- The cryptocurrency market rose over 11%, from $2.81tn to $3.12tn on Sunday after US President Trump posted on Mar 2, 16:24 CET on his Truth Social platform that his January "Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA", later adding that "obviously, BTC and ETH, as other valuable Cryptocurrencies, will be at the heart of the Reserve".

- Following the announcement, Bitcoin's price increased 10.7% to over $94,500 in just under 3 hours. It currently trades around $92,000, making it 7% higher than a day ago, with a 24h volume that is 188.12% higher than a day ago at $69.29bn. Ether increased more than 13% to $2,488 following the announcement, and currently trades 7.54% higher than a day ago.

- On Friday Feb 28, David Sacks, the White House lead on AI and crypto affairs, announced on X the White House will host its first ever crypto summit this Friday Mar 7.

- Following the announcement, a significant influx of over $300 billion into spot markets resulted in a $10,000 gap in CME Bitcoin futures, the largest-ever Bitcoin futures gap as reported by TradingView.

- According to Whale Alert, on Mar 1 at around 22:00 CET, 735 BTC ($62.8m) were transferred from Kraken to an unknown wallet, and according to Lookonchain, a whale created a new wallet and withdrew 1,500 BTC ($129m) from Binance at 14:00 CET. On Mar 2 at 12:00 CET, the whale withdrew another 600 BTC from Binance. A whale deposited 6m USDC to Hyperliquid in the past 8 hours to long BTC and ETH with 50x leverage. He went long on ETH at $2,197 and will be liquidated at $2,149.4 and went long on BTC at $85,908 and will be liquidated at $84,752. All of these happened prior to Trump's reserve announcement.

- Last Friday, easing inflation data from the US Personal Consumption Expenditures (PCE) index YoY had already provided market relief, boosting risk assets and weakening the US dollar.

- The US Bureau of Economic Analysis reported that annual inflation, as measured by the change in PCE Index, declined to 2.5% in January from 2.6% in December. The core PCE Price Index, which excludes volatile food and energy prices, rose 2.6% year-over-year in January, down from 2.9% in December. On a monthly basis, both the PCE Price Index and the core PCE Price Index increased by 0.3%. These figures aligned with market expectations.

- BlackRock is adding a 1%-2% allocation of Bitcoin via the iShares Bitcoin Trust ETF (IBIT) in its target allocation portfolios that allow for alternatives, according to an investment outlook viewed by Bloomberg, signaling institutional acceptance despite market volatility. The firm sees Bitcoin as a long-term diversifier but limits exposure due to its risk.

- The international derivatives marketplace CME Group announced plans on Friday Feb 28 to launch Solana (SOL) futures on Mar 17, pending regulatory review. In a press release, they announced that "Market participants will have the choice to trade both a micro-sized contract (25 SOL) and a larger-sized contract (500 SOL)." CME Group's SOL futures will be cash-settled and determined by a daily benchmark for SOL's US dollar price, calculated at 16:00 London time.

