Global markets rose as the US economy surpassed expectations, adding 147,000 jobs in June, exceeding forecasts and leading investors to scale back bets on interest rate cuts. The Dow Jones (+0.77%), S&P 500 (+0.83%), and Nasdaq (+1.02%) all closed higher. The US private sector lost 33,000 jobs, missing expectations, but government sector growth boosted the labor market. The US tariff receipts surged to a record $24.2bn in May, highlighting potential distortions to global trade flows. The global crypto market cap decreased 0.55% in the past 24h to $3.36tn while the 24h volume decreased 15% to $110bn.

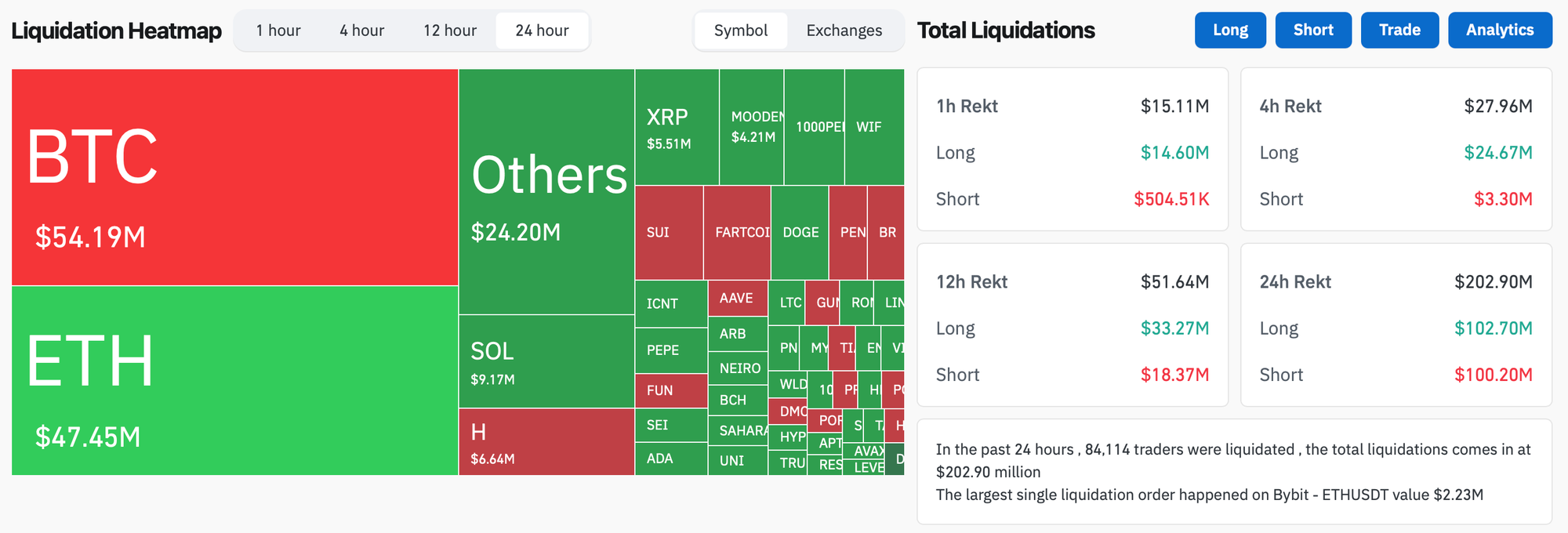

- In the past 24 hours, crypto liquidations decreased by 35% and totaled $202m, split into 50% shorts and 50% longs.

