Global markets fell sharply on Friday as Middle East tensions escalated, triggering a spike in oil and gold prices. The Dow Jones (-1.79%), S&P 500 (-1.13%), and Nasdaq (-1.30%) all closed lower, led by declines in financials and tech, while energy stocks gained on a 7% surge in crude oil. In Europe, the Euro Stoxx 600 fell 0.89% and the FTSE 100 fell 0.39%, with airlines and travel firms down but defence and energy shares up. US consumer sentiment improved for the first time in six months, and inflation expectations eased, but geopolitical risks overshadowed macro data. Bond yields rose globally, with the US 10-year yield up to 4.40% and Germany’s at 2.53%, while gold rose 1.37% to $3,432. Oil markets braced for disruption. The Bank of England prepares for a rate vote amid uncertainty, while the Federal Reserve faces pressure from President Trump to cut rates. According to the CME FedWatch, there is a 96.7% probability that the Fed will keep the target rate unchanged at the upcoming FOMC Meeting.

Since Friday, the total crypto market cap increased 2.7% to $3.32tn.

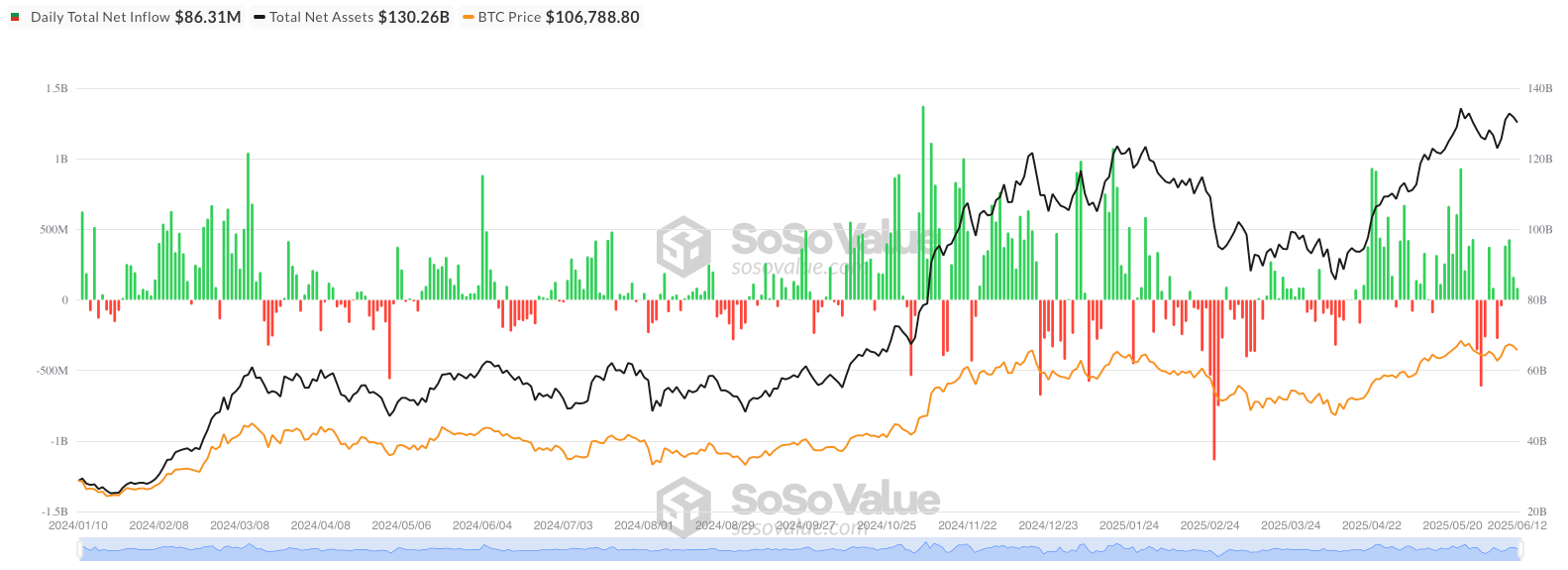

- According to data from SoSo Value, US spot Bitcoin ETFs added $301.62 million in net inflows on June 13, marking a strong rebound from the previous day’s $86 million. BlackRock’s IBIT led with $238.99 million, bringing its cumulative inflows to $49.77 billion and total assets to $70.66 billion. Fidelity’s FBTC followed with $25.24 million, while Bitwise’s BITB added $14.88 million. Grayscale’s GBTC saw $9.11 million in inflows despite a continued discount and its 1.5% fee. Total trading volume across the 12 ETFs reached $3.12 billion, with group net assets at $127.96 billion. Most ETFs declined around 1.5% as Bitcoin traded lower.

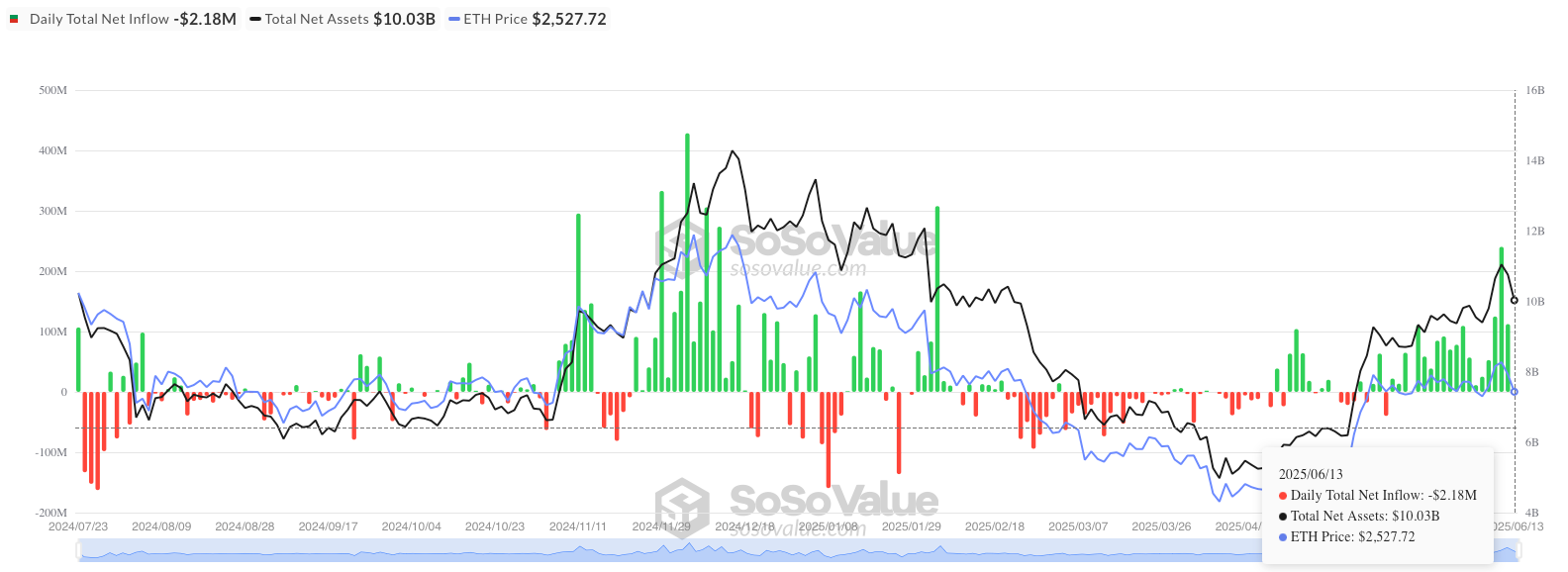

- U.S. spot Ether ETFs saw a net outflow of $2.18 million on June 13, marking their first collective daily outflow since May 15. Grayscale’s ETH product led with $6.67 million in inflows, while Fidelity’s FETH posted a $8.85 million outflow.

- On June 16, Tokyo-listed Metaplanet disclosed the purchase of 1,112 additional Bitcoins, bringing its total holdings to exactly 10,000 BTC.

