Global markets rose as the Dow Jones (+0.51%), S&P 500 (+0.58%), and Nasdaq (+0.81%) all closed higher, despite concerns over the escalating trade war. The US imposed 50% tariffs on steel and aluminum imports, while the OECD warned that the trade war would drag down the global economy. Job openings surprisingly increased to 7.4 million in April, and euro zone inflation fell to 1.9%, below the ECB's target. The US growth forecast was cut sharply by the OECD, with the economy now expected to expand by just 1.6% in 2025.

- In crypto, the global crypto market cap remained unchanged in the past 24 hours at $3.32tn. The total crypto market 24h decreased 6% to $106bn.

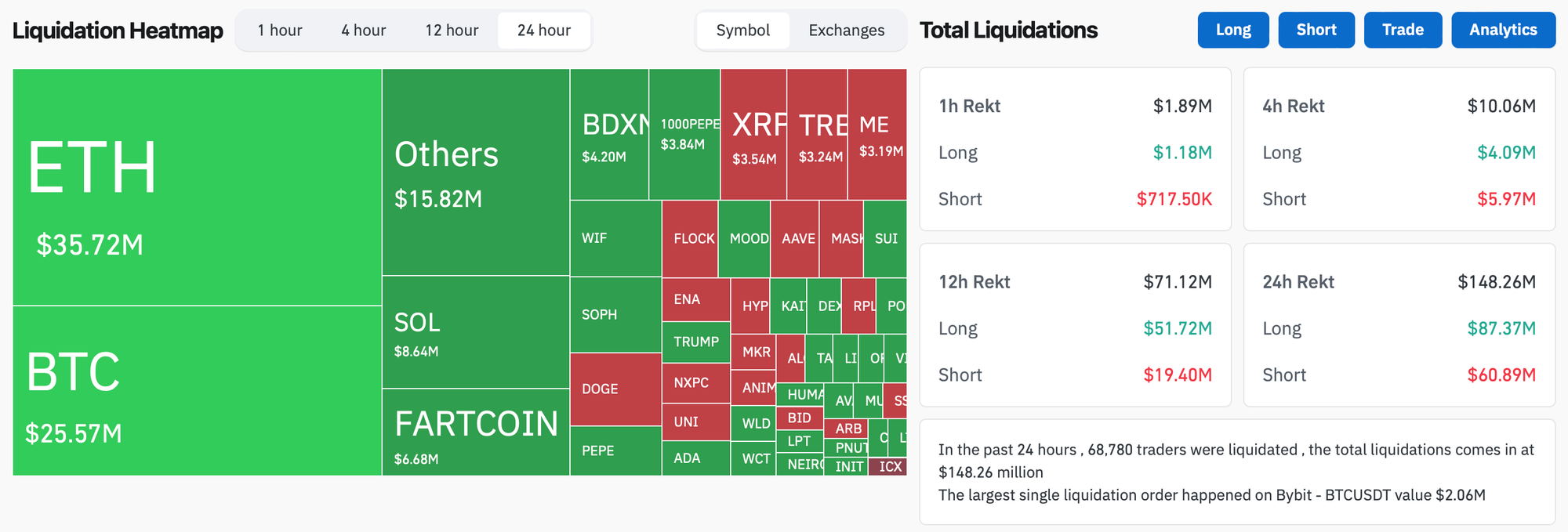

- In the past 24 hours, crypto liquidations decreased 28% and totaled $148m, with 59% of them long positions.