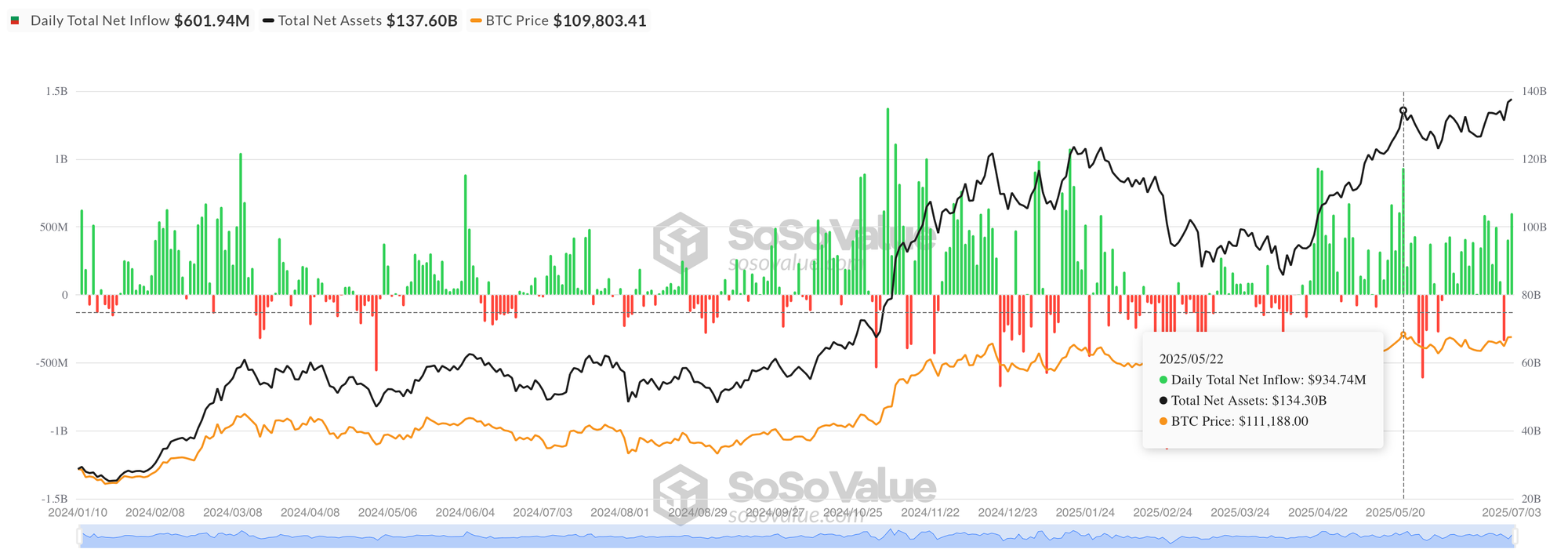

- According to data from SoSo Value, Bitcoin ETFs recorded their strongest day since May 22 on July 3, attracting a massive $601.9 million in net inflows despite Bitcoin trading slightly lower, demonstrating robust institutional appetite that has now sustained through two consecutive days of heavy buying. Fidelity's FBTC led the charge with $237.1 million in inflows, followed closely by BlackRock's IBIT at $224.5 million and Ark's ARKB contributing $114.3 million, while Grayscale's GBTC maintained zero flows for the second straight day. All Bitcoin ETFs declined modestly around 0.4% as the cryptocurrency consolidated recent gains, but total assets reached a new high of $137.6 billion with cumulative net inflows surpassing $49.6 billion since launch. The record-breaking inflows, totaling over $1 billion across just two trading days, suggest institutional investors are aggressively accumulating Bitcoin exposure during price weakness, with the ETFs serving as the preferred vehicle for large-scale cryptocurrency investment strategies.