- Crypto analytics firm Santiment found that Ether whales increased their ETH holdings by 3.72% as retail investors were banking their profits.

- Bybit will launch Byreal, its first on-chain trading platform, on June 30, aiming to combine the best features of traditional and decentralized crypto exchanges. Built on the Solana blockchain, Byreal is designed to offer fast, low-cost trading and user-friendly tools for earning rewards. The launch follows a major overhaul of Bybit’s Web3 services after a $1.4 billion hack, as the exchange shifts focus to more secure and streamlined products. A public test version of Byreal will go live this month, with the full platform expected later this year.

- A 26-year-old French crypto TikToker was kidnapped near Paris on Friday and later released after his abductors realized he couldn’t meet their €50,000 ($57,000) crypto ransom demand. The trader, who has around 40,000 TikTok followers, was beaten and forced into a stolen vehicle, but convinced the four kidnappers to let him go by showing his low account balance, according to Europe 1.

- Michael Saylor, Strategy Chair, met with Pakistan’s finance and crypto ministers on June 15 to advise on the country’s cryptocurrency ambitions. In talks with the Finance Minister and the State Minister for Blockchain, Saylor praised Pakistan’s forward-looking stance, calling Bitcoin a tool for national resilience and digital transformation. The meeting comes after Pakistan launched its Crypto Council in March to integrate blockchain into the financial system.

- Bitcoin advocate Michael Saylor praised Pakistan’s efforts to embrace cryptocurrency and digital assets during a meeting with Finance Minister Muhammad Aurangzeb and State Minister for Blockchain and Crypto Bilal Bin Saqib on June 15. According to an official press release, Saylor endorsed Pakistan’s vision of using Bitcoin to enhance monetary resilience and economic sovereignty, calling it a “once-in-a-generation opportunity” for emerging markets. Saqib, also head of the Pakistan Crypto Council (PCC), said Pakistan aims to lead the Global South in crypto innovation and regulation. The meeting marks a key milestone in Pakistan’s push to develop a national digital asset framework and attract institutional investment.

- The U.S. Securities and Exchange Commission has appointed Jamie Selway, former global head of institutional markets at Blockchain.com, as its new director of trading and markets, signaling the agency’s continued focus on crypto expertise amid ongoing regulatory debates. Brian Daly, a crypto-savvy partner at law firm Akin Gump, will head the SEC’s investment management division. The hires come as Congress prepares to vote on the CLARITY Act, which aims to define SEC and CFTC authority over digital assets.

- The U.S. Securities and Exchange Commission and Ripple Labs filed a joint motion Thursday seeking court approval to release $125 million held in escrow, marking the final step in their nearly five-year legal battle. Under the proposed resolution, $50 million will go to the SEC as a civil penalty, while $75 million will be returned to Ripple. The case, which began in December 2020, centered on whether Ripple’s XRP token constituted a security. Though Judge Analisa Torres ruled in July 2023 that secondary XRP sales were not securities, Ripple was still penalized for institutional sales. Both sides dropped their appeals earlier this year, and the escrow motion effectively closes one of crypto’s most high-profile regulatory showdowns.

- Walmart and Amazon are evaluating the use of digital currencies to enhance e-commerce and cross-border transactions.

- A YouTube personality exposed an $800,000 global cryptocurrency scam operation based in Cebu by hacking into CCTV systems and confronting the scammers live, revealing the extensive fraud operation.

- The criminal trial of the Tornado Cash developer is expected to begin on July 14, roughly two years after the initial indictment.

- KuCoin has entered the Thai market with a fully licensed exchange after acquiring ERX, Thailand's first SEC-supervised digital token platform, expanding its global presence and offering digital asset services to Thai users.

- Shopify is rolling out USDC payments via Coinbase's Base network, offering cashback perks and expanding crypto checkout options through Shopify Payments, as part of its strategy to integrate more comprehensive cryptocurrency payment solutions.

- The Securities and Exchange Commission (SEC) has approved Trump Media's capital raise to purchase Bitcoin, a move that comes just weeks after the company confirmed its plans to invest in cryptocurrency following initial denials of earlier reports.