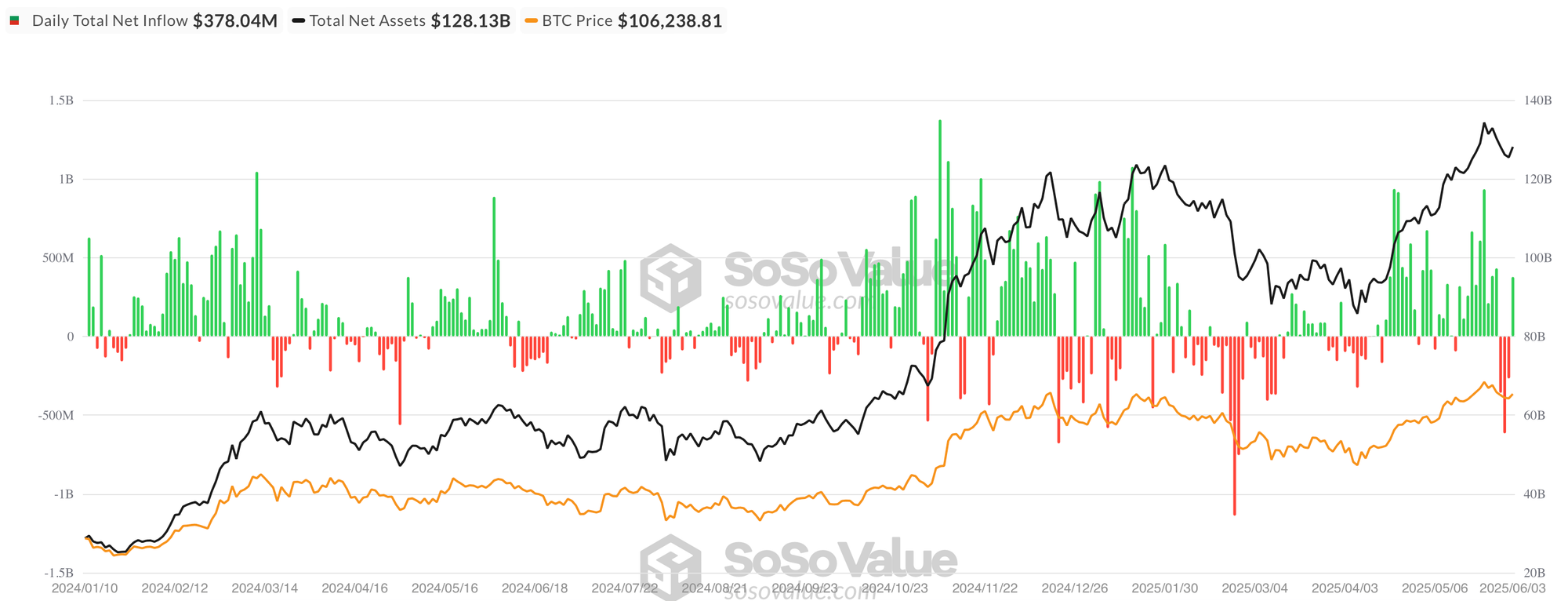

- Bitcoin ETFs saw a strong rebound on June 3, pulling in $378m in net inflows after three straight days of outflows totaling over $1.2bn. Fidelity’s FBTC led with $137m, followed closely by ARKB ($140m) and BlackRock’s IBIT ($58m). All twelve funds traded higher, lifted by a broad crypto rally that sent Bitcoin above $106k. Total net assets rose to $128.13bn, matching last week’s levels.

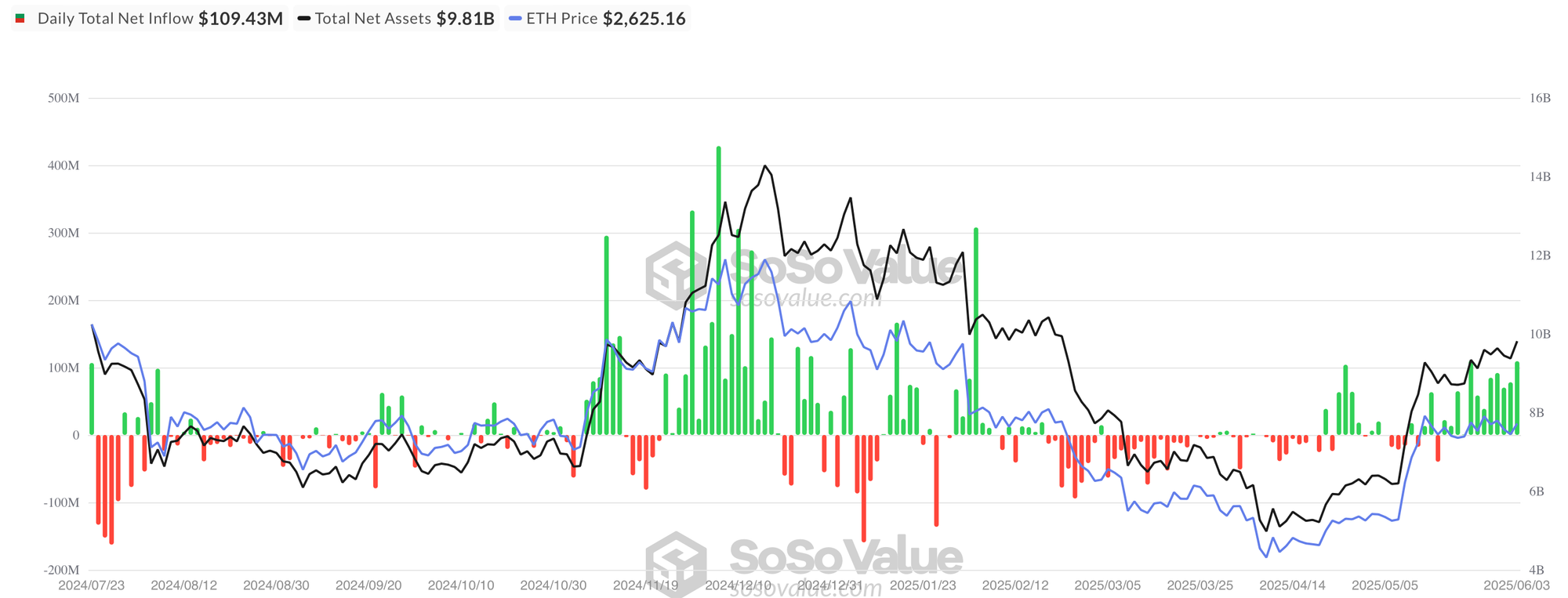

- Ethereum ETFs extended their positive streak with $109m in net inflows on June 3. BlackRock’s ETHA led with $77m, followed by Fidelity’s FETH ($21m) and Grayscale’s ETH ($8m). All nine funds traded higher as Ether surged lifting total net assets to a new high of $9.81bn.

