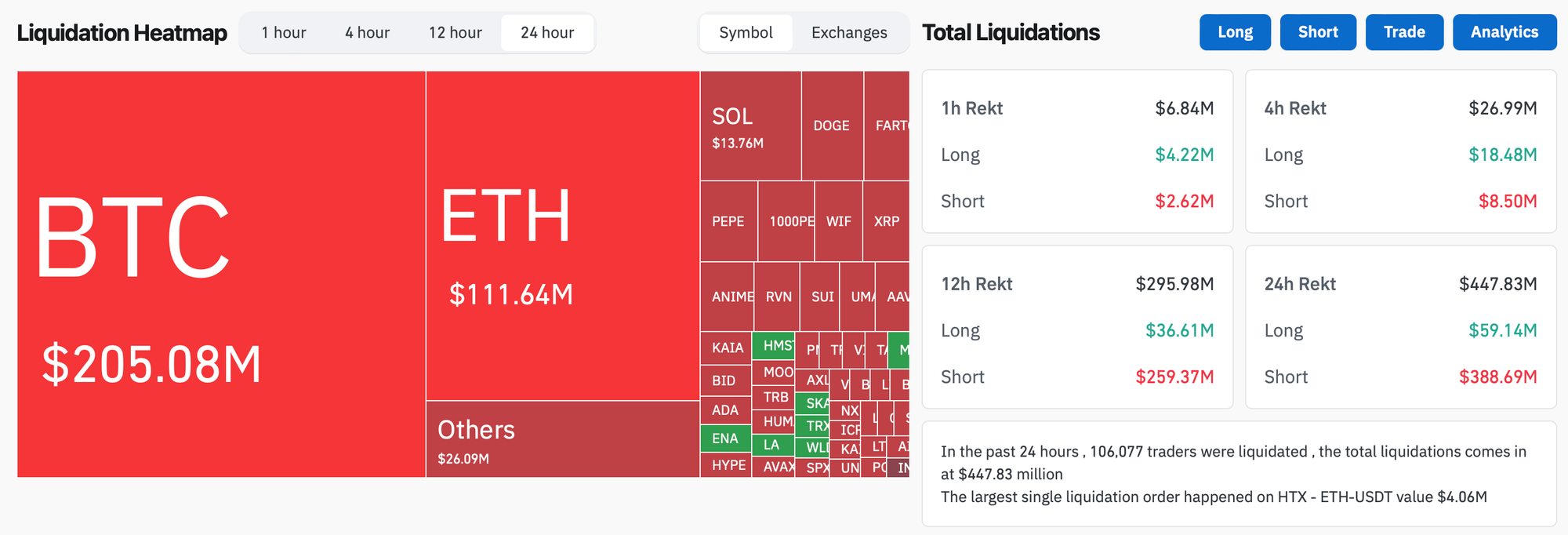

- In the past 24 hours, crypto liquidations increased 255% and totaled $447.8m, with over 87% of them short positions. BTC positions made up 46% of all liquidated positions.

