Global markets rose as the Dow Jones (+0.77%), S&P 500 (+0.83%), and Nasdaq (+0.98%) all closed higher, driven by optimism over trade deal prospects and tariff adjustments. The US labor market growth slowed, with only 54,000 jobs added in August, according to ADP, and job openings data fell to levels rarely seen since the pandemic. Meanwhile, the yield curve remains inverted, and economists rallied behind Federal Reserve Governor Lisa Cook amid President Trump's attempts to remove her. The US trade rebounded slightly in July, and a new trade deal with Japan was finalized, with 15% tariffs.

The global crypto market cap increased 0.32% to $3.83tn while the 24hr volume decreased 3% to $144bn.

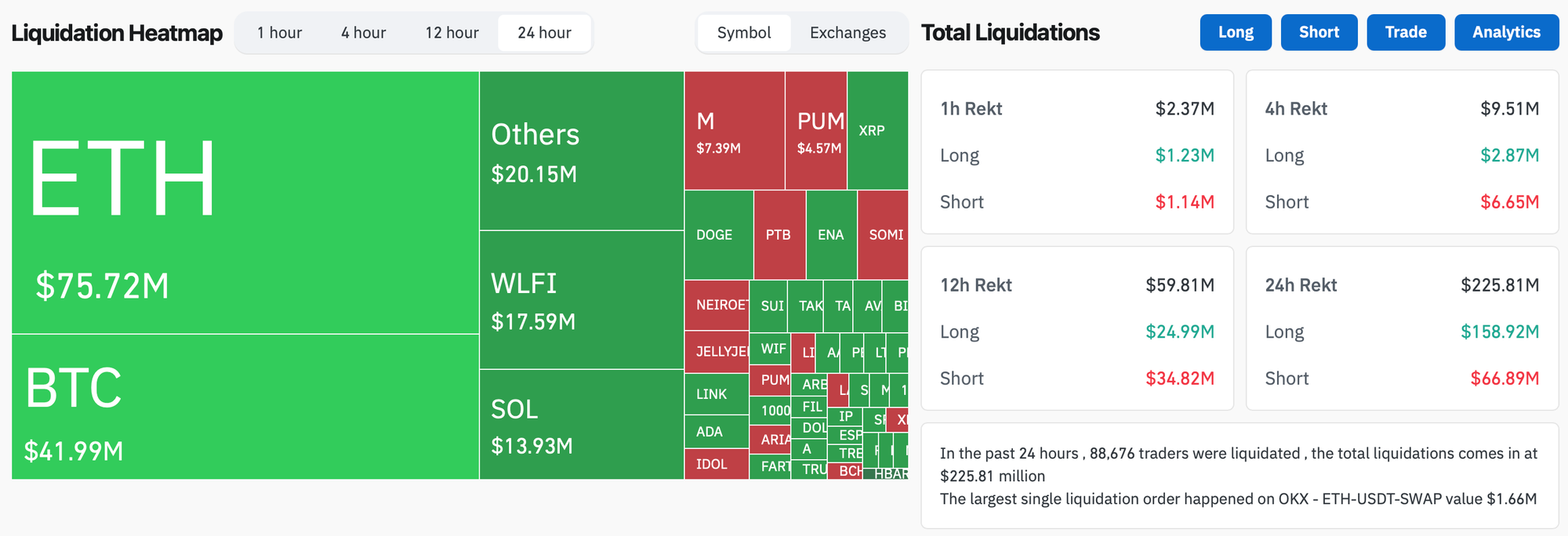

- In the past 24 hours, crypto liquidations totaled $225.8m, with 70.4% of them long positions. The dominance of ETH in liquidations (36.6% of the total) surpasses that of BTC (20.3%).

