Market Overview

| Asset | Level | 1d Change | 7d Change | 30d Change |

|---|---|---|---|---|

| Global Crypto Market Cap | $2.58T | -2.07% | - | - |

| BTC | $76,457 | +1.09% | -14.27% | -18.56% |

| ETH | $2,267 | +1.78% | -24.59% | -29.72% |

| Dow Jones | 49,241 | -0.34% | +0.29% | - |

| S&P 500 | 6,918 | -0.84% | +0.03% | - |

| Nasdaq | 23,255 | -1.43% | -1.05% | - |

| VIX | 18.00 | +10.16% | +11.87% | +20.72% |

U.S. equities markets declined with the S&P 500 sliding 0.8% to 6,918 and the Nasdaq 100 falling 1.6% after Anthropic released an AI automation tool that sparked a tech selloff, particularly in software stocks with the iShares Expanded Tech-Software ETF plunging 4.5% and names like Gartner (-21%), PayPal (-20%), and Expedia (-15%) hit hard; however, beneath the surface a rotation into economically sensitive sectors offered hope with the Russell 2000 adding 0.3% and cyclical stocks like FedEx rallying.

MBA Mortgage Applications, ADP Employment Change for January, and ISM Services Index for January are scheduled for release.

The Stoxx 600 edged up 0.1% to an all-time high despite similar AI disruption fears affecting U.S. counterparts, with professional analytics providers RELX and Wolters Kluwer plunging over 10% but basic resources surging 4.2% to their highest level since 2008 led by Anglo American (+7.2%), Rio Tinto (+3.5%), and Glencore (+3.3%); energy stocks climbed 1.5% to a 2008 high while banks closed at their best level since 2008 with ING gaining 3.1%.

CPI Core YoY and MoM data is scheduled for release.

Precious metals staged a dramatic recovery with gold jumping 6% to around $4,939 per ounce and silver surging over 11% to $85.54 after last week's historic rout; oil prices climbed 2.6% for Brent crude to $68 and 3% for WTI to $64 on Middle East tensions; Bitcoin fell as much as 7% to briefly dip below $73,000 before recovering to around $76,000, erasing all gains since Trump's election and down 40% from October highs.