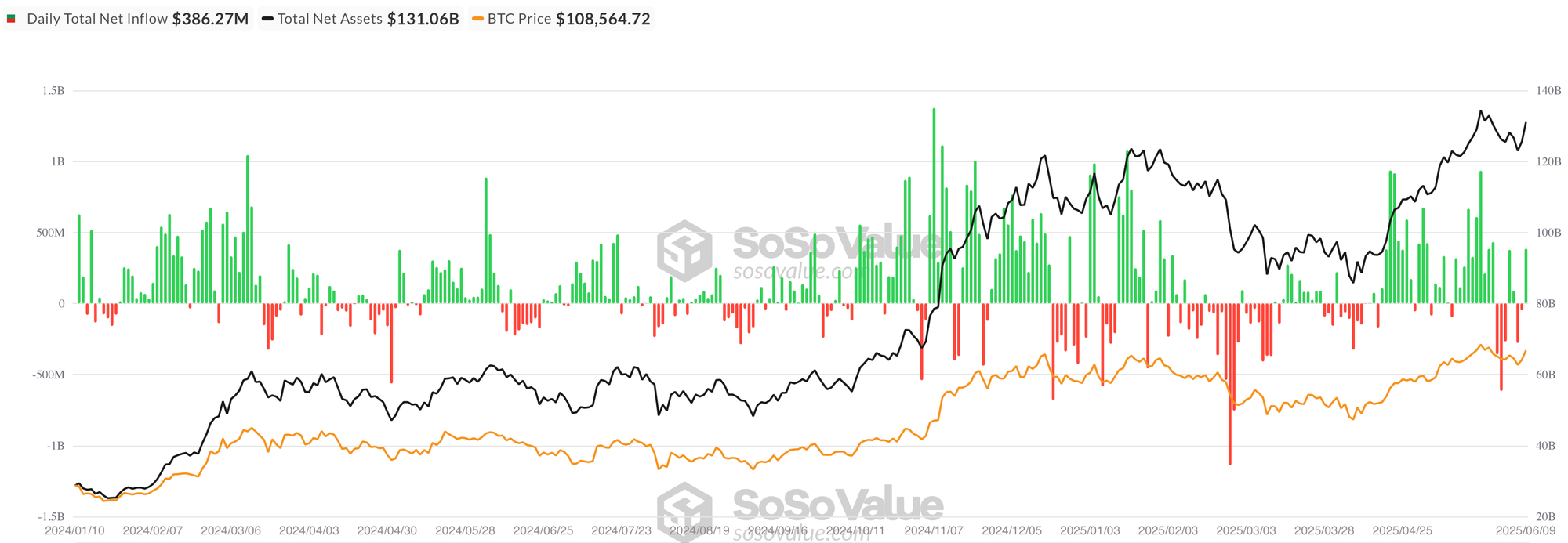

- U.S. spot Bitcoin ETFs rebounded on June 9 with $386 million in net inflows, marking the strongest single-day haul since May 28. Fidelity’s FBTC led with $173 million, followed by BlackRock’s IBIT at $121 million and Bitwise’s BITB with $69 million. The renewed demand lifted cumulative net inflows across all issuers to $44.63 billion. Total assets under management climbed to $131.06 billion, while daily trading volumes surged to $3.41 billion, the highest in a week. The recovery came after two consecutive days of outflows totaling over $326 million, suggesting investor confidence returned ahead of key macro data and following Bitcoin’s weekend bounce.

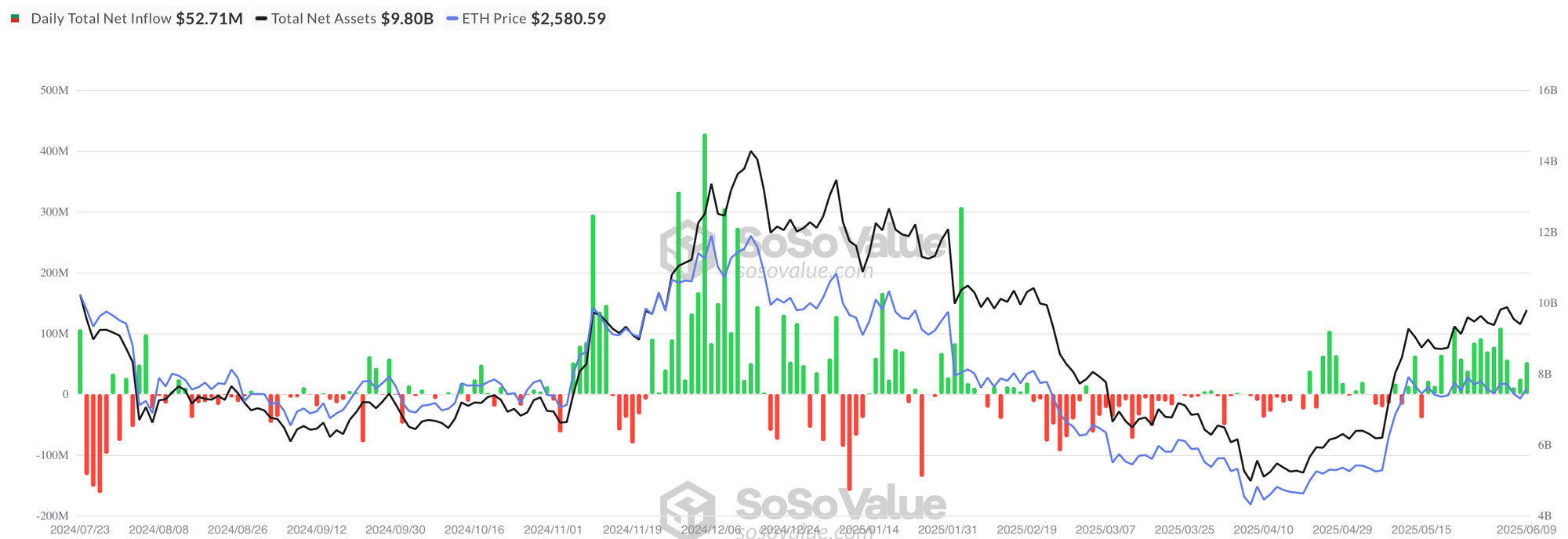

- U.S. spot Ethereum ETFs added $52.7 million in net inflows on June 9, led by BlackRock’s ETHA with a $35.2 million gain, followed by Fidelity’s FETH at $12.9 million. Total cumulative inflows rose to $3.38 billion, while assets under management reached $9.80 billion. Trading activity remained solid at $398.7 million in daily turnover, reflecting strong investor interest. Grayscale’s ETHE remained flat, while its lower-fee ETH fund took in $4.6 million. Despite modest flows compared to Bitcoin ETFs, Ethereum products continue to build traction, recording their 16th consecutive daily net inflow.

