- Bitcoin is up 10% in the past week, reversing nearly all losses from early December after retaking the $102,000 level yesterday evening around 5 pm CET, and remains above the $101,000 mark.

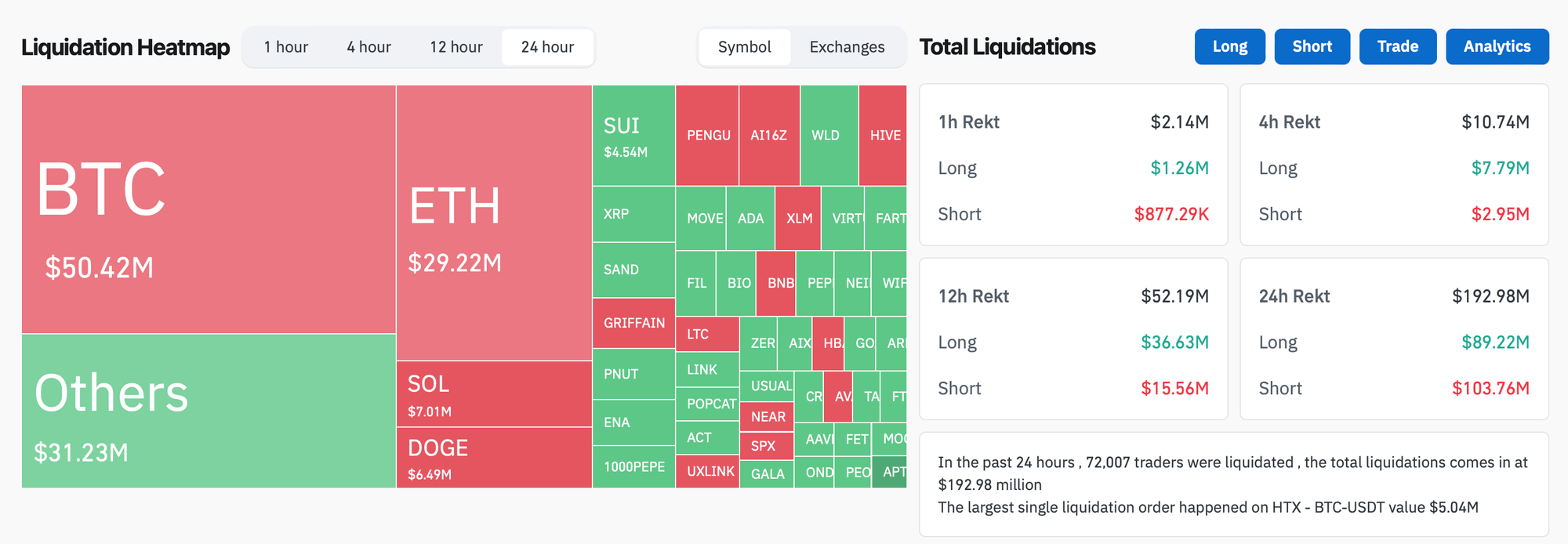

- Total crypto liquidations came at $192.98 million in the past 24 hours.

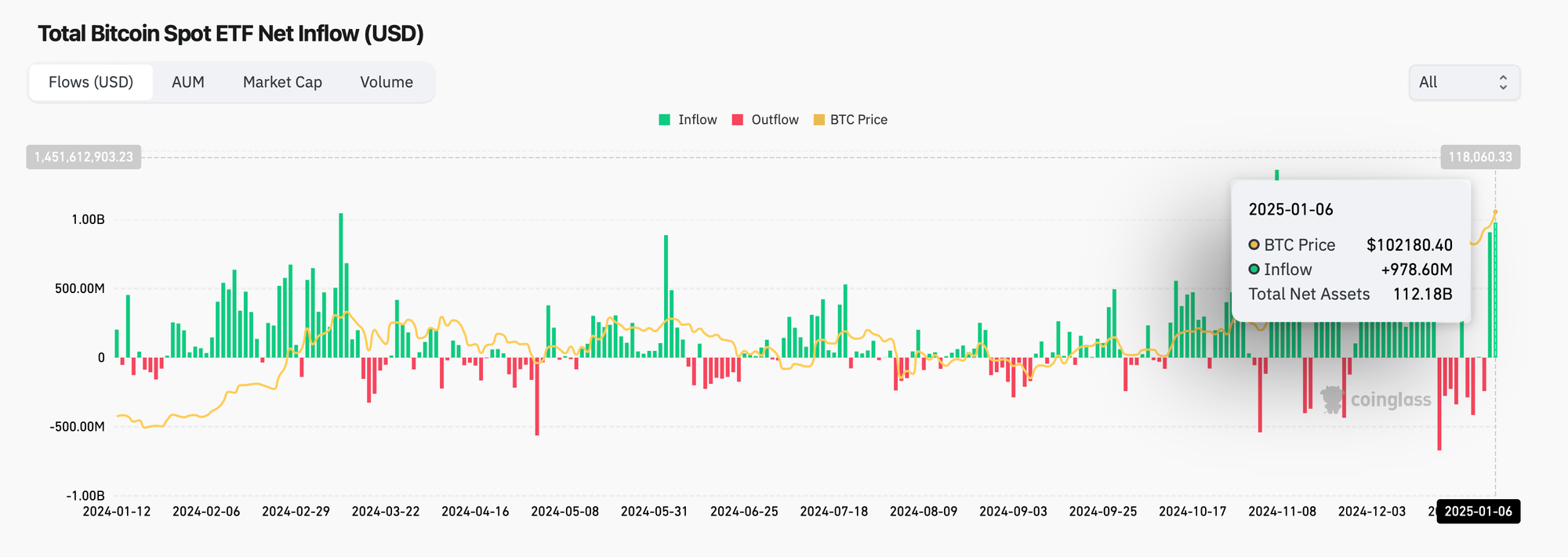

- US BTC Spot ETFs recorded the highest daily inflow since Nov 21 2024 on Monday Jan 6 2025, at $978.6M in inflows.

