Global markets were mixed as trade developments took center stage. The S&P 500 rose 0.47% and the Nasdaq gained 0.94%, while the Dow Jones slipped 0.02%. The US reached a trade deal with Vietnam, according to President Trump, and the private sector lost 33,000 jobs in June, missing expectations. With the June jobs report looming, concerns over federal layoffs and a potential debt crisis are growing. Meanwhile, the ECB is questioning whether the euro has strengthened too much, and Fed Chair Powell signaled openness to a July interest rate cut. The global crypto market cap increased 3.12% in the past 24h to $3.38tn while the 24h volume increased 30% to $129bn.

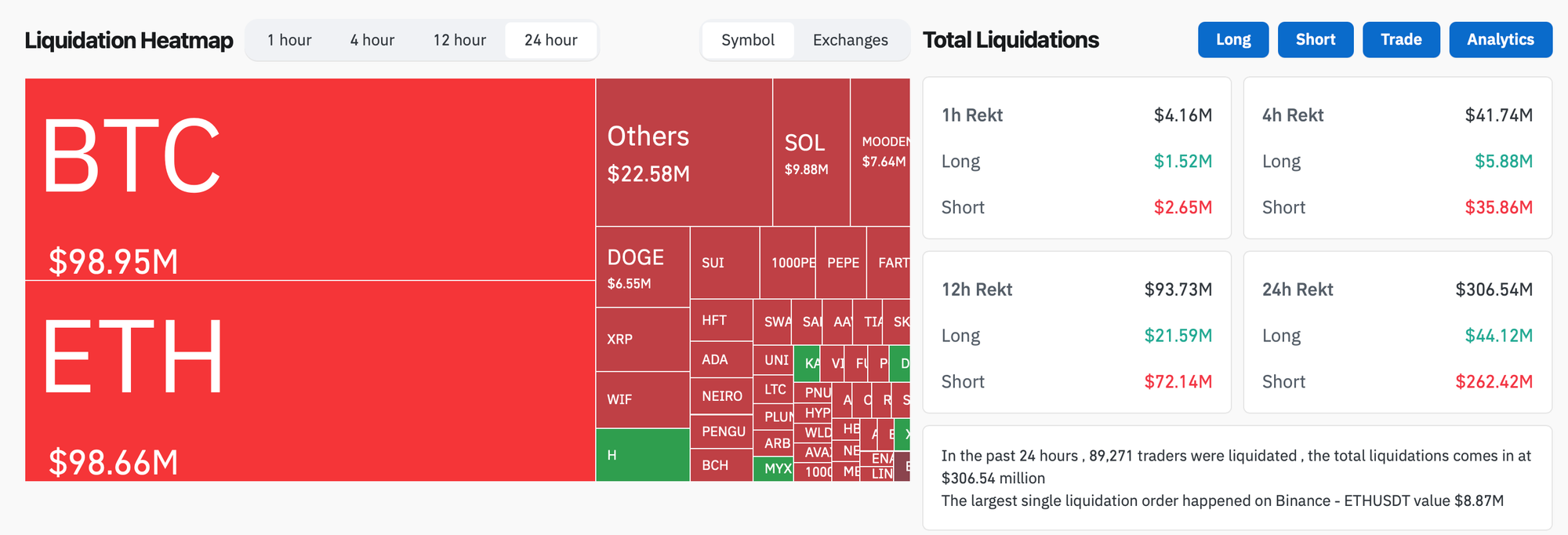

- In the past 24 hours, crypto liquidations increased by 20% and totaled $306.5m, with 85.6% of them short positions. BTC and ETH positions each made up over 32% of liquidated positions.

