Global markets were mixed as the Dow Jones (-0.22%) and S&P 500 (+0.01%) showed muted movement, while the Nasdaq (+0.32%) edged higher. The OECD warned that US growth will slow to 1.6% in 2025 due to escalating trade tensions, as President Trump's 50% tariffs on steel and aluminum imports took effect. The euro zone's inflation rate fell to 1.9% in May, below the ECB's target, while the US private sector added just 37,000 jobs in May, according to ADP. The trade war continued to dominate sentiment, with the US and China locked in a dispute over supply chains and tariffs.

- In crypto, the global crypto market cap decreased 1% in the past 24 hours to $3.29tn. The total crypto market 24h decreased 4% to $102bn.

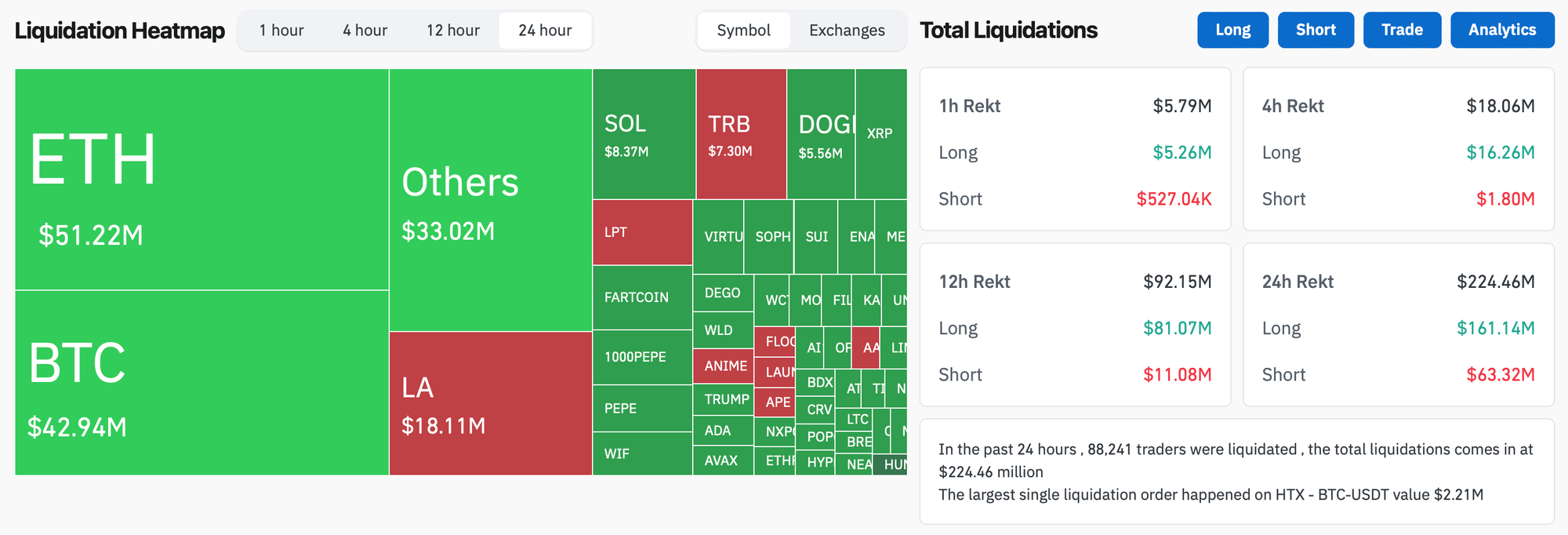

- In the past 24 hours, crypto liquidations increased 51% and totaled $224.45m, with 72% of them long positions.

