Global markets edged higher, with the Dow Jones (+0.28%), S&P 500 (+0.4%), and Nasdaq (+0.39%) all closing in the green, supported by strong earnings from Nvidia (+3%). Investors navigated a complex trade landscape as a US appeals court granted a temporary reprieve to Trump’s tariffs, helping push Treasury yields lower. Meanwhile, economic data showed the US economy contracted in Q1, dragged by weak consumer spending and a larger-than-expected trade deficit. Pending home sales fell sharply — the worst drop since September 2022 — and jobless claims ticked higher, pointing to cooling labor conditions. The US dollar slipped (-0.4%) as markets priced in a more dovish Fed outlook, with growing attention on the upcoming PCE inflation print.

- In crypto, the global crypto market cap decreased over 2% in the past 24 hours to $3.35tn. The total crypto market 24h increased 7% to $138bn.

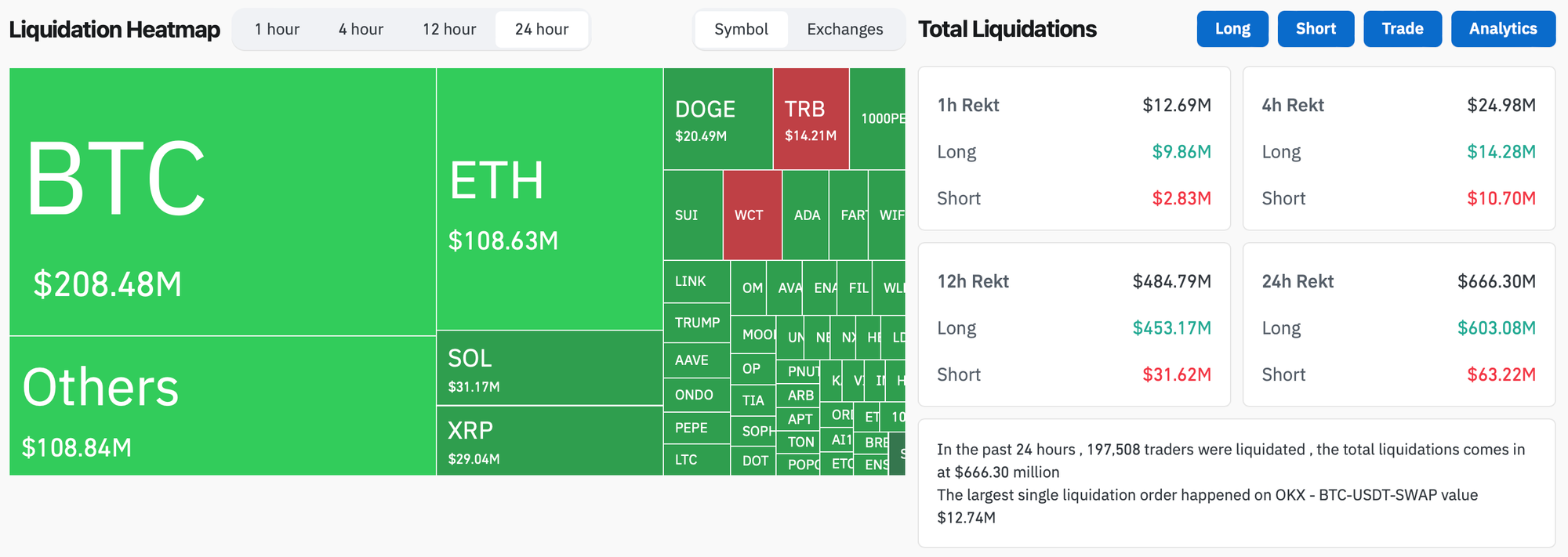

- In the past 24 hours, crypto liquidations increased 127% and totaled $666.3m, with more than 90% of them long positions. BTC positions made up more than 31% of all liquidated positions.

