Global markets traded quietly on Tuesday with US cash markets closed for Labor Day, while European stocks gained 0.2% led by defense companies on Ukraine security planning reports. Gold surged 0.8% to $3,476.19 near record highs on Fed rate cut expectations, with futures pricing over 140 basis points of easing through 2026 ahead of the September 17 Fed meeting. Oil rose 1% to $68.15 on geopolitical tensions while Bitcoin gained 0.6% to $109,126, as investors prepare for key employment and inflation data in what is historically the weakest month for equities.

The global crypto market cap increased 1.74% in the past 24h to $3.81tn while the 24h volume increased 30% to $168bn.

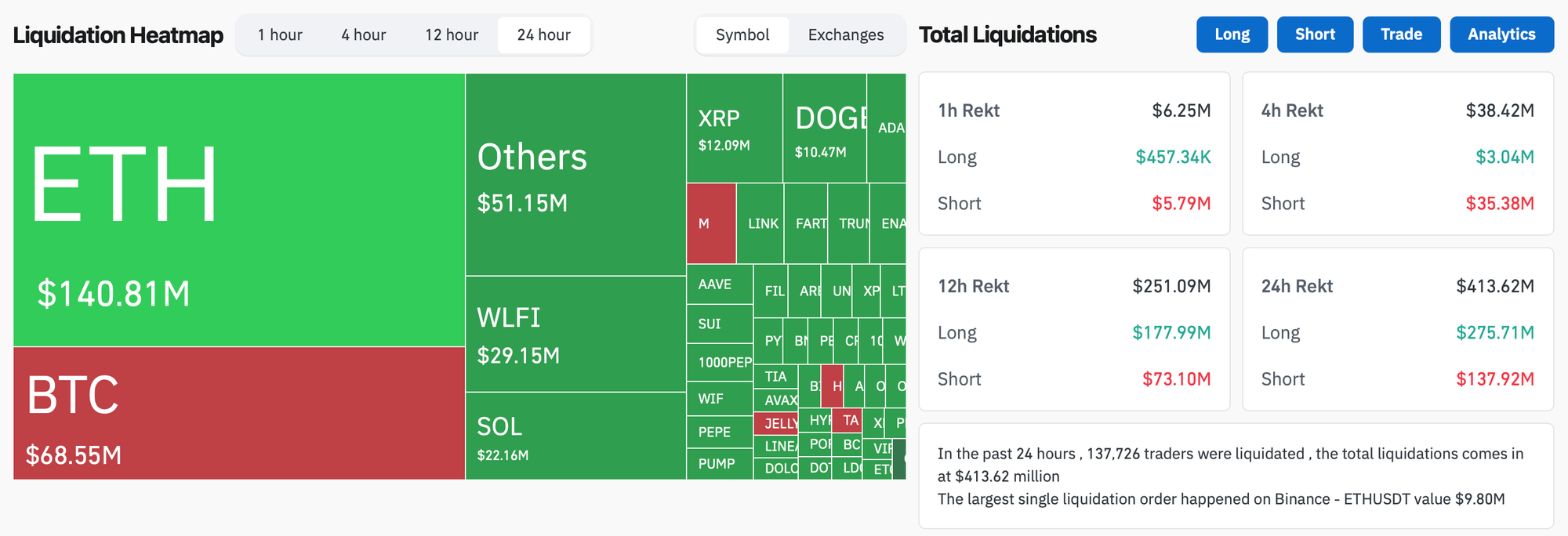

- In the past 24 hours, crypto liquidations increased by 78% and totaled $413.51m, with 66.7% of them being long positions. Bitcoin and Ether accounted for 16.6% and 34% of total liquidations, respectively, with Ether dominating the market share.

- An $11 billion Bitcoin whale sold another 2,000 BTC ($215 million) to purchase 48,942 ETH on Hyperliquid, bringing their total ETH holdings to 886,371 tokens worth over $4 billion and surpassing SharpLink Gaming's $3.5 billion position to become larger than the world's second-largest corporate Ether holder, according to Lookonchain data on Monday.

- Metaplanet acquired 1,009 BTC to reach 20,000 BTC holdings worth nearly $112 million on Monday while issuing 11.5 million new shares following Evo Fund's warrant exercise, despite the Japanese Bitcoin treasury firm's stock falling 54% since mid-June and facing pressure from its fundraising model as it seeks shareholder approval for up to 555 million preferred shares that could raise $3.7 billion.

- World Liberty Financial proposed using 100% of protocol fees to buy back and burn WLFI tokens to reduce supply and boost holder value, as the Trump family-tied DeFi project's token fell as much as 25% to $0.21 on its first day of trading Monday following a 24.6 billion token unlock that increased the Trump family's holdings to $5 billion, with WLFI trading at $0.229 after dropping 36% from its $0.331 peak.

- Binance launched Medá, a regulated Electronic Payment Funds Institution in Mexico backed by a $53 million investment over four years, to provide peso deposit and withdrawal services while expanding the exchange's regulatory footprint to 22 jurisdictions including France, Italy, Spain, Dubai, Japan, Brazil, and Argentina.