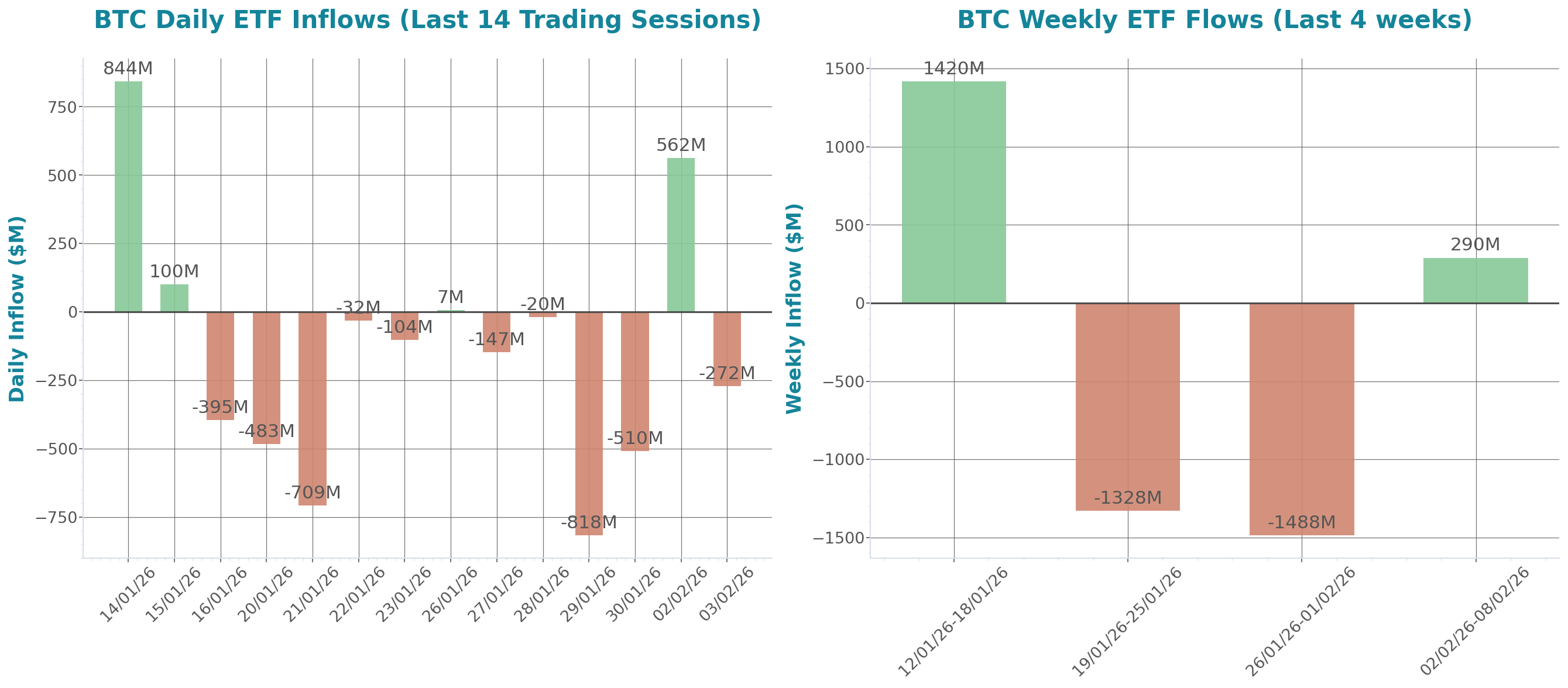

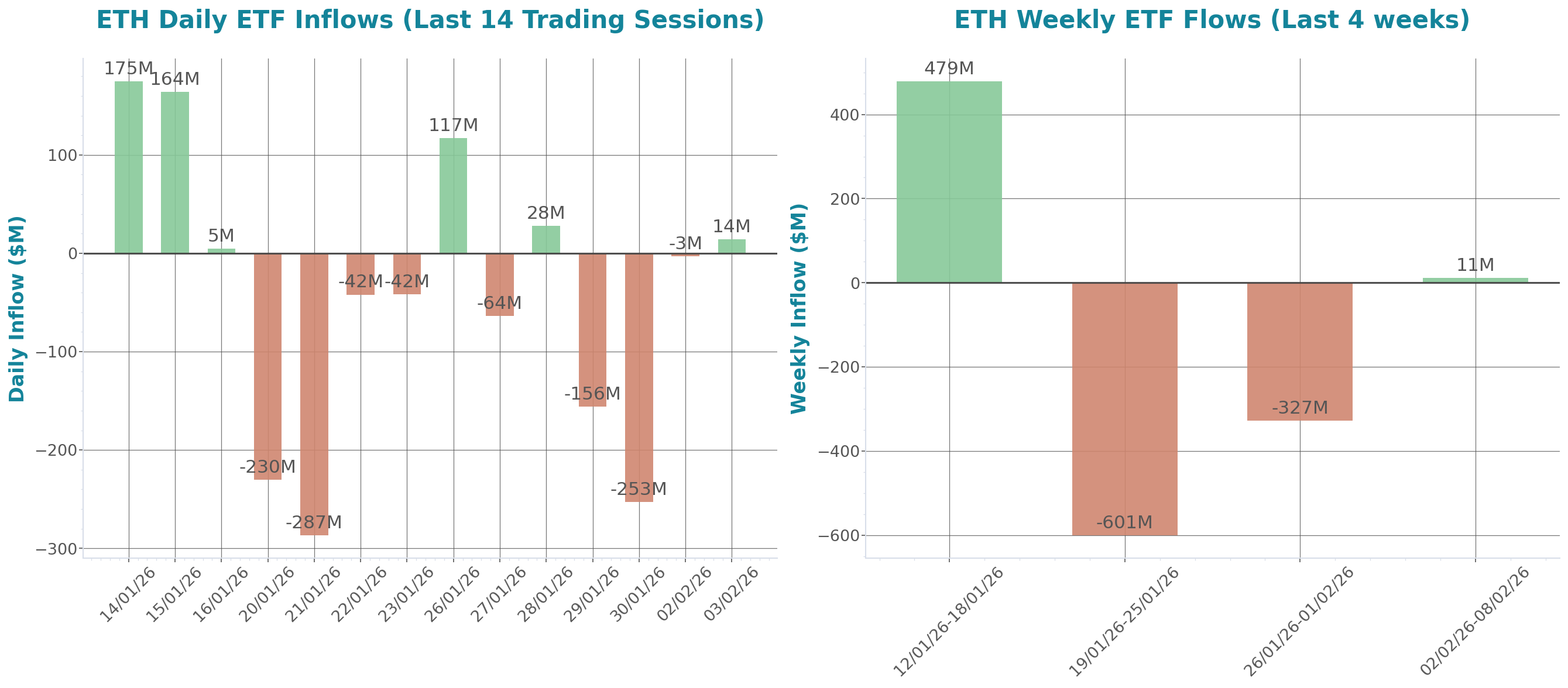

US Spot ETF Flows

| Asset | Daily Inflow | Daily Change | Weekly Inflow | Total Assets | Daily Volume |

