Global markets were mixed as the Nasdaq 100 rose 0.2% driven by Nvidia's 4.3% surge to a record high, while the Russell 2000 fell 1.2% and the S&P 500 held near all-time highs. Investors fled US long-term bonds at the swiftest rate since the Covid-19 pandemic, citing concerns over the US debt load and inflation. Trump threatened Spain with higher tariffs, sending the IBEX 35 down 1.6% in its worst day since April. Fed Chair Powell testified before Congress, maintaining a "wait-and-see" stance on rate cuts due to uncertainties from tariffs and inflation.

- The global crypto market cap increased 0.9% in the past 24 hours to $3.30tn. The total crypto market 24h volume decreased 2% to $110bn.

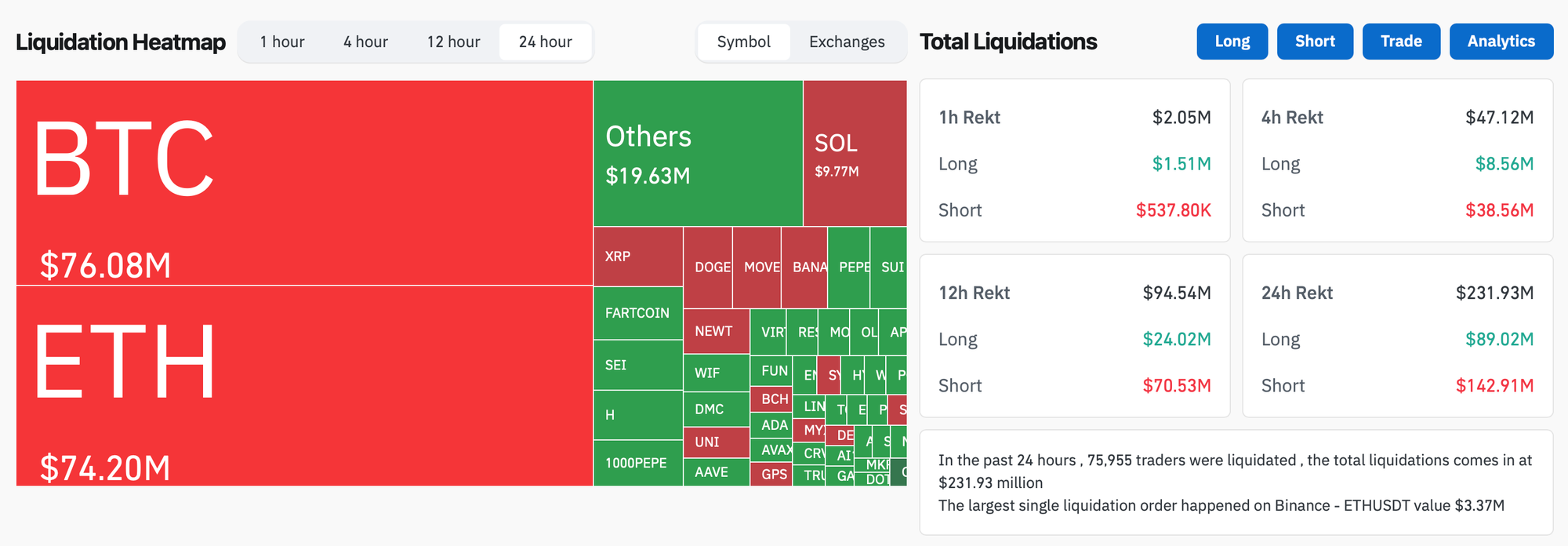

- In the past 24 hours, crypto liquidations increased by 24% and totaled $181m, with 56% of them short positions. ETH positions made up over 37% of all liquidated positions.

