Global markets rallied, with the Dow Jones (+1.19%), S&P 500 (+1.11%), and Nasdaq (+1.43%) all gaining on news of a lasting Middle East ceasefire that sent oil prices plunging over 5%. Fed Chair Jerome Powell testified before Congress, maintaining his cautious stance on rate cuts despite other officials signaling earlier cuts, while consumer confidence dropped further in June amid job security concerns. European markets followed suit with the Euro Stoxx 600 (+1.11%) rising, though the FTSE 100 remained flat due to declining BP and Shell shares.

- The global crypto market cap increased 0.50% in the past 24 hours to $3.27tn. The total crypto market 24h volume decreased 25% to $112bn.

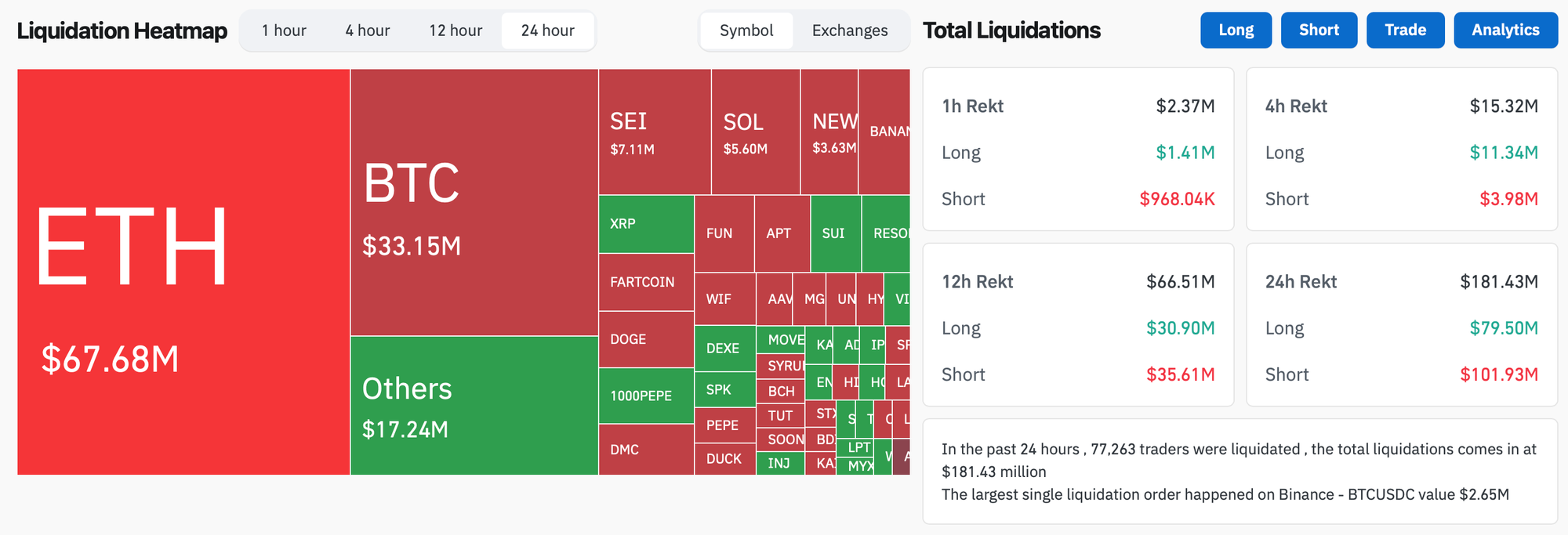

- In the past 24 hours, crypto liquidations decreased by 60% and totaled $181m, with 56% of them short positions. ETH positions made up over 37% of all liquidated positions.