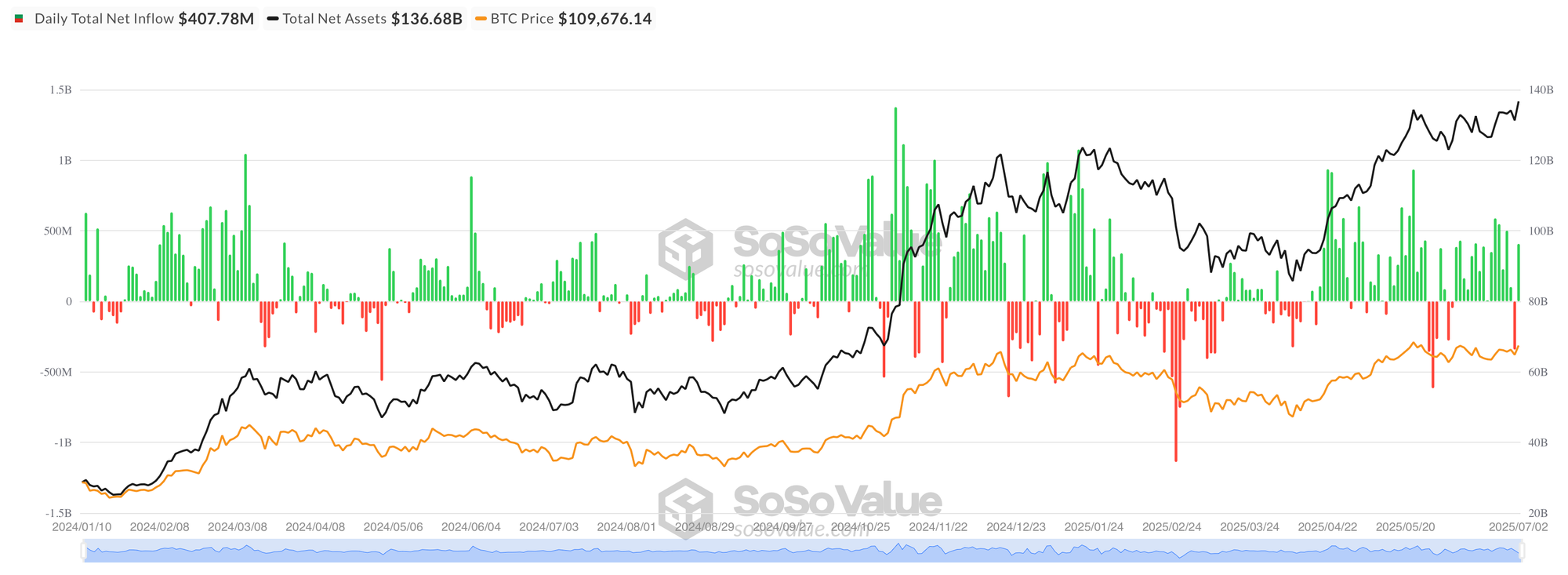

- According to data from SoSo Value, Bitcoin ETFs staged a dramatic recovery on July 2, attracting $407.8 million in net inflows just one day after suffering massive $342.3 million outflows, demonstrating the volatile nature of institutional crypto demand. Fidelity's FBTC led the rebound with $184.0 million in inflows, followed by Ark's ARKB at $83.0 million and Bitwise's BITB contributing $65.0 million, while even Grayscale's GBTC posted $34.6 million in inflows—a rare occurrence for the typically outflow-heavy fund. BlackRock's IBIT recorded zero flows despite the broad rally, an unusual pattern given its typical dominance in daily flows. All Bitcoin ETFs surged over 4.2% as the cryptocurrency rebounded strongly, with total assets climbing to $136.7 billion and cumulative net inflows reaching $49.0 billion, while trading volume nearly doubled to $5.22 billion reflecting heightened institutional activity during the sharp reversal.