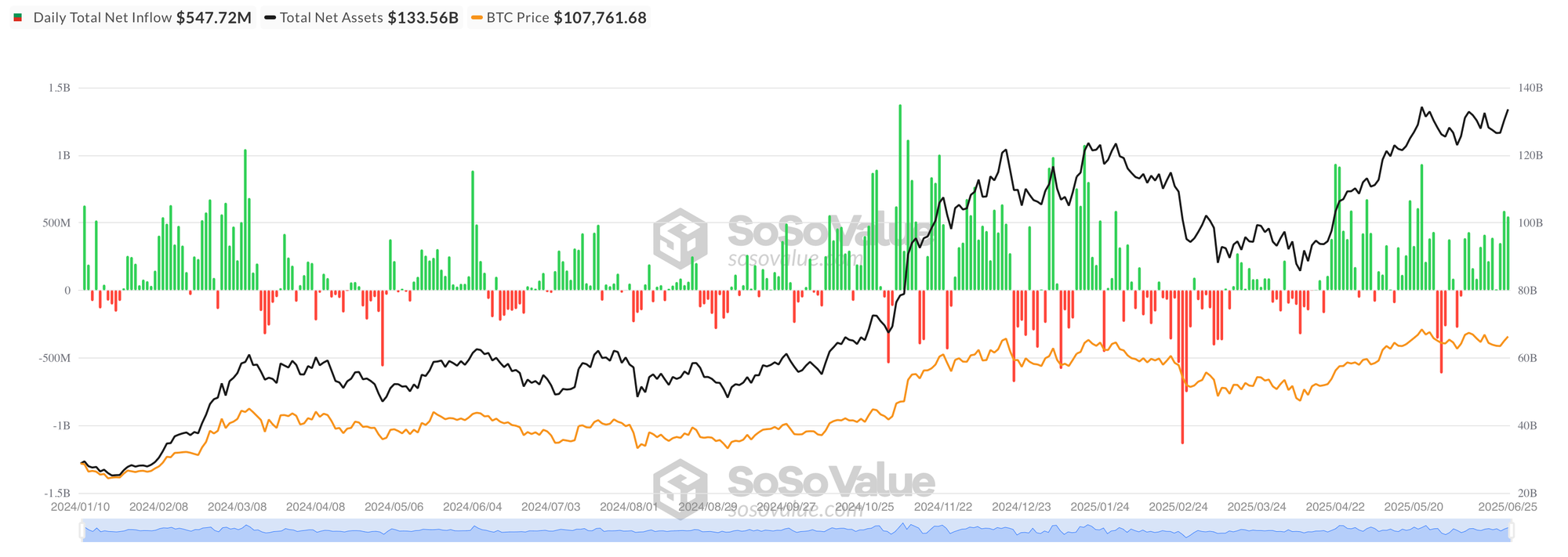

- According to data from SoSo Value, Bitcoin ETFs maintained strong momentum on June 25, attracting $547.7 million in net inflows despite a slight pullback from the previous day's $588.6 million. BlackRock's IBIT again dominated with $340.3 million in inflows, followed by Fidelity's FBTC at $115.2 million and Ark's ARKB contributing $70.2 million. Grayscale's GBTC recorded zero flows for the second consecutive day, continuing its recent pattern of stabilization after months of outflows. All Bitcoin ETFs posted gains around 2% as the cryptocurrency rallied, with total assets climbing to $133.6 billion and cumulative net inflows reaching $48.1 billion. The sustained institutional demand reflects growing confidence in Bitcoin's prospects, with the ETFs posting three consecutive days of strong inflows totaling nearly $1.5 billion since June 23.