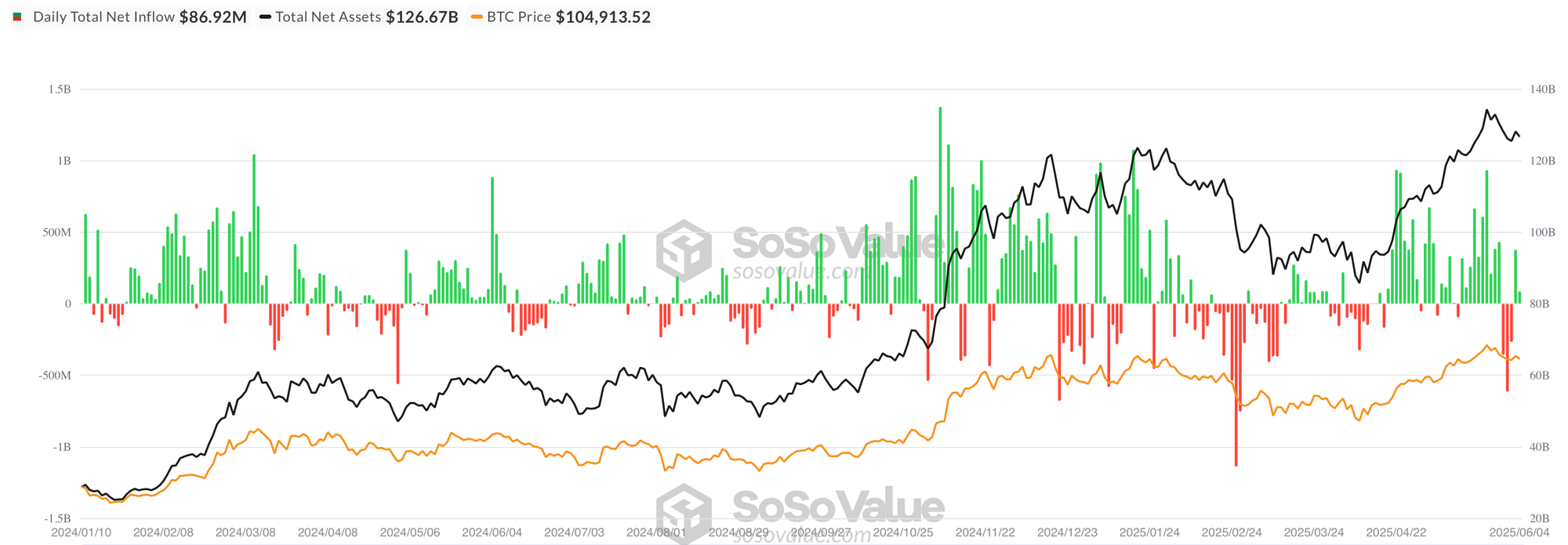

- US Spot Bitcoin ETFs saw net inflows of $86.9 million on June 4, a sharp slowdown from the prior day’s $378 million as market momentum eased. BlackRock’s IBIT was the sole contributor, pulling in $284 million, while all other funds reported flat flows. Fidelity’s FBTC led outflows with -$197 million.

