Global markets edged higher on Wednesday, with the Dow Jones (+0.7%), S&P 500 (+0.43%), and Nasdaq (+0.27%) all gaining as investors awaited a potential US-UK trade deal announcement and the first US-China trade talks since Trump's tariffs. The Federal Reserve warned of rising economic risks while holding rates steady, while China cut a key interest rate to 1.4%. The US and China are set to discuss trade and economic matters, and Poland cut interest rates by half a point ahead of a presidential vote. Tariff uncertainty continued to weigh on automakers, with Ford and GM reporting significant costs.

- In crypto, the global crypto market cap increased 2.6% over the past day to $3.06tn. The total crypto market 24h volume increased 25% to over $100bn. Bitcoin increased 2.55% in the past 24h and currently trades around $98.9k, Ether increased 4.2%, currently trading around $1,900.

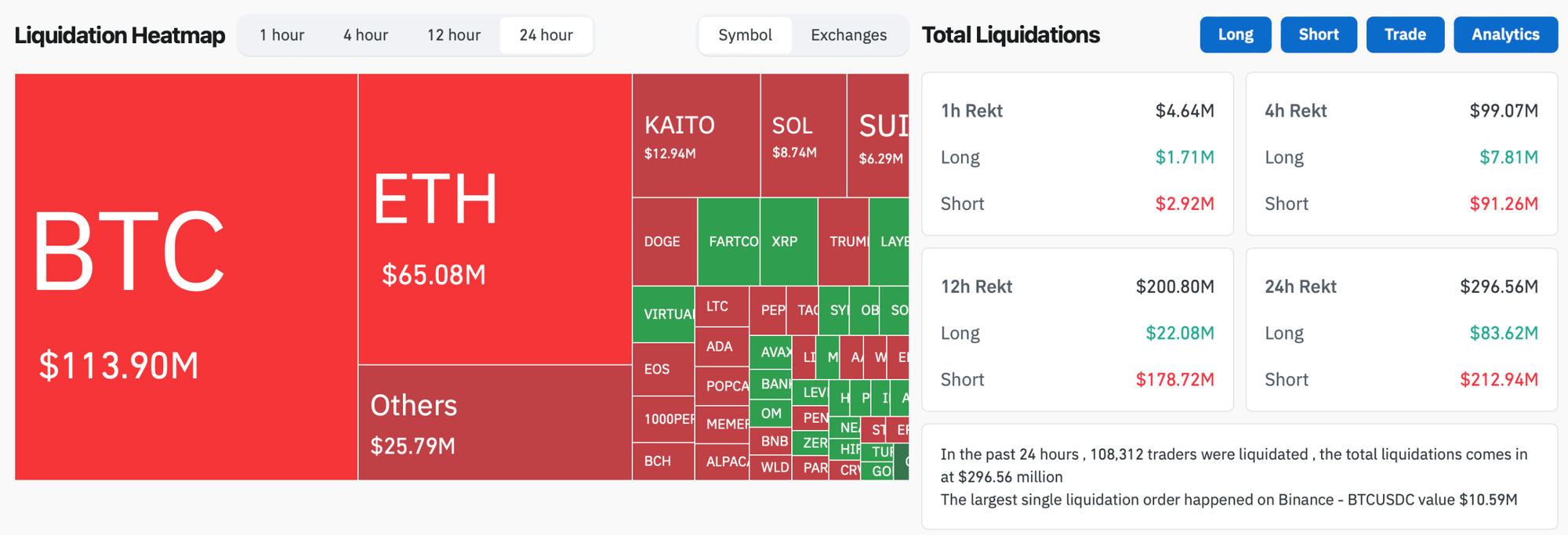

- In the past 24 hours, crypto liquidations decreased by 6% and totaled $296.6m, with 72% of them short positions.BTC liquidated positions made up 38% of all liquidated positions, with 84% of liquidated positions being shorts.