|---|---|---|---|---|---|

| BTC ETFs | $-272.0M | -148.4% | $289.9M | $97.0B | $8.6B |

| ETH ETFs | $14.1M | -592.2% | $11.2M | $13.4B | $2.8B |

| SOL ETFs | $1.2M | -77.8% | $6.8M | $854.3M | $58.0M |

US BTC Spot ETF Flows

US ETH Spot ETF Flows

US SOL Spot ETF Flows

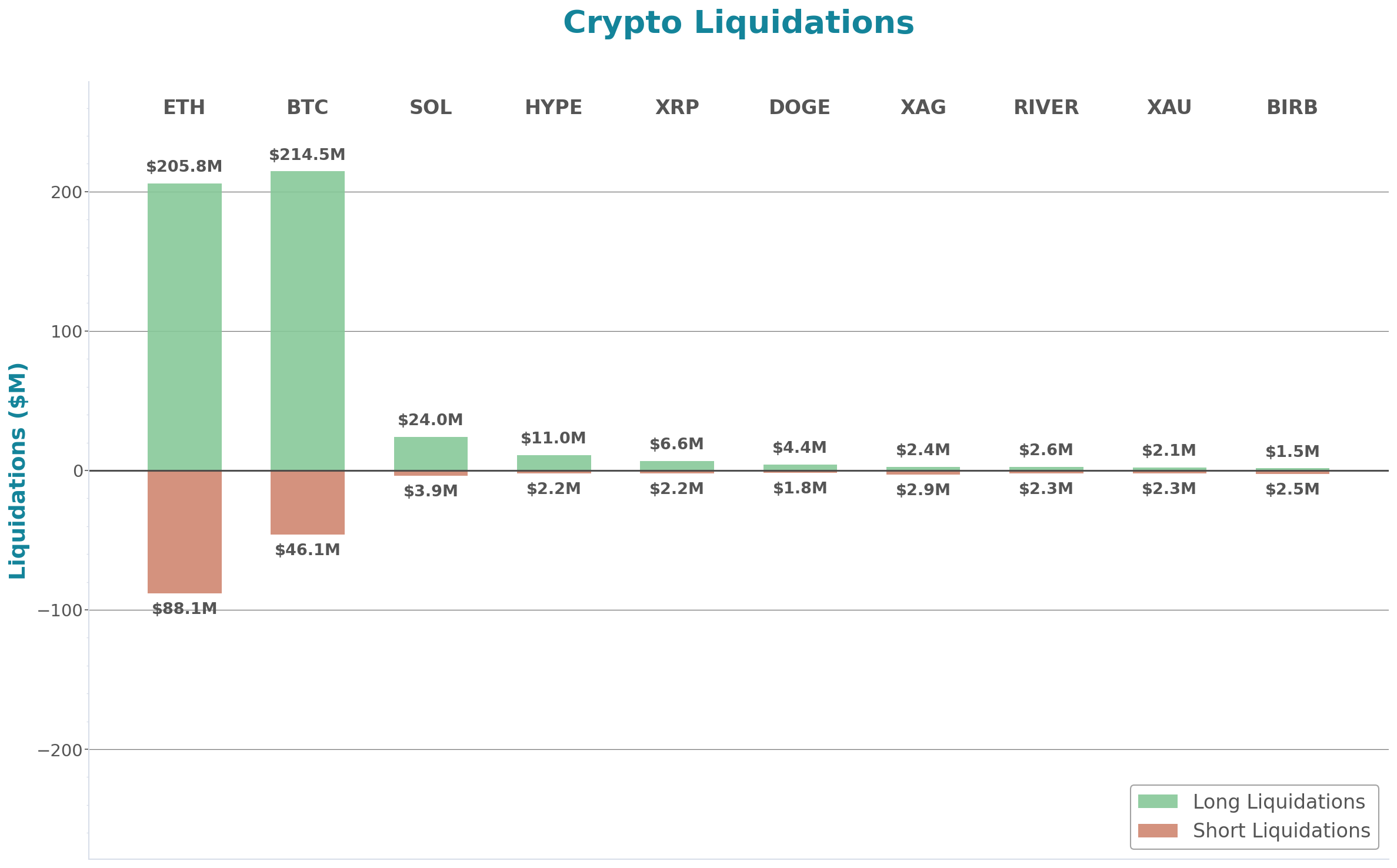

Crypto Liquidations Summary

| Liquidation Type | Value | % of Total | 24h Change |

|---|---|---|---|

| Total Liquidations | $680.17M | - | $+390.11M (+134.49%) |

| Shorts | $169.10M | 24.9% | $-28.66M (-14.49%) |

| Longs | $511.07M | 75.1% | $+418.76M (+453.66%) |

| BTC | $260.59M | 38.3% | $+172.59M (+196.11%) |

| ETH | $293.89M | 43.2% | $+194.41M (+195.42%) |

- Crypto.com launches standalone prediction market app 'OG' after reporting explosive growth in its prediction markets business, entering the booming industry.

- Galaxy Digital reports a $482 million net loss in Q4 2025, due to lower digital asset prices and $160 million in one-time costs.

- Coin Metrics reported a tripling of stablecoin 'dust' transactions on Ethereum post-Fusaka, with 43% of 227 million USDC and USDT balance updates being transfers under $1, according to Coin Metrics analysis.

- World Liberty launches a $3.4-billion stablecoin and lending platform to expand its presence in onchain credit and DeFi markets.

- Spot crypto trading volumes plummet 50% since October, hitting 2024 lows, as liquidity and investor demand weaken.