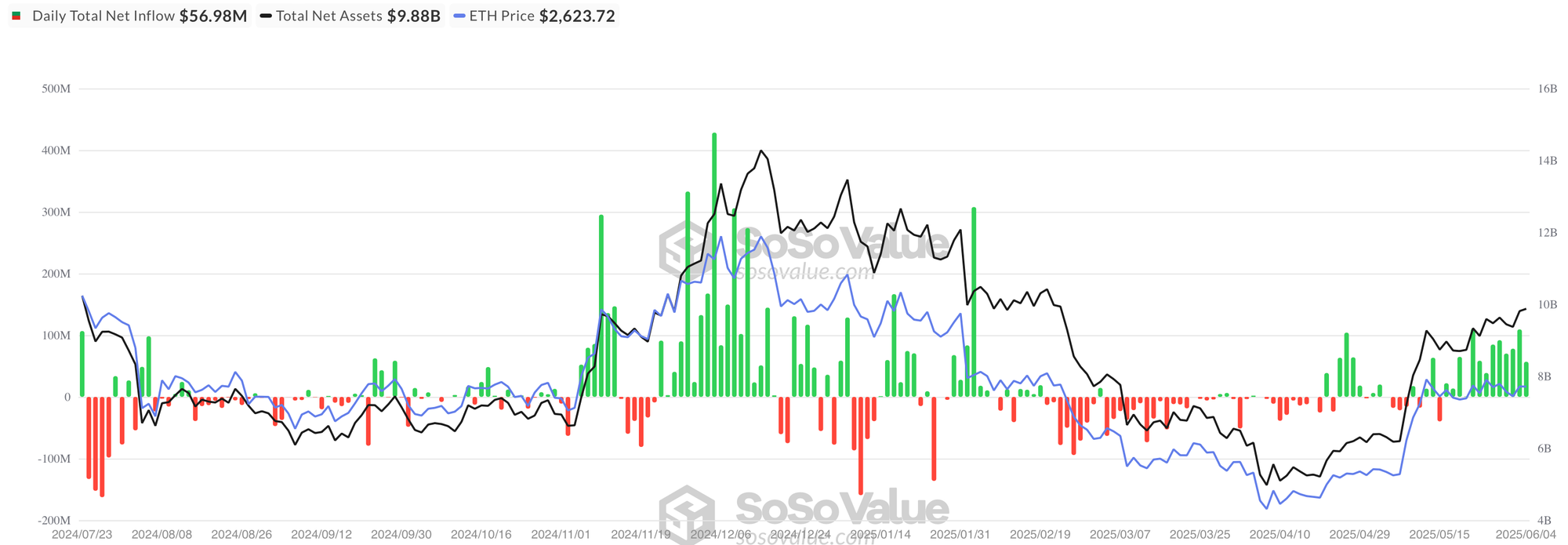

- Ethereum ETFs posted $56.98 million in net inflows on June 4, marking a 13th consecutive session of inflows, slowing down from the $109 million the day prior but still extending the positive streak since May 16. BlackRock’s ETHA led with $73.18 million in inflows, followed by minor inflows from Grayscale's ETH (+$7.42m) while Fidelity’s FETH saw outflows totaling $23.62 million.

- Circle, the issuer of the USDC stablecoin, raised $1.05 billion in its upsized US IPO by pricing 34 million shares at $31 each, valuing the company at roughly $8 billion fully diluted. The listing, one of the year’s largest and among the biggest crypto-related IPOs since Coinbase’s 2021 debut, reflects renewed investor appetite for regulated crypto firms amid a more favorable policy shift under President Trump. Backed by J.P. Morgan, Goldman Sachs, and Citigroup, Circle is set to begin trading on the NYSE under the ticker “CRCL” on Thursday.

- Solana-based memecoin launchpad Pump.fun is reportedly preparing for a $1 billion token sale, with a 10% community airdrop, according to anonymous sources cited by Blockworks. While the project has not officially confirmed the sale, the rumored deal would value Pump.fun at $4 billion and mark one of the largest token offerings in recent crypto history. The speculation follows growing hype after a community post hinted at exchange listings within two weeks. Meanwhile, Pump.fun has rolled out a Creator Revenue Sharing feature, allocating 50% of PumpSwap revenue to token creators as it seeks to expand its ecosystem and reward engagement.

- Nasdaq-listed entertainment firm K Wave Media (KWM) has announced a $500 million securities deal to fund a bitcoin-treasury strategy as part of its ambitious plan to become the "Metaplanet of Korea", after which its stock soared 133%.

- Hong Kong’s Securities and Futures Commission (SFC) is weighing a move to legalize crypto derivatives trading for professional investors, aiming to boost market liquidity and solidify the city’s status as a global crypto hub, according to China Daily. The SFC cited the $70 trillion crypto derivatives market in 2024—vastly eclipsing spot volumes—as a key reason for the shift. It argues that derivatives can support hedging strategies while enhancing transparency and market efficiency. The proposal follows recent regulatory milestones, including the launch of crypto ETFs and authorized staking services, as Hong Kong builds out a comprehensive virtual asset framework.

- Bybit has unveiled a major security overhaul, including upgrades to audits, wallet protection, and information security, in response to a $1.4 billion hack that occurred in February.

- Pakistan's crypto minister met with former US President Trump's digital asset leadership to promote cross-border cooperation and discuss plans for bitcoin-powered infrastructure development in the country.

- Moroccan authorities have arrested a French-Moroccan man suspected of involvement in a string of kidnappings in France targeting wealthy crypto holders, a source told Reuters. The 24-year-old, identified as Bajjou Badiss Mohamed AmiDe, was wanted under an Interpol red notice for organized crime, kidnapping, and extortion. Though sought by France, he will be prosecuted in Morocco due to his dual nationality. The case comes amid a wave of violent attacks against crypto entrepreneurs in France, including the January kidnapping of a Ledger co-founder and a recent attempted abduction in Paris.

- The liquid supply of bitcoin has fallen by 30% in 18 months due to increased institutional demand and new reserve strategies, according to a report by Sygnum Bank.

- Medical tech firm Semler Scientific has added $20 million in Bitcoin to its balance sheet, acquiring 185 BTC between May 23 and June 3, according to a June 4 SEC filing. This brings the company’s total holdings to 4,449 BTC—worth roughly $472.9 million—purchased at an average price of $107,974. Since launching its Bitcoin strategy in May 2024, Semler has invested $410 million and seen a 26.7% return. The company has been steadily expanding its crypto reserves, including a $50 million top-up in May and $10 million more between February and April.

- Hackers are shifting their focus from exploiting smart contract vulnerabilities to targeting human behavioral weaknesses, according to the co-founder of web3 cybersecurity firm Certik, indicating a need for cybersecurity strategies to adapt and address these new social engineering threats.