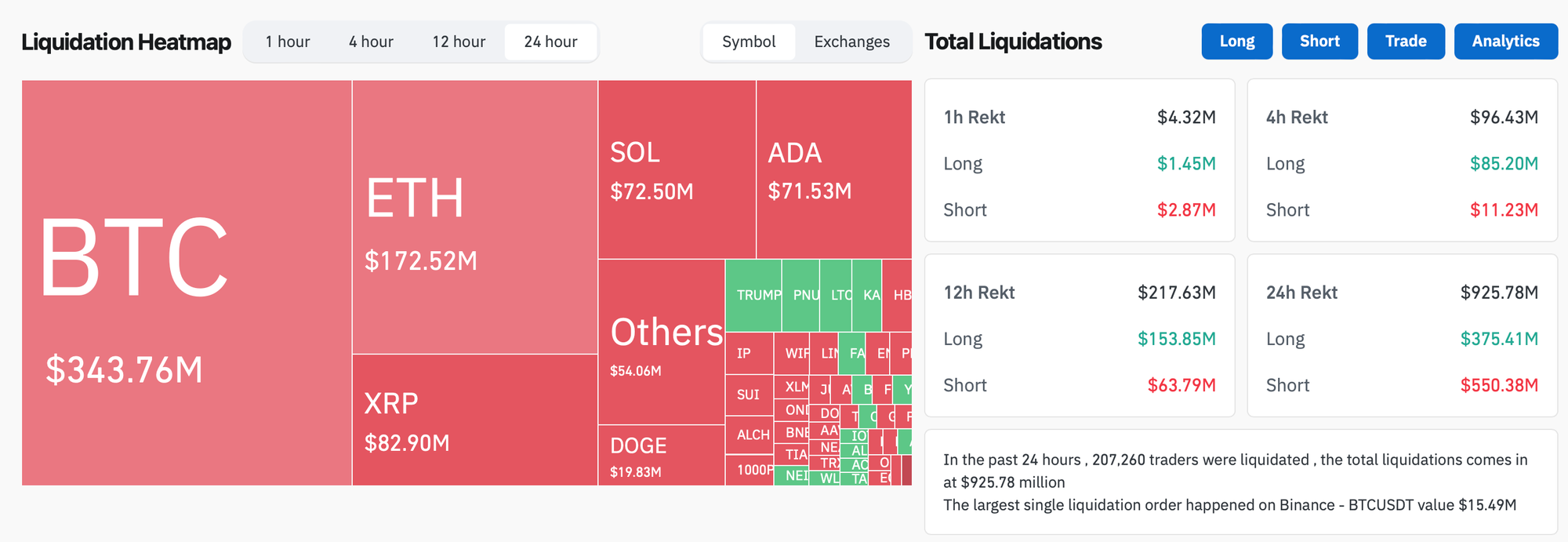

- Crypto liquidations came in at $925.78m over the past 24 hours, with over 59% of those short positions, valued at $550.38m. BTC short positions lead followed by ETH short positions.

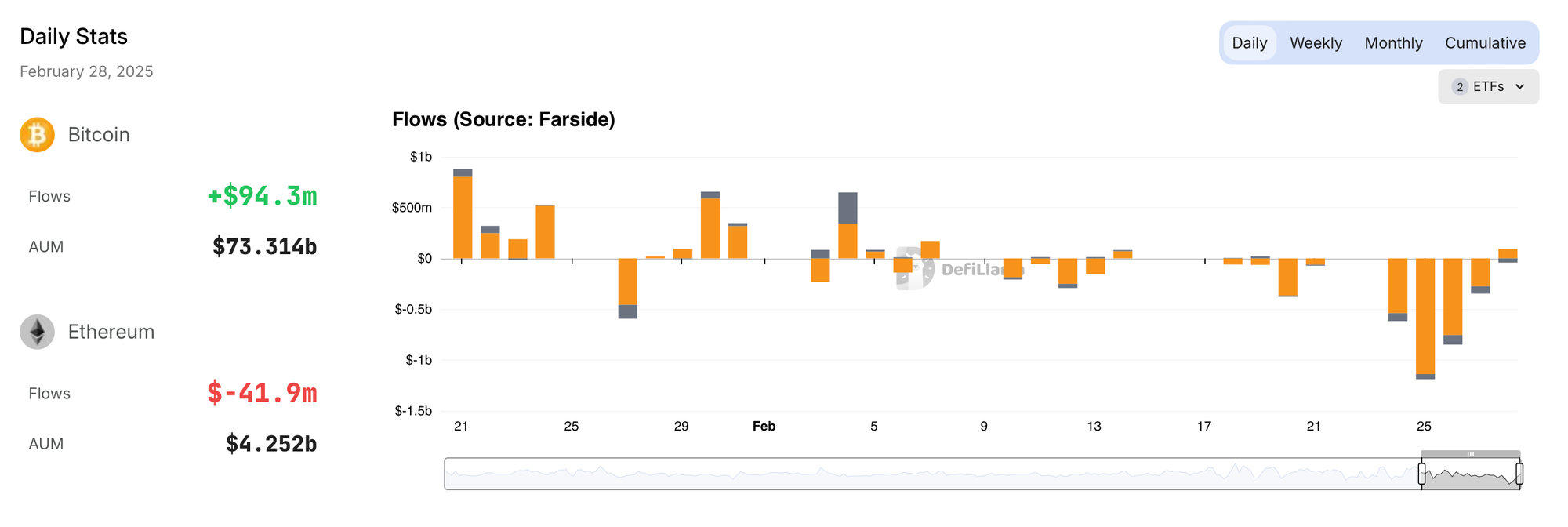

- On Friday, US BTC spot ETFs recorded net inflows of $94.3m, while ETH ETFs recorded net outflows of $41.9m. On Feb 28, both BTC and ETH ETFs recorded weekly net outflows, with BTC losing $2.614 billion and ETH $336 million.

source: DefiLlama

- Whale Alerts reports a total of 1 billion XRP tokens were unlocked by Ripple today.

- DTTM Operations, a company that manages US President Donald Trump's intellectual property rights, filed a trademark with the US Patent and Trademark Office (USPTO) which might hint at potential non-fungible tokens (NFTs) and metaverse platform, according to the document which was filed on Feb 24, 2025.