- Over 28% of Ethereum's current circulating supply is now staked according to a Dune dashboard, reaching a new record this week, as users increasingly participate in the cryptocurrency's validation and consensus process by locking up their coins.

- MicroStrategy has acquired 1,045 bitcoin for $110.2 million, increasing its total holdings to 582,000 BTC.

- According to crypto security firm Cyvers, a crypto investor lost $2.6 million in hours after falling victim to a zero-value transfer scam, a form of address poisoning scam that manipulates victims into sending cryptocurrency to a fraudulent address.

- Australian authorities have dismantled a $123 million crypto laundering operation allegedly run through a cash-in-transit security firm, charging four individuals after an 18-month probe. The Queensland Joint Organized Crime Taskforce uncovered a scheme where illicit cash was disguised as legitimate business income, funneled through shell entities including a classic car dealership and then converted to cryptocurrency. The operation led to the seizure of $13.6 million in assets, including properties and vehicles.

- Kakao's blockchain, Kaia, has entered South Korea's stablecoin market, coinciding with a 30% surge in Kakao's payments app on the stock market.

- Kenya is weighing a 1.5% tax on all crypto transactions under a proposed Digital Asset Tax (DAT), a move that risks undermining its fintech leadership in Africa. While aimed at expanding the tax base, critics warn the blanket levy could drive users to informal markets, increase transaction costs, and deter startups and global exchanges from operating in Kenya. The tax is significantly higher than similar measures elsewhere—15 times Indonesia’s rate—which previously triggered capital flight. The proposal comes alongside the pending VASP Bill 2025, which introduces strict compliance and surveillance provisions, raising privacy concerns and potential conflict with Kenya’s data protection laws. As regional rivals like South Africa embrace more innovation-friendly frameworks, industry voices are urging Kenya to adopt a phased, privacy-conscious approach to maintain its digital edge and lead Africa’s economic integration through smart crypto policy.

- The U.S. Department of Justice has charged Iurii Gugnin, a Russian national and New York resident, with laundering over $500 million through his crypto payments firm, Evita, in violation of sanctions and export controls. Gugnin allegedly used cryptocurrency—including Tether (USDT)—to obscure the origin of funds tied to sanctioned Russian banks, later converting them into U.S. dollars through Manhattan bank accounts. The 22-count indictment includes charges of money laundering, bank and wire fraud, and operating an unlicensed money transmission business. Prosecutors say Gugnin helped Russian clients procure sensitive U.S. technology, including parts for state-owned nuclear agency Rosatom, while falsifying documents and ignoring anti-money laundering rules. If convicted, Gugnin faces decades in prison. The case was brought by the DOJ’s Disruptive Technology Strike Force, underscoring heightened enforcement against crypto-enabled sanctions evasion.

- The UK Insolvency Service has appointed its first crypto specialist, former police investigator Andrew Small, to trace digital assets in bankruptcy and criminal cases. Announced on June 9, the move follows a 420% rise in crypto-related insolvencies over five years, with over £520,000 in assets identified in 2024/25. Small will support investigations as crypto ownership surges, now held by 12% of UK adults, according to the FCA.

- In a June 9 press release, the U.S. Department of Justice announced that five men pleaded guilty in Los Angeles for their roles in laundering over $36.9 million stolen from victims in a global digital asset investment scam run from Cambodia. The defendants — including U.S. residents and Chinese nationals — helped operate shell companies, launder funds through U.S. banks, convert them to Tether (USDT), and funnel the proceeds to scam centers in Southeast Asia. The scheme involved fake crypto investments promoted via social media and dating apps. All five face up to 20 years in prison, with several co-conspirators already convicted.

- In a June 7 update, Cetus Protocol—a decentralized exchange (DEX) on the Sui blockchain—announced its relaunch and plans to go open-source after a $220 million exploit in May. The attacker exploited a pricing vulnerability, draining major liquidity pools before $162 million was frozen. To recover, Cetus replenished pools using $7 million in reserves, a $30 million USDC loan from the Sui Foundation, and recovered assets, though some pools remain only 85–99% restored. A compensation plan will allocate 15% of CETUS tokens to affected users.

- Argentina’s anti-corruption office has cleared President Javier Milei of wrongdoing over his February promotion of the $LIBRA cryptocurrency, which crashed shortly after launch. The office ruled Milei acted “as an economist, not a public official,” using a personal X account created before his presidency.