Global markets ended lower, with the Dow unchanged, the S&P 500 (-0.27%), and the Nasdaq (-0.5%) closing lower as weakness in tech offset a drop in core CPI that bolstered hopes for Fed rate cuts. The US trade deficit and inflation data showed a 0.1% rise in May, below expectations, while the World Bank cut its global growth outlook due to trade turbulence. The European Union unveiled fresh sanctions on Russia and targeted Chinese banks over Russian trade links. Meanwhile, the US and China agreed on a framework to restore their trade truce, with President Trump hailing progress, but investors remained cautious pending further details. The US budget deficit hit $316 billion in May, with the annual shortfall up 14% from a year ago.

- The global crypto market cap decreased 1.7% over the past 24 hours to $3.39tn. The total crypto market 24h volume decreased 4% to $135.7bn.

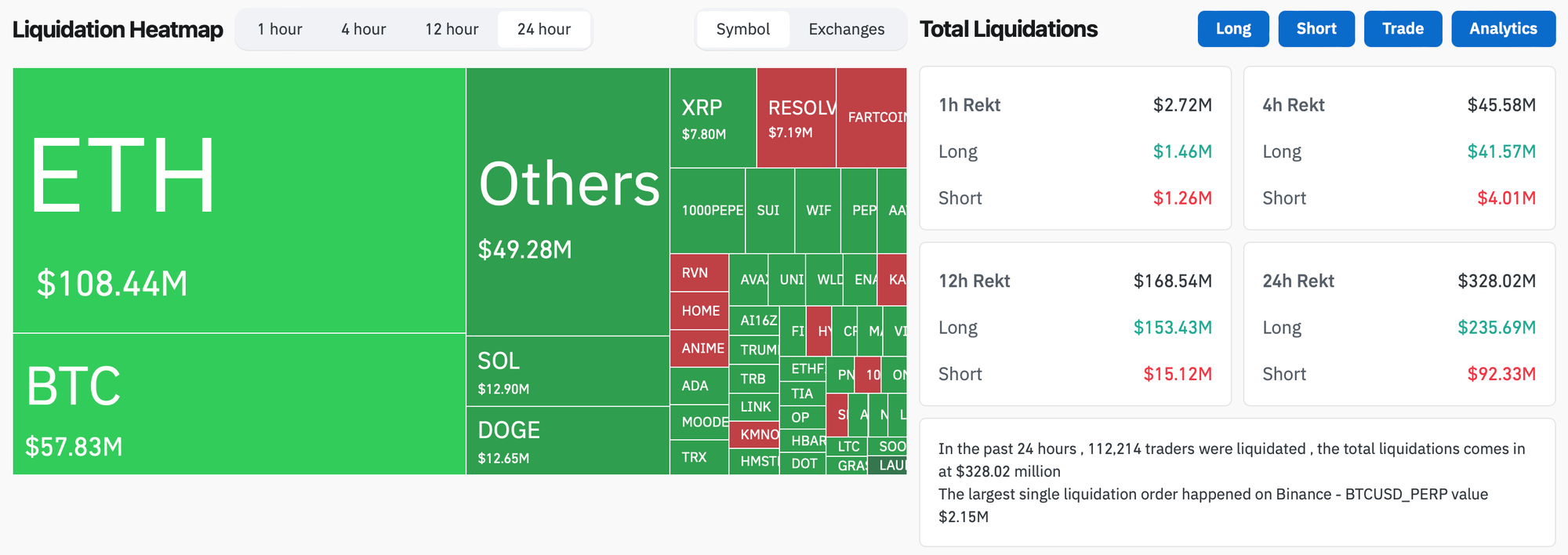

- In the past 24 hours, crypto liquidations increased 7.5% and totaled $328m, with almost 72% of them long positions. ETH positions made up 33% of all liquidated positions.