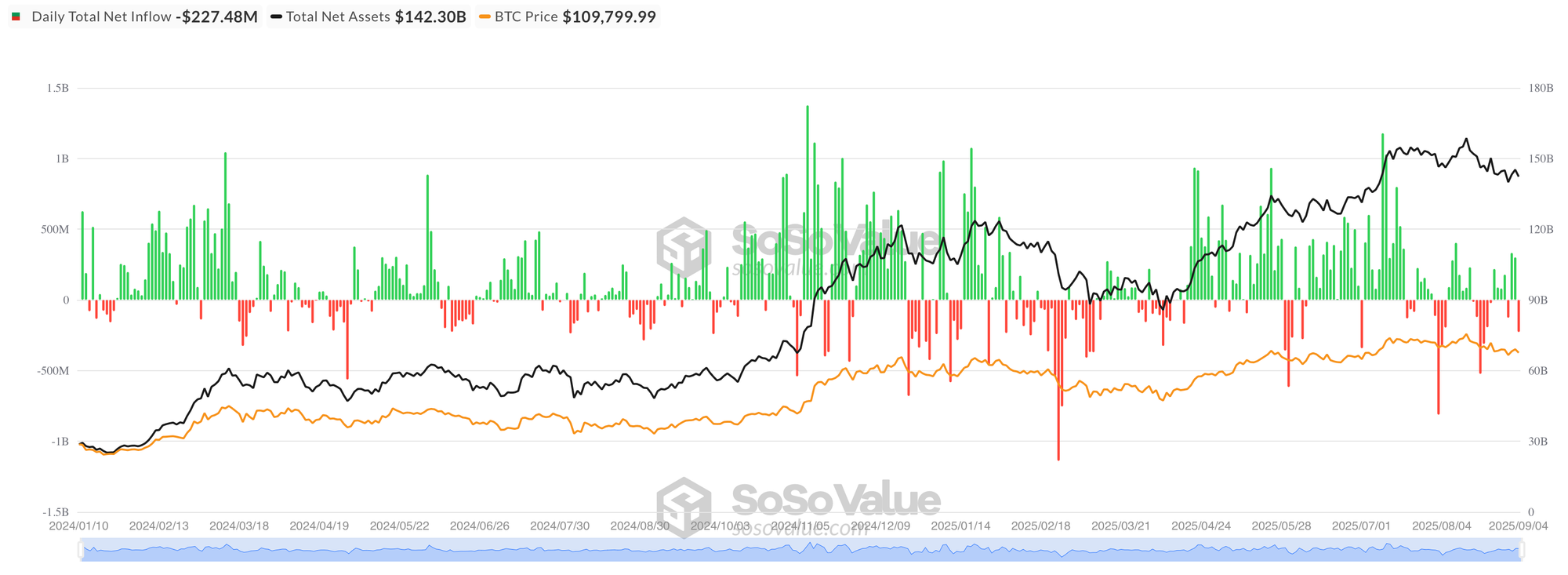

- According to SoSo Value data, US Spot BTC ETFs experienced a reversal with a daily net outflow of $227m, a stark contrast to the previous day's $301m inflow. The weekly net inflow from September 2 to 4 remains positive at $406m.

- According to SoSo Value data, US Spot ETH ETFs saw a daily net outflow of $167.4m, a 337.7% increase from the previous day, suggesting a significant shift in investor sentiment. The top ETFs by AUM, such as ETHA and ETHE, also saw significant daily outflows, with ETHA's daily volume reaching $149m and ETHE's daily outflow hitting $26.4m. The total assets in the market still stand at $27.8bn, with a daily volume of $2.6bn. The outflows are part of a larger trend, with the market experiencing a weekly net outflow of $341m from September 2 to 4, a stark contrast to the $1.08bn net inflow seen in the previous week.

- Public companies have reached a milestone of holding over 1 million Bitcoin (1,000,698 BTC) worth more than $111 billion, representing 5.1% of Bitcoin's total supply, with Michael Saylor's MicroStrategy leading at 636,505 BTC among 184 listed companies that have adopted Bitcoin treasury strategies, according to BitcoinTreasuries.NET data released Thursday.

- Boerse Stuttgart Group launched Seturion, a blockchain settlement platform for tokenized assets across Europe, already tested with the European Central Bank and live at its Swiss venue, as part of a broader European tokenization trend that includes Taurus's Solana platform, Robinhood's Arbitrum layer-2, and Backed Finance's expansion to Ethereum with 60 tokenized US equities.

- The SEC Office of Inspector General found that "avoidable errors" by the IT department led to the permanent loss of nearly a year's worth of text messages from former SEC Chair Gary Gensler's phone between October 2022 and September 2023, including communications about crypto enforcement actions, after a poorly understood automated policy caused an enterprise wipe of his government device during the height of the agency's crypto crackdown.

- Tron founder Justin Sun's World Liberty Financial (WLFI) token address was blacklisted on Thursday after transferring 50 million WLFI tokens worth $9 million to HTX exchange, with Sun claiming the transactions were routine deposit tests that wouldn't impact the market as the Trump-backed DeFi project's token fell 22% to below $0.18 amid efforts to shore up prices through token burns and proposed buyback programs.

- Crypto whales lost millions on Trump family-linked WLFI tokens as the price fell over 40% since its Monday launch despite a 47 million token burn, with whale wallet 0x432 losing $1.6 million on a leveraged long position and the token becoming the ninth-most-bearish by investor sentiment according to CoinMarketCap data.