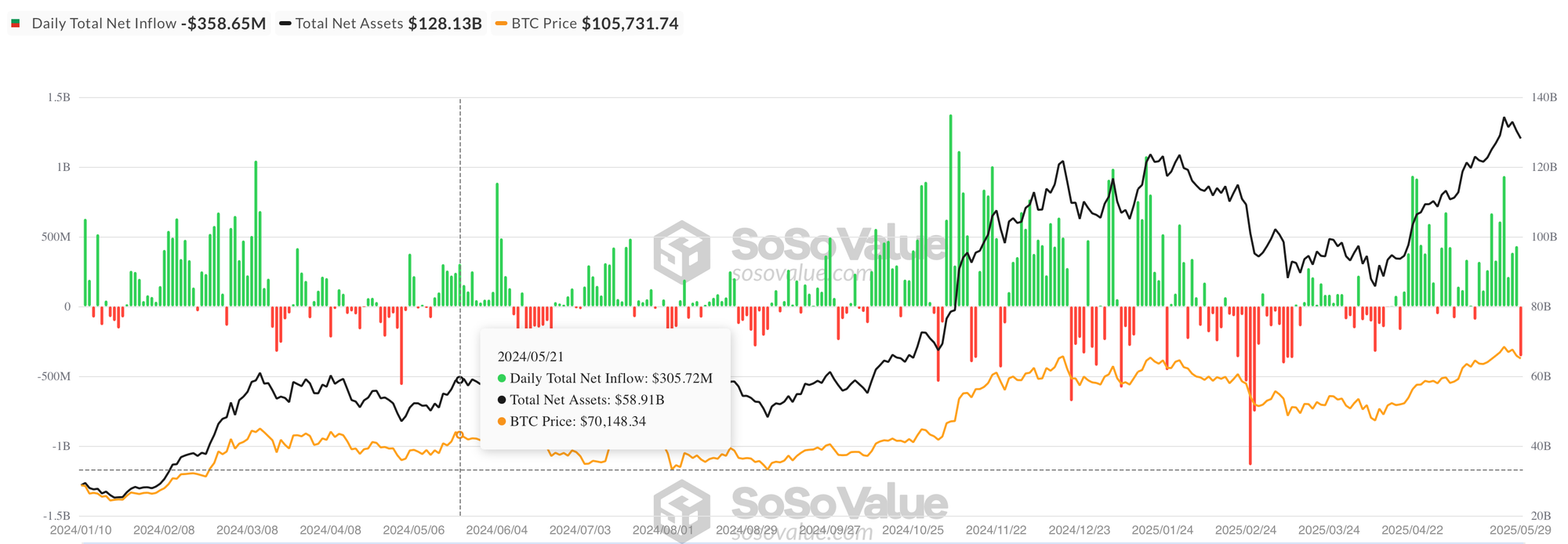

- US spot Bitcoin ETFs saw a sharp reversal on Wednesday, posting $358.65 million in net outflows after an extended run of inflows that spanned 13 of the past 14 trading sessions. The move marks the largest single-day outflow since April 8 and comes just despite BlackRock’s IBIT pulling in over $125 million. Only IBIT managed a net inflow. Fidelity’s FBTC saw $166 million in redemptions, followed by Grayscale’s GBTC (-$107m) and Ark’s ARKB (-$89m). Despite the drop, cumulative net inflows remain near record highs at $44.99 billion, with total assets under management at $128.13 billion. Trading volume picked up to $5.39 billion, the highest since May 22. While the pullback breaks a strong inflow trend, the broader trajectory remains positive heading into June, as dominant funds continue to consolidate long-term institutional demand.