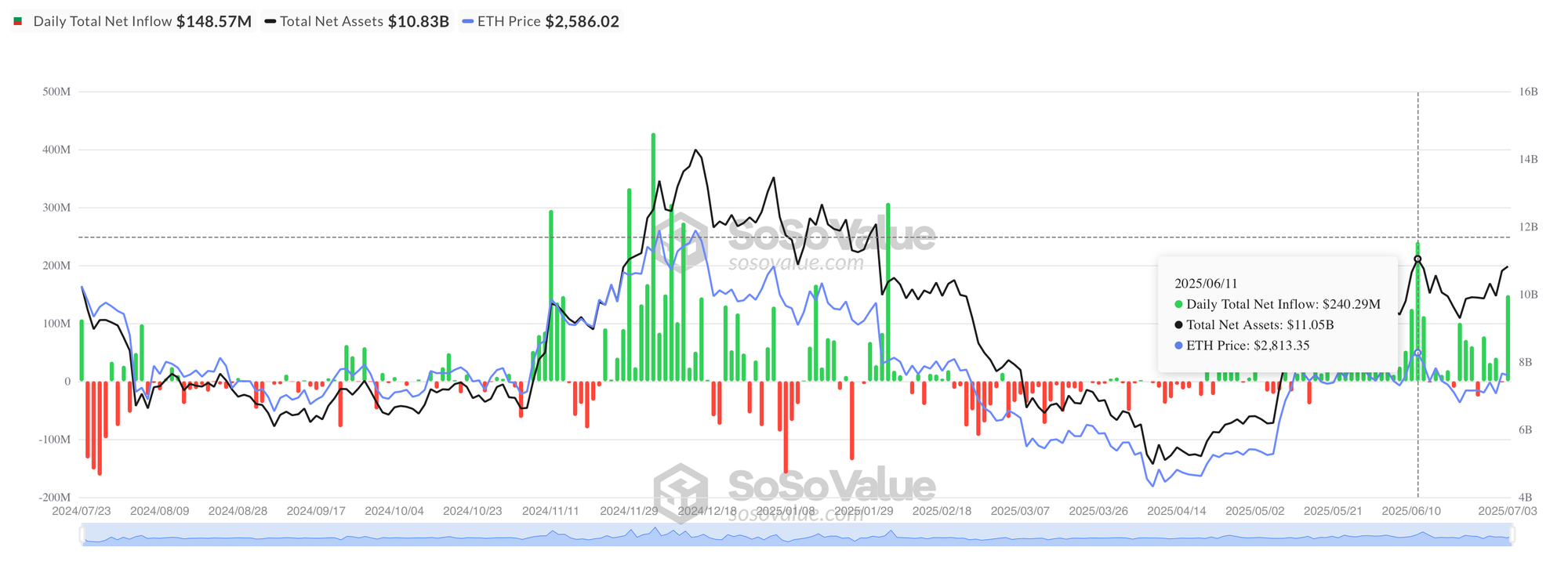

- According to data from SoSo Value, Ethereum ETFs recorded strong net inflows of $148.6 million on July 3, the strongest since June 11, bouncing back decisively from the previous day's minor outflows as institutional demand for ETH exposure accelerated. BlackRock's ETHA dominated with $85.4 million in inflows while Fidelity's FETH contributed $64.7 million, together accounting for over 100% of the day's total as these two providers continue to capture the majority of new institutional interest. Grayscale's products showed mixed signals with the lower-fee ETH adding $3.9 million while the higher-fee ETHE recorded $5.4 million in outflows, reflecting the ongoing fee-sensitive nature of ETH investors. All Ethereum ETFs declined around 1.2% as the cryptocurrency pulled back, but total assets climbed to $10.8 billion with cumulative net inflows reaching $4.40 billion since launch.

- USDC transactions on BitPay nearly doubled USDT transactions in 2024, but the trend has shifted in favor of USDT this year, indicating a significant change in user preference or market demand for stablecoins on the platform.

- Federal prosecutors have seized $40,000 in cryptocurrency from scammers who were posing as officials of the Trump-Vance inaugural committee.

- Over 40 fake Firefox extensions impersonating popular crypto wallets have been discovered as part of an ongoing campaign to steal users' wallet credentials.

- Peter Märkl, General Counsel at Bitcoin Suisse, criticized the European Union and Swiss stablecoin regulations as inadequate and burdensome.

- The International Monetary Fund has blocked Pakistan's proposal to use cheap electricity for cryptocurrency mining due to concerns that it could destabilize the country's energy market and impact its economic stability.

- Europe's largest asset manager Amundi warned that the US GENIUS Act could backfire by creating an alternative to the dollar and destabilizing global payments, with chief investment officer Vincent Mortier saying the requirement for full collateralization of stablecoins might signal "the dollar is not that strong" and turn stablecoin issuers into "quasi-banks."

- Singapore's Monetary Authority granted crypto exchange Bitstamp a license to operate in the country, making it one of the few firms to secure approval after regulators warned they had "set the bar high for licensing and will generally not issue a license" amid a Monday deadline for unlicensed crypto firms to cease operations.

- Mining companies' stocks rose sharply on Thursday in response to the surprisingly positive US nonfarm payrolls report, which indicated a stronger labor market than expected.

- Tornado Cash Roman Storm is scheduled to appear in a New York courtroom on July 14 for his criminal trial, facing charges of money laundering and conspiracy.

- UAE authorities arrested WhiteRock Finance founder Ildar Ilham for extradition to the Netherlands over allegations connected to the $30 million ZKasino fraud case, causing WhiteRock's native token to plunge 40%, according to crypto investigator ZachXBT.