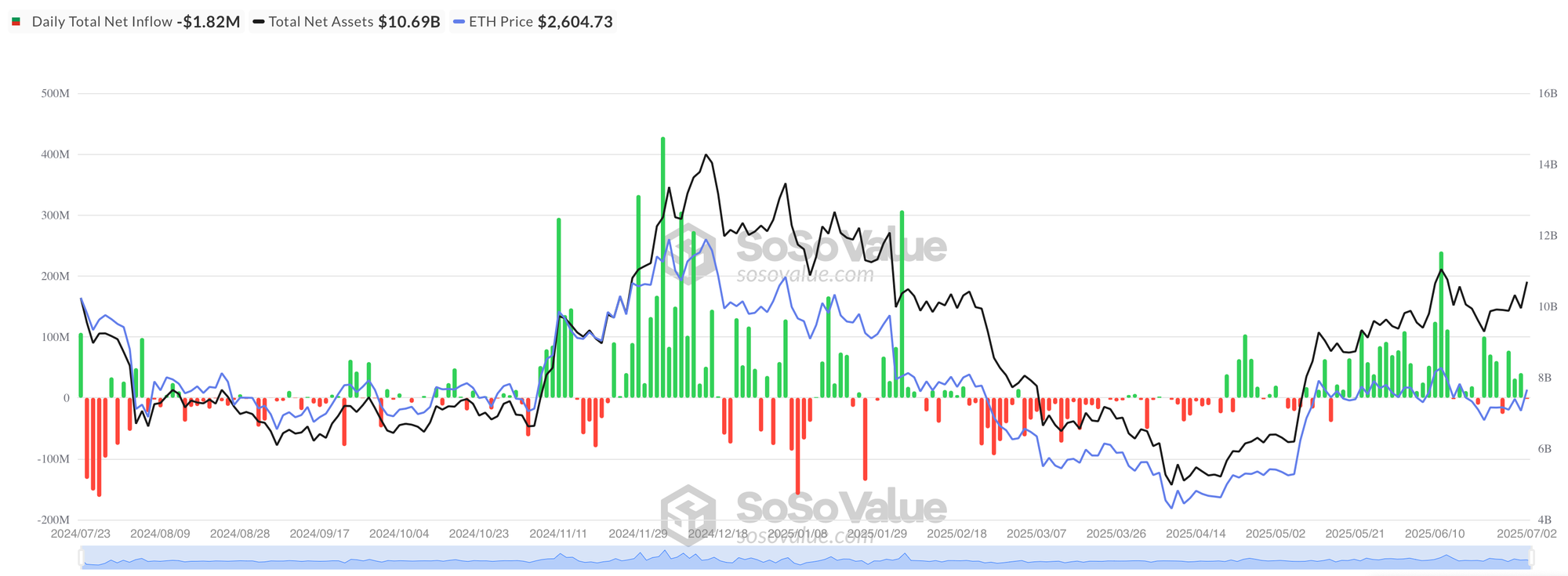

- According to data from SoSo Value, Ethereum ETFs recorded minor net outflows of $1.8 million on July 2 despite a massive 8.5%+ rally in ETH, as BlackRock's ETHA suffered $46.9 million in outflows that offset strong inflows elsewhere. Fidelity's FETH led the positive flows with $25.8 million in inflows, while Grayscale's lower-fee ETH product added $8.1 million, Bitwise's ETHW contributed $8.3 million, and VanEck's ETHV brought in $2.8 million, demonstrating selective institutional appetite across providers. All Ethereum ETFs posted impressive gains exceeding 8.4% as the cryptocurrency surged, with total assets climbing to $10.7 billion while cumulative net inflows held steady at $4.25 billion. Trading volume more than doubled to $832.1 million, reflecting heightened activity during the rally, though the mixed flow pattern suggests investors remain more cautious about ETH exposure compared to the strong rebound seen in Bitcoin ETFs on the same day.

- Ripple applied for a US national banking license with the Office of the Comptroller of the Currency and a Federal Reserve master account, following Circle's similar move as crypto firms seek regulatory legitimacy after the Senate passed the GENIUS Act governing stablecoin issuers.

- Brazil has implemented a new 17.5% flat tax on all digital asset gains, replacing previous exemptions and applying universally to crypto transactions within the country, effective immediately.

- Binance Pay and Lyzi have partnered to bring crypto payment solutions to over 80 businesses across the French Riviera, including locations in Cannes, Nice, Antibes, and Monaco, in a move to expand cryptocurrency adoption in the region.

- Rex-OSprey's Solana staking ETF, after overcoming regulatory hurdles posed by the Securities and Exchange Commission, launched with a notable $33 million in first-day trading volume.

- Coinbase has acquired Liquifi in a move to simplify and accelerate token launches for on-chain builders, aiming to make the process faster and easier by addressing existing complexities and providing enhanced support for blockchain development and innovation.

- KBC Bank in Belgium plans to allow retail customers to invest in Bitcoin and Ether through its Bolero platform, pending regulatory approval expected later this year.

- Allunity, a joint venture between Deutsche Bank and DWS, has received a BaFin license to issue EURAU, a MiCA-compliant euro stablecoin in Germany, marking a significant regulatory approval for the issuance of digital assets in the European market.

- PancakeSwap reached a new high of $325 billion in trading volume in June, driven by the adoption of cross-chain swaps and its expansion into Solana, cementing its leading position on the BNB Chain.

- Bybit and OKX have launched MiCA-compliant crypto exchanges in the European Union, marking a significant push into Europe's newly unified regulatory landscape, as major cryptocurrency exchanges move to operate within the region's harmonized and transparent crypto market framework.

- SEC Chair Paul Atkins pledged to empower businesses to innovate through tokenization in a media interview, signaling a supportive stance towards businesses exploring new technologies to drive growth and development.