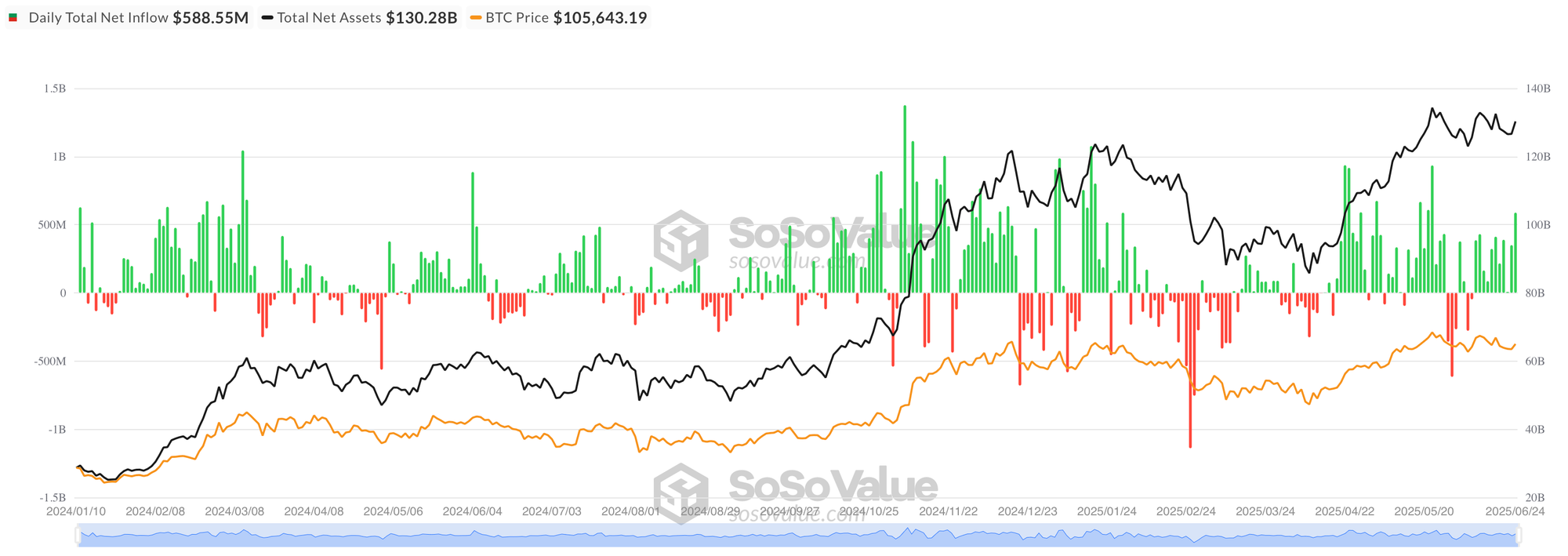

- According to data from SoSo Value, Bitcoin ETFs surged to their strongest day since May 22, 2025, attracting a $588.6 million in net inflows as the Middle East ceasefire sent markets rallying. BlackRock's IBIT dominated with $436.3 million in inflows—its largest single-day haul in recent weeks—while Fidelity's FBTC added $85.2 million and Ark's ARKB contributed $43.9 million. Even Grayscale's GBTC recorded zero outflows, a notable shift from its typical redemption pattern. All Bitcoin ETFs posted gains of over 2.3% as Bitcoin climbed, with total assets jumping to $130.3 billion while cumulative net inflows reached $47.6 billion. The strong performance reflects renewed institutional appetite as geopolitical tensions eased and risk assets rebounded across global markets.