- Paris-based Blockchain Group has acquired $68 million in Bitcoin, bringing its total holdings to 1,471 BTC.

- Texas Representative Brandon Gill is under scrutiny for late disclosures of $500,000 in bitcoin trades, prompting questions about the timing of these transactions and potential violations of the Stock Act.

- BCP Technologies' CEO suggests that the company's new pound-backed stablecoin, TGBP, could act as a live proof-of-concept for future stablecoin regulation by the Financial Conduct Authority, potentially influencing how regulatory bodies approach the stablecoin market.

- A data breach at Coinbase has reignited backlash against Know Your Customer (KYC) rules, after the exchange disclosed that overseas contractors were bribed to leak the personal data of 70,000 users, including government IDs and home addresses. Critics argue that mandatory KYC has become a liability, exposing users to threats while failing to stop fraud. Blockchain sleuth ZachXBT highlighted how easy it is to bypass these checks, revealing he once passed Gate.io’s verification using a fake ID for “Kim Jong-Un.” Others, like Secret Foundation’s Lisa Loud, say the breach has already led to suspicious activity targeting them. While privacy advocates push for zero-knowledge alternatives, regulators remain committed to traditional KYC, even as its flaws become increasingly evident.

- The Crocodilus Android banking trojan is rapidly expanding beyond its original base in Turkey, launching new campaigns across Europe and South America that now target both banking apps and crypto wallets, according to ThreatFabric. The malware, which first appeared in March 2025, has been spotted in Poland, Spain, Argentina, Brazil, India, and the U.S., deploying tactics like fake browser updates and malicious Facebook ads to infect devices. Crocodilus overlays fake login screens onto legitimate apps and now includes new features such as a seed phrase collector for crypto wallets and contact list manipulation for social engineering. With enhanced obfuscation making it harder to detect, analysts warn that the malware is increasingly focused on draining crypto accounts through stealthy and highly targeted attacks.

- Crypto trader James Wynn has opened a second $100 million leveraged Bitcoin position just days after being liquidated from a similar trade on May 30, when BTC briefly dipped below $105,000, according to blockchain tracker Hypurrscan. Wynn, whose new position risks liquidation at $103,630, claims on X that he’s being targeted by a “market-making cabal,” urging followers not to let “these evil bastards liquidate me.” The claim drew support from crypto influencer Altcoin Gordon, who alleged in an X post on June 2 that market makers had manipulated prices toward Wynn’s stop. At least 24 blockchain users have sent donations to Wynn’s address, with one transfer nearing $8,000, per data from pseudonymous analyst “dethective.” Despite losses, Wynn remains bullish, predicting a rally that will “catch investors off guard.”

- Malikie Innovations, the owner of 32,000 recently acquired BlackBerry patents, has sued Bitcoin miners Marathon Digital and Core Scientific for allegedly using its intellectual property without permission, sparking a legal dispute over patent infringement in the cryptocurrency mining sector.

- Tether and Bitfinex have moved $3.9 billion in Bitcoin to Jack Mallers' Twenty One Capital, making it the third-largest corporate Bitcoin holder after Strategy and Mara.

- Cango mined 954.5 bitcoins, valued at over $100 million, in April and May after pivoting to bitcoin mining and selling its legacy operations.

- Mara has increased its bitcoin holdings to 49,179 BTC as of May's mining production, with Chief Financial Officer Salman Khan confirming that the company has sold zero BTC, indicating a long-term investment strategy.

- A K-12 education company, Classover, has allocated up to $900 million to purchase Solana tokens, marking a significant investment in cryptocurrency with potential implications for the education sector's adoption of blockchain technology.

- Tokenized short-term funds have surged to $5.7 billion in assets since 2021, driven by rising institutional demand, according to a new Moody’s report. These blockchain-based funds—typically backed by low-risk assets like U.S. Treasurys—offer real-time settlement, improved liquidity, and operational efficiency, making them attractive for asset managers, insurers, and brokerages. BlackRock leads the space with $2.5B in assets, followed by Franklin Templeton and others like Circle and Superstate. While Moody’s sees continued growth, the report also flags blockchain-specific risks, including smart contract bugs and legal ownership discrepancies.

- Trump-linked asset manager filed a Truth Social Bitcoin ETF with the Securities and Exchange Commission to be listed on a major exchange and made available for public trading.

- The California State Assembly has unanimously passed a bill that would allow state agencies to accept cryptocurrency for payment, which will now be considered by the Senate after receiving a 68-0 vote.