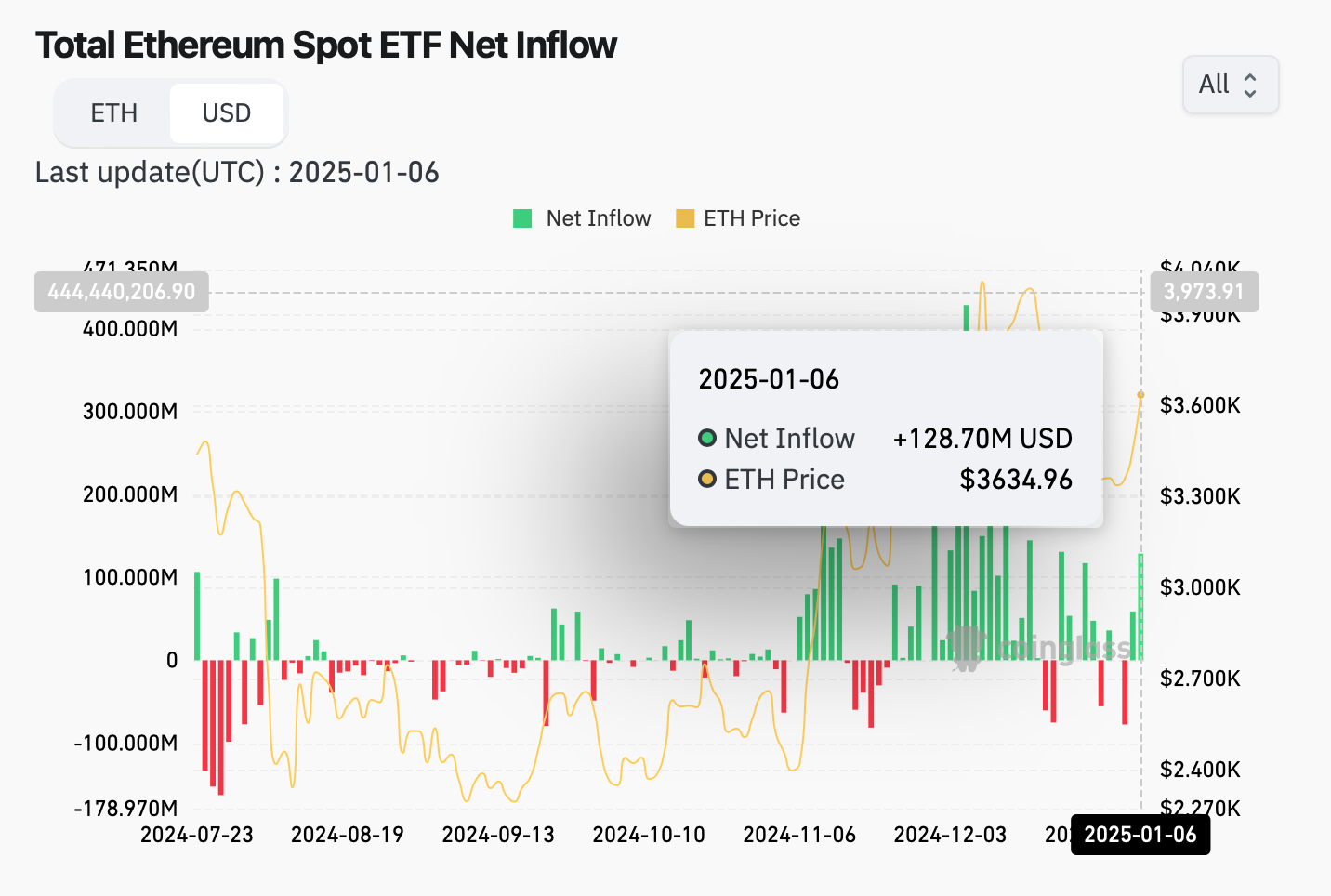

- US ETH Spot ETFs also recorded a net daily inflow of $128.7M.

- Tether's market capitalization came at around $137 bn on Jan 6 2025 compared to $140 bn on Dec 21 2024. The trading volume also dropped from the levels of late December, with only $20 bn recorded on Jan 6 2025, a sharp 91% decline compared to the $233 bn recorded on Dec 21 2024. However, the 24h trading volume as of 09:30 CET on Jan 7 2025 is above $78 bn.

- The decline can be partially attributed to the holiday season and the MiCA regulation leading to the delisting of USDT from Coinbase.

Tether's market cap. Source: Coingecko

- Campaigners have launched a people's initiative to oblige the Swiss National Bank (SNB) to hold part of its reserves in bitcoin. The initiative has 18 months to collect the 100,000 signatures necessary for it to be put to a public referendum.

- The US Federal Reserve’s Michael Barr is set to resign as vice chair for supervision, while continuing to serve as a member of the Federal Reserve Board of Governors. Barr’s resignation will take effect on Feb 28 or earlier if a successor is appointed, he said in a Jan 6 letter addressed to President Joe Biden.