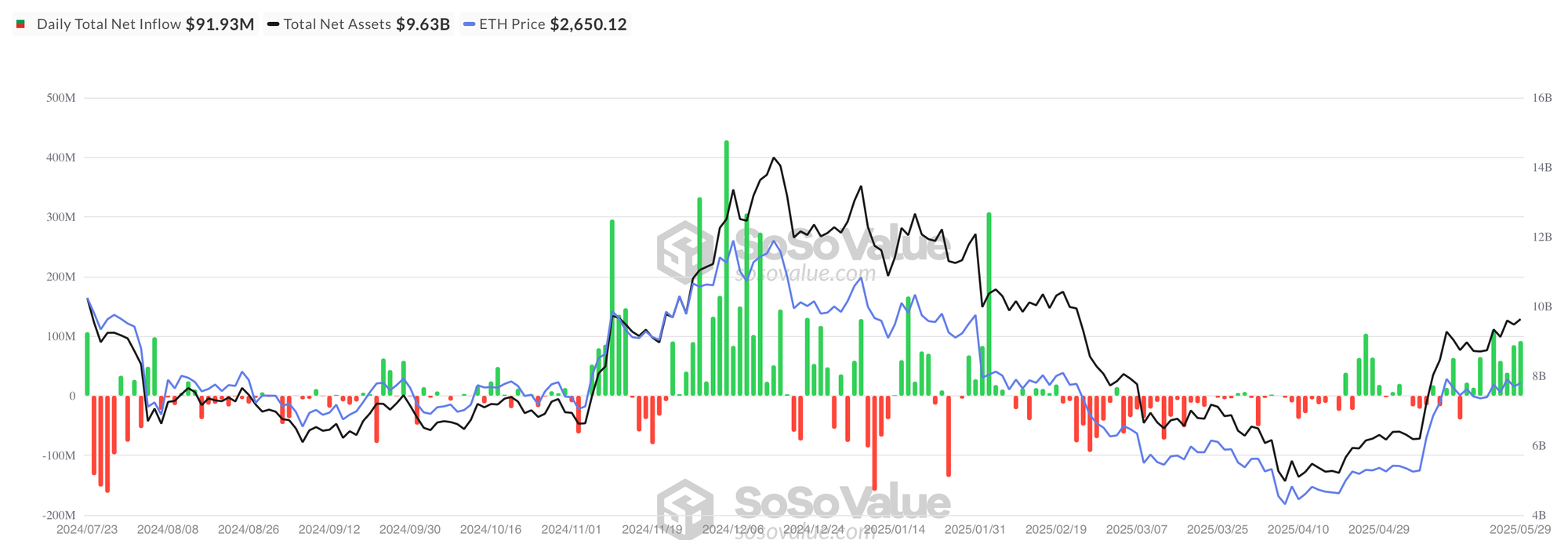

- US spot Ethereum ETFs recorded their ninth straight session of inflows, pulling in $91.93 million — the highest since May 22. Over this run, the ETFs have absorbed over $530 million, lifting cumulative net inflows to $2.98 billion and total assets under management to $9.63 billion. The gains were broad-based, with every ETF recording net inflows except Grayscale’s ETHE, which saw a $4.62 million outflow, continuing its ongoing bleed. BlackRock’s ETHA led again with $50.45 million, followed by Fidelity’s FETH at $38.31 million. Daily trading volumes came in at $552 million, reflecting solid investor interest ahead of expected spot ETH market developments.

- James Wynn, a hyperliquid trader, had his 949 Bitcoin long positions liquidated when the cryptocurrency's price dipped below $105,000, resulting in significant losses due to his inability to meet margin requirements.

- Blockchain intelligence platform Bubblemaps has launched its V2 product, offering new tools such as Magic Nodes and Time Travel to help users detect insider activity and prevent memecoin-related scams by uncovering hidden wallet connections and reconstructing historical token distribution.

- Bybit has obtained a MiCA license from Austria's Financial Market Authority, allowing it to operate as a regulated crypto asset service provider across the 29 European Economic Area member states and serve nearly 500 million Europeans from its new European headquarters in Vienna, Austria.

- The Bank of Russia has permitted financial institutions to offer cryptocurrency-based financial instruments to accredited investors, excluding actual cryptocurrency delivery, and major banks like T-Bank have already begun rolling out such products following the announcement on May 28.

- Hidden Road, following its acquisition by Ripple, has launched a product allowing its US clients to trade cash-settled over-the-counter swaps across major crypto assets, marking one of the company's first significant product launches since the acquisition.

- Sol Strategies, a Solana-focused investment firm, has filed a preliminary base shelf prospectus to offer up to $1 billion in common shares, providing flexibility to access capital and support long-term growth plans in the Solana ecosystem.

- The Reserve Bank of India is expanding its digital rupee pilots by introducing new use cases and features, exploring programmability and offline capabilities, and scaling adoption, while also reporting significant growth in digital payments and dominating global real-time payments.

- The Ethereum Foundation has borrowed $2 million in GHO, a decentralized stablecoin developed by Aave, signaling its deeper engagement with decentralized finance strategies and marking a significant move towards more sophisticated treasury management.

- Donut Labs, a New York-based company, has raised $7 million in a pre-seed funding round led by Sequoia, Bitkraft, and HackVC to develop the world's first agentic crypto browser, which uses artificial intelligence to help users interact with blockchain-based applications and redefines the traditional browser experience.

- The first atomic swap occurred on May 27, where $2 million in USDC was exchanged for the new MTBill asset in a trustless and intermediary-free transaction.