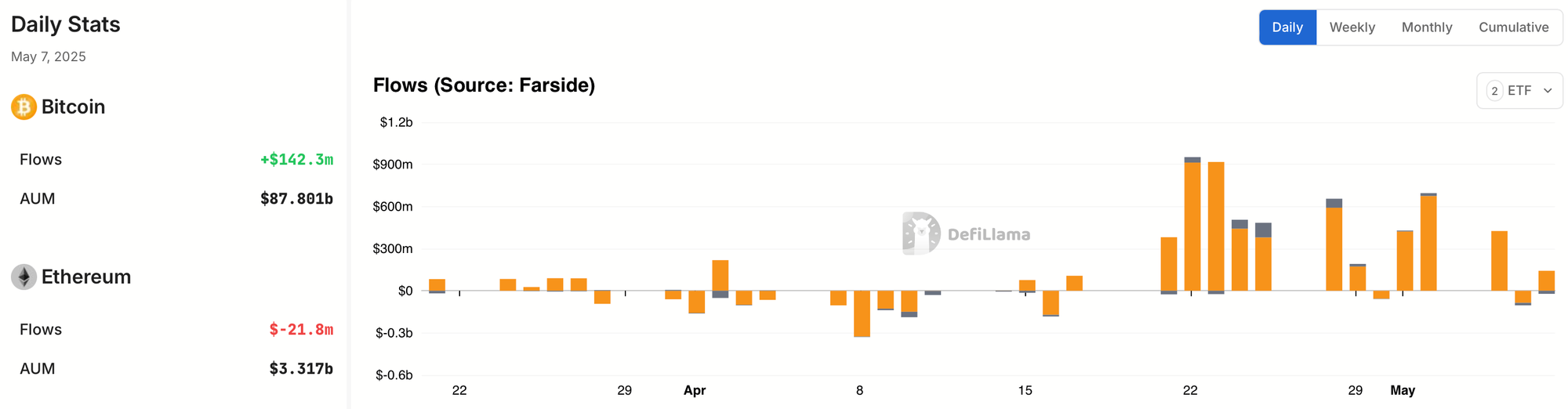

- According to data from SoSo Value, US Bitcoin spot ETFs recorded a net inflow of $142.31 million on May 7, 2025, marking a continuation of the broader institutional accumulation trend. The day’s flows were led by Ark Invest’s ARKB with $54.73 million, followed by Fidelity’s FBTC ($39.92m), BlackRock’s IBIT ($37.19m), and Bitwise’s BITB ($10.48m). All other funds saw no net activity, with Grayscale’s GBTC and BTC funds again posting flat flows. While modest compared to last week’s surges, the steady inflows underscore sustained demand—bringing total net inflows to over $1.58 billion so far this month. Meanwhile, US Ether spot ETFs logged a net outflow of $21.77 million, marking the second consecutive session of withdrawals after a $17.87 million outflow on May 6. The outflows erased the gains seen earlier in the month, bringing the weekly total to –$39.64 million.

- Google’s Threat Intelligence division has identified a new malware dubbed LOSTKEYS, deployed by the Russian-backed hacking group COLDRIVER to steal documents from high-profile Western targets. In a report released on May 7, Google detailed how the malware is delivered via fake CAPTCHA pages, PowerShell scripts, and device evasion techniques before installing its payload. Once active, LOSTKEYS can exfiltrate files from specific directories and send system data back to the attackers. This marks a shift in COLDRIVER’s tactics from traditional phishing to more advanced malware-based operations. Google has taken steps to counter the threat, including blacklisting the associated malicious domains.

- Onchain analyst ZackXBT has uncovered an additional $45 million in funds stolen from Coinbase users through social engineering scams in the past week, contributing to a total annual loss of $330 million and highlighting a unique and growing problem for the exchange.

- Arizona Governor Katie Hobbs signed a bill into law on May 7 allowing the state to claim and manage abandoned cryptocurrency, establishing a Bitcoin Reserve Fund without using taxpayer money, in a move that could pave the way for future crypto legislation in the state.

- The USD1 stablecoin, backed by former US President Donald Trump and primarily issued on the BNB Chain, has rapidly grown to become the seventh-largest stablecoin globally with a market capitalization of $2.2 billion in just two months since its launch.

- The Bybit exchange has recovered its liquidity to pre-hack levels just 30 days after a $1.5 billion hack in February 2025, with Bitcoin's market depth fully rebounding and altcoin liquidity reaching 80% of pre-hack levels, according to a report by crypto research firm Kaiko.

- Strive Asset Management, founded by Vivek Ramaswamy, is merging with a Nasdaq-listed company to become a Bitcoin treasury company, planning to issue $1 billion in equity and debt to accumulate Bitcoin and offer tax-free stock swaps to Bitcoin holders.

- Robinhood is developing a blockchain network to enable European retail investors to trade US securities, specifically tokenized stocks, and is considering partnerships with Arbitrum and Solana Foundation, as part of its expansion into the European market and exploration of blockchain-based solutions.

- Stripe has launched stablecoin-based accounts in over 100 countries, supporting USDC and USDB stablecoins, to enable clients to send, receive, and hold US-dollar stablecoin account balances, amid growing demand for stablecoins as stores of value in developing economies.

- Binance founder Changpeng Zhao has applied for a pardon from US President Donald Trump, despite denying Bloomberg and The Wall Street Journal reports in March of seeking one. This could potentially allow him to assume a management role at Binance.US if granted, following his guilty plea and sentencing for a money laundering charge.

- Tornado Cash, a decentralized crypto mixer that uses smart contracts and zero-knowledge proofs to enhance transaction privacy, was sanctioned by the US Treasury in 2022 for allegedly facilitating money laundering, but the sanctions were lifted in late April 2025, highlighting the challenges of regulating permissionless systems and sparking a debate about balancing financial privacy with security.

- Visa has invested in BVNK, a London-based startup focused on stablecoin payment infrastructure, as part of its continued expansion into the digital asset space, which includes recent moves such as allowing instant deposits and withdrawals from crypto exchange Coinbase and launching its Visa Tokenized Asset Platform.

- Bhutan has partnered with Binance Pay and DK Bank to launch the world's first national-level crypto tourism payment system, allowing travelers to pay for services using over 100 crypto assets and providing small businesses with access to international travelers through a QR code payment system.

- HIVE Digital Technologies is expanding its Bitcoin mining operations in Paraguay, driven by the country's geopolitical stability and low-cost hydro energy, while also diversifying its global presence to hedge against risks and aiming to increase its hashrate to 25 exahash per second by September.