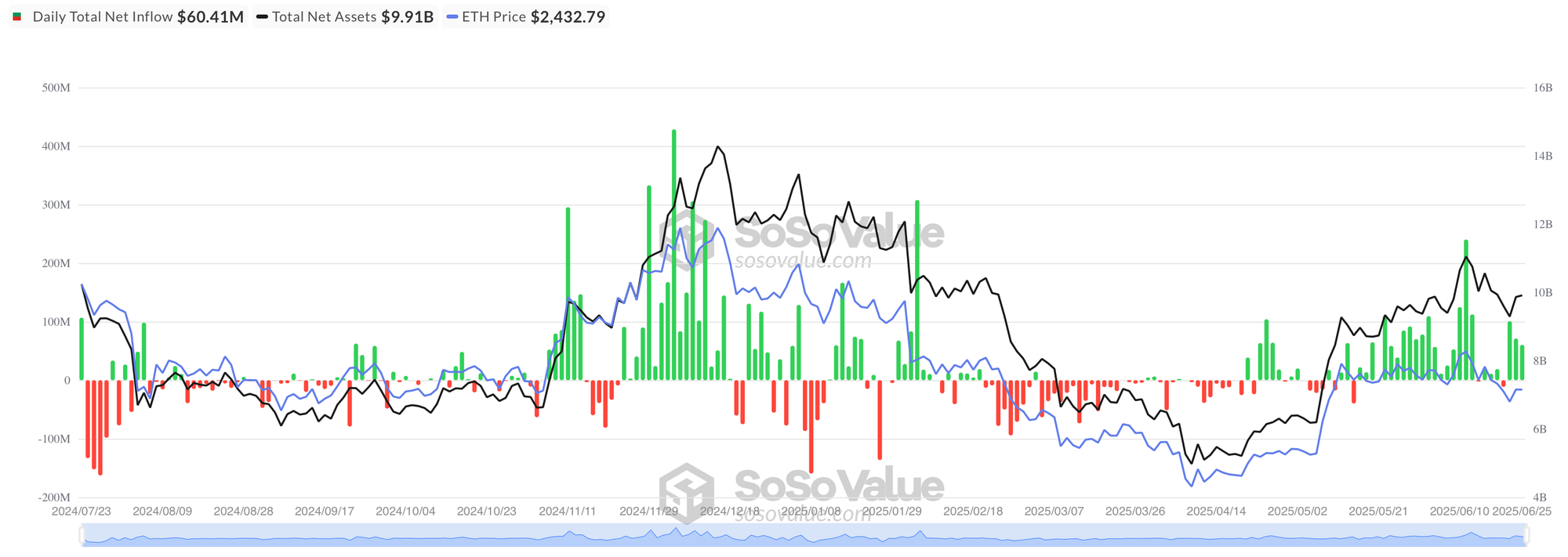

- According to data from SoSo Value, Ethereum ETFs recorded more modest inflows of $60.4 million on June 25, marking a slowdown from the previous day's $71.2 million and well below the $100.8 million seen on June 23. BlackRock's ETHA continued to dominate with $55.2 million in inflows, accounting for over 90% of the day's total, while Bitwise's ETHW contributed $5.2 million. Grayscale's ETHE and ETH both recorded zero flows for consecutive days, and Fidelity's FETH also posted no movement after previous volatility. Most Ethereum ETFs traded flat to slightly negative as the cryptocurrency underperformed Bitcoin, with total assets edging up to $9.91 billion and cumulative inflows reaching $4.13 billion. The deceleration in flows suggests Ethereum ETFs are struggling to maintain the momentum seen earlier in the week, with institutional interest appearing more concentrated in BlackRock's offering.

- JPMorgan filed a new trademark for "JPMD" between June 15-17, 2025, covering crypto trading and digital currency services, marking the bank's first move into public blockchain infrastructure. Unlike JPMorgan's existing JPM Coin, which operates on private networks, JPMD is being piloted on Coinbase's Base Ethereum layer-2 as a "deposit token" backed by actual bank deposits rather than offchain assets like traditional stablecoins. Naveen Mallela, head of JPMorgan's blockchain unit Kinexys, confirmed the token is already live with vetted clients and called it "a superior alternative to stablecoins" due to regulatory compliance.

- Eight major banks in South Korea are working together to develop a stablecoin backed by the Won, aiming to counter the growing dominance of the US dollar.

- Between June 15 and Tuesday, Bitcoin's hashrate dropped by over 15%, marking the most significant decline in three years.

- UK bank Barclays will ban cryptocurrency transactions on its credit cards starting Friday, citing concerns over volatile token prices and lack of regulatory protection for investors. The bank said "a fall in the price of crypto assets could lead to customers finding themselves in debt they can't afford to repay," noting crypto purchases aren't covered by the Financial Ombudsman Service or Financial Services Compensation Scheme. The move comes amid an ongoing UK debate over restricting crypto purchases with credit, after the Financial Conduct Authority published a paper in May seeking views on potential restrictions. The Payments Association opposed such measures, arguing they would unfairly equate crypto with gambling and that consumers should be empowered to make informed choices within credit limits. Barclays has allowed crypto transactions via credit cards since at least 2018 across its five million UK credit card accounts.

- Invesco and Galaxy Digital filed initial documents with US regulators to launch a spot Solana ETF, becoming the ninth similar proposal to be considered for approval.

- Fuzzland reported that a former employee used insider access and malware to exploit Bedrock's UniBTC protocol, resulting in $2 million in losses.