- The leader of Reform UK announced plans to introduce a digital asset bill if the party wins the next election, as revealed during their pro-crypto speech at the Bitcoin 2025 conference.

- Hester Peirce, head of the SEC's crypto task force, stated that the context of a digital asset transfer can determine whether it is considered a securities transaction, indicating a nuanced regulatory approach to digital assets.

- Kazakhstan's president has announced plans to build a "cryptocity" pilot zone, a regulatory sandbox for digital assets where crypto can be used for payments, aiming to promote innovation and establish a framework for the use of cryptocurrencies in the country.

- Coinbase's layer-2 blockchain Base saw a short-lived surge in transactions per second during the launch of a token on the Virtuals AI platform, demonstrating its potential to handle high volumes of transactions during high-demand events.

- The Securities and Exchange Commission and Binance have signed a joint stipulation to end their two-year legal battle, as shown in court documents, marking a significant conclusion to the lengthy dispute between the two parties.

- Blockchain analysis company Arkham Intelligence claims to have uncovered previously undisclosed wallet addresses tied to Strategy, potentially exposing $7.6 billion in Bitcoin holdings and bringing the company's total holdings to $54.5 billion, which represents 87.5% of its total Bitcoin stash.

- Two NYPD detectives have been placed on modified duties amid an investigation into their alleged involvement in a crypto torture case in Manhattan, according to multiple reports.

- Buyers of BlackRock and Fidelity's spot Ether ETFs are facing an average unrealized loss of around 21%, according to Glassnode, indicating significant losses due to market fluctuations.

- The Office of Foreign Assets Control claims that FunNull Technology purchased and altered a code repository to redirect legitimate websites to scam websites, potentially compromising the security of online platforms and users.

- Cetus, a Sui-based decentralized exchange that was exploited for over $220 million, may recover some of the lost funds pending the outcome of a community governance vote scheduled to end June 3, which will determine the recovery of $162 million in frozen assets.

- The Open Network Foundation has appointed former Visa executive Nikola Plecas as its Vice President of Payments, tasking him with shaping and executing the payment infrastructure strategy for the network, which aims to provide services to over 1 billion Telegram users.

- GameStop has confirmed its first Bitcoin investment, acquiring 4,710 Bitcoin worth around $513 million, as part of its previously announced plans to move into Bitcoin investment using debt financing from a $1.3 billion convertible notes offering launched in March. Gamestop's shares dropped nearly 11% after the company made the announcement.

- Elon Musk's artificial intelligence company XAI has partnered with Telegram to integrate its AI chatbot Grok across the messaging platform, bringing a range of features to a billion users and generating significant revenue for both parties through a one-year agreement worth $300 million and 50% of subscription sales.

- Metalayer Ventures, a crypto-focused venture capital firm led by former Chainlink and Two Sigma executives, has launched a $25 million fund to invest in early-stage blockchain projects, with a focus on stablecoins, tokenization, and cryptocurrency infrastructure, and has already backed seven companies using its proprietary data platform Moirai.

- Non-fungible token sales saw a 15% increase in May, reaching $430 million, after a five-month decline, with the number of transactions also hitting a 2025 high of 5.5 million, suggesting renewed interest in digital collectibles.

- A smart contract exploit on the Cork Protocol, a decentralized finance platform, resulted in the loss of approximately $12 million in digital assets on May 28, with the attacker stealing roughly 3,761 Wrapped Staked Ether that was immediately converted to Ether.

- In May 2025, Coinbase suffered a significant data breach due to insider manipulation, resulting in the theft of sensitive customer information, including personal data and account details, affecting 69,461 users, and prompting the company to take swift action to mitigate the damage and strengthen its security infrastructure.

- The US Labor Department has officially rescinded its 2022 guidance that limited the inclusion of cryptocurrency in 401(k) retirement plans, giving asset managers more flexibility to include digital assets in retirement investment options and marking a significant shift in the government's approach to cryptocurrency regulation.

- A US federal court has frozen around $57.65 million worth of USDC as part of a class-action lawsuit against Kelsier Ventures and its co-founders, among others, for allegedly creating the Libra cryptocurrency and misleading investors to siphon over $100 million from liquidity pools.

- Norwegian crypto brokerage firm K33 plans to buy and hold up to 57 Bitcoins after raising $6.2 million through convertible loans and a new issue of shares and warrants to establish a Bitcoin treasury strategy.