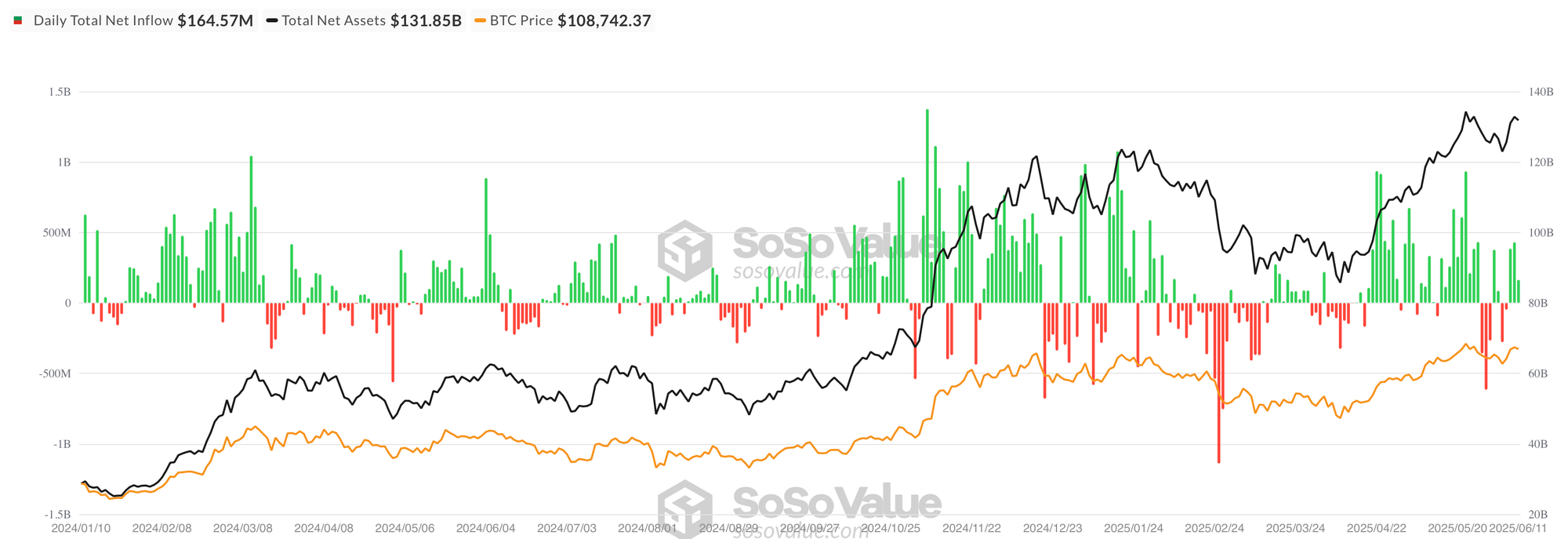

- U.S. spot Bitcoin ETFs added $164.57 million in net inflows on June 11, a decrease of more than 60% compared to the $431 million net inflow recorded the previous day. BlackRock’s IBIT led with $131.01 million, pushing its cumulative inflows to $49.24 billion and total assets to $72.55 billion. VanEck’s HODL followed with $15.39 million, while Fidelity’s FBTC added $11.87 million. Total trading volume across the 12 ETFs was $2.41 billion, with net assets across the group standing at $131.85 billion. Grayscale’s GBTC again saw no flows, though it still holds $20.14 billion in assets, maintaining its outsized fee of 1.5%.

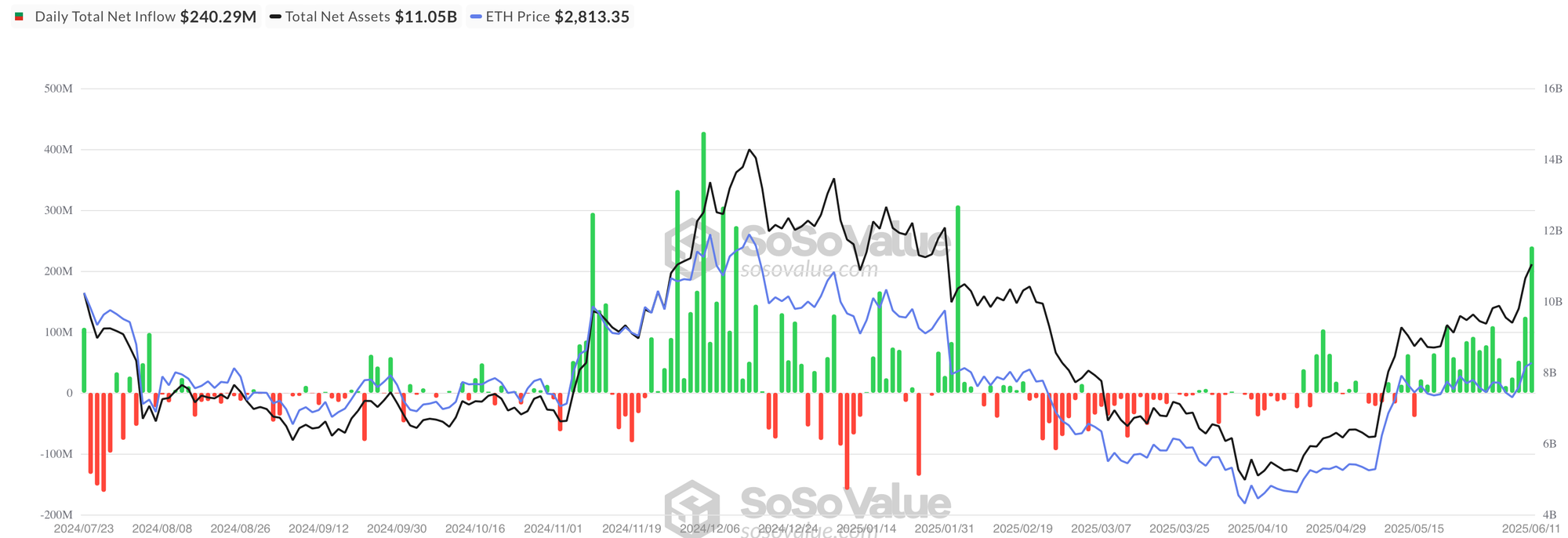

- U.S. spot Ethereum ETFs brought in $240.29 million in net inflows on June 11, almost double the prior day's inflows. BlackRock’s ETHA led with $163.64 million, pushing its net assets above $4.5 billion. Fidelity’s FETH added $37.28 million, followed by Grayscale’s ETH with $19.61 million. Total assets across all nine funds rose to $11.05 billion (3.25% of ETH's market cap), with daily trading volume reaching $831 million. ETH ETF momentum continues to build.

- According to a June 11 report from Glassnode and Gemini, as of 2025, 30% of Bitcoin’s supply—over 6.1 million BTC—is held by 216 centralized entities, including ETFs, exchanges, and governments. Early adopters still dominate, with top players controlling up to 90% of holdings in some categories. Despite exchange outflows, spot custodial balances have remained stable due to rising ETF adoption.

Bitcoin volatility continues to fall as institutional inflows grow, with trading volume shifting to offchain venues like ETFs and derivatives markets. Sovereign holdings—whether through legal seizures or long-term accumulation—now exert significant but infrequent market influence. - The U.S. Senate voted 68-30 to advance the GENIUS Act, a Trump-backed stablecoin bill aimed at mainstreaming crypto, despite Democratic concerns over ethics and consumer protections, setting it up for full debate and a possible House vote.

- PancakeSwap has partnered with Across Protocol to offer one-click crosschain swaps across Arbitrum, Base, and BNB Chain.

- MEXC has introduced a $100 million fund to safeguard users against financial losses resulting from platform breaches, hacks, and technical failures, accompanied by real-time wallet transparency to enhance security and trust.

- Sandeep Nailwal, co-founder of Polygon, has assumed full executive control of the organization, marking a significant departure from its decentralized governance model, under his leadership.

- The state of Connecticut has prohibited government entities from investing in or making payments with cryptocurrencies, joining a growing list of US states rejecting the notion of a state bitcoin reserve.

- OneBalance, a multichain developer platform founded by ex-Coinbase and Flashbots engineers, has raised $20 million in a Series A round led by cyber•Fund and Blockchain Capital to launch a Toolkit that simplifies crypto transactions into one click, aiming to fix fragmented user experiences and improve app conversions, while its Resource Lock feature offers a more secure alternative to traditional crosschain bridges.

- John Woeltz and William Duplessie, accused of kidnapping and torturing a cryptocurrency holder Michael Valentino Teofrasto Carturan in New York City pleaded not guilty on Wednesday, with prosecutors alleging they held the victim for three weeks to extract his crypto wallet access; both face life in prison if convicted, while the case adds to growing concerns over crypto-related violence globally.

- Circle, the issuer of the USDC stablecoin, has launched its stablecoin on World Chain and partnered with Matera to enable Brazilian banks to offer multicurrency payments, expanding its services and increasing the accessibility of USDC in the Brazilian market.

- h100 group, a Swedish health firm, announced it had raised $10.6 million to increase its Bitcoin holdings, leading to a surge in the company's shares following the news.

- According to crypto analytics platform Santiment, Bitcoin sentiment on social media has reached its highest point in seven months. In a post on X dated June 11, they said that there are 2.12 positive Bitcoin comments for every negative comment on social media.