Global markets declined as trade tensions and economic concerns weighed on investor sentiment. The Dow Jones (-0.45%), S&P 500 (-0.25%), and Nasdaq (-0.3%) all closed lower. President Trump extended the China tariff truce by three months, while also naming EJ Antoni as the new Commissioner of the Bureau of Labor Statistics, sparking concerns over data credibility. A Financial Times report revealed Nvidia (-0.35%) and AMD (-0.28%) agreed to pay 15% of AI chip sales revenue to China for US export licenses, with critics calling it "monetization of trade policy." The US and China are set to resume trade talks, with a CPI print expected tomorrow, forecasted at 2.8% y/y by Bloomberg and 2.72% by the Cleveland Fed. European markets fell 0.06% as defense stocks dropped on hopes for US-Russia peace talks in Alaska. Gold tumbled 1.63% after Trump clarified no tariffs on gold bars. The Mexican peso surged as the 'carry trade' reignited following tariff delays.

The global crypto market cap is down 2.52% over the past 24 hours to below $4tn again, at $3.95tn, with the 24h volume increasing 11% to $192.7bn.