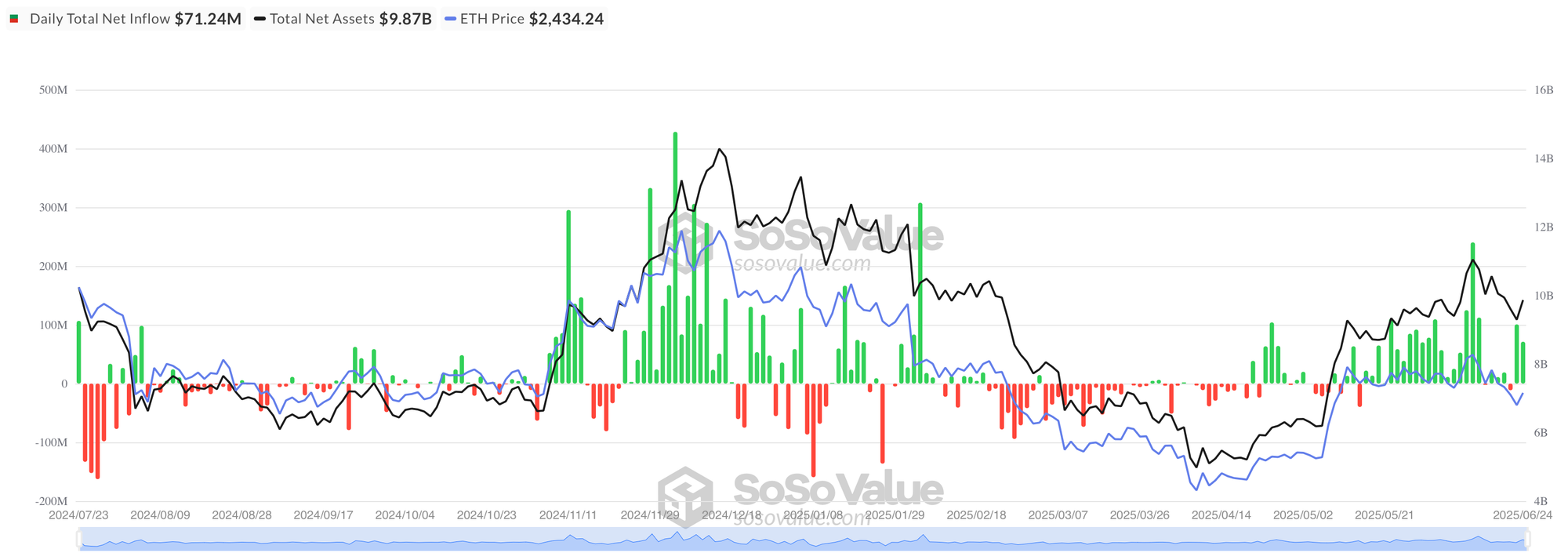

- According to data from SoSo Value, Ethereum ETFs continued their momentum on June 24, recording $71.2 million in net inflows despite a slight pullback from the previous day's $100.8 million. BlackRock's ETHA led the charge with $97.98 million in inflows, while Fidelity's FETH experienced $26.7 million in outflows, marking a rare divergence among major providers. Grayscale's higher-fee ETHE maintained zero flows for the second consecutive day, suggesting stabilization after months of redemptions. All Ethereum ETFs posted strong gains exceeding 5% as ETH rallied alongside the broader crypto market, with total assets climbing to $9.87 billion and cumulative net inflows reaching $4.07 billion since launch. The solid performance underscores growing institutional interest in Ethereum exposure, though flows remain more volatile than their Bitcoin counterparts.

- The US Federal Housing Finance Agency is studying whether cryptocurrency holdings like Bitcoin could be used to qualify for mortgages, Director William Pulte, who was nominated by Trump, announced Tuesday on X. The FHFA sets rules for government-sponsored enterprises Fannie Mae and Freddie Mac. The move follows the SEC's January 23 decision to rescind controversial accounting guidance SAB 121, which previously prevented major banks from offering crypto-backed loans by requiring them to list client crypto holdings as liabilities on their balance sheets.

- Turkey's Finance Ministry is implementing stricter cryptocurrency regulations requiring platforms to collect detailed source and purpose data for all transfers, with users mandated to provide transaction descriptions of at least 20 characters. The new rules impose holding periods of 48-72 hours on crypto withdrawals and cap stablecoin transfers at $3,000 daily and $50,000 monthly to combat money laundering from illegal betting and fraud, according to state-run Anadolu Agency. Treasury and Finance Minister Mehmet Şimşek said the measures aim to "curb criminal misuse without stifling legitimate activity," with platforms fully complying with Travel Rule identity requirements eligible for double the transfer limits. The regulations follow Turkey's March introduction of licensing requirements for crypto service providers, including minimum capital thresholds of $4.1 million for exchanges and $13.7 million for custodians, as the country aligns its framework with international standards like the EU's MiCA regulations.

- Japan's Financial Services Agency proposed Tuesday to reclassify cryptocurrencies as "financial products" under the Financial Instruments and Exchange Act, potentially paving the way for crypto ETFs and slashing capital gains taxes from up to 55% to a flat 20%. The sweeping proposal would treat digital assets the same as stocks and securities, making crypto investing more attractive to retail and institutional players. The move comes as Japan's crypto market has surged to over 12 million active accounts holding more than 5 trillion yen ($34 billion) in assets, with crypto ownership now exceeding participation in some traditional financial products like FX and corporate bonds. The FSA cited global institutional adoption, noting over 1,200 financial institutions including US pension funds and Goldman Sachs now hold Bitcoin ETFs, as Japan seeks to support similar domestic developments.

- Digital Asset raised $135 million from major financial institutions including Goldman Sachs and Citadel Securities to scale its Canton Network blockchain for institutional real-world asset tokenization. Digital Asset plans to use the capital to integrate "billions" of real-world assets into its permissionless layer-1 blockchain, which offers configurable privacy and institutional-grade compliance. The Canton Network, launched in May 2023 with partners including Microsoft and Goldman Sachs, has already completed pilot projects tokenizing US Treasury bonds with DTCC and gold with Euroclear. The funding comes as the RWA market surged over 260% in the first half of 2025 to exceed $23 billion in total valuation, driven by increasing regulatory clarity and institutional adoption.

- Norwegian deep-sea mining firm Green Minerals AS announced plans to raise $1.2 billion to buy Bitcoin as a treasury asset, with executive chair Ståle Rodahl saying the company aims to make its first purchase within days to hedge against currency debasement. The firm also plans to adopt blockchain technology for supply chain transparency in its mining operations. Green Minerals' stock surged 300% Monday on the announcement but dropped 34% Tuesday, reflecting mixed investor sentiment on corporate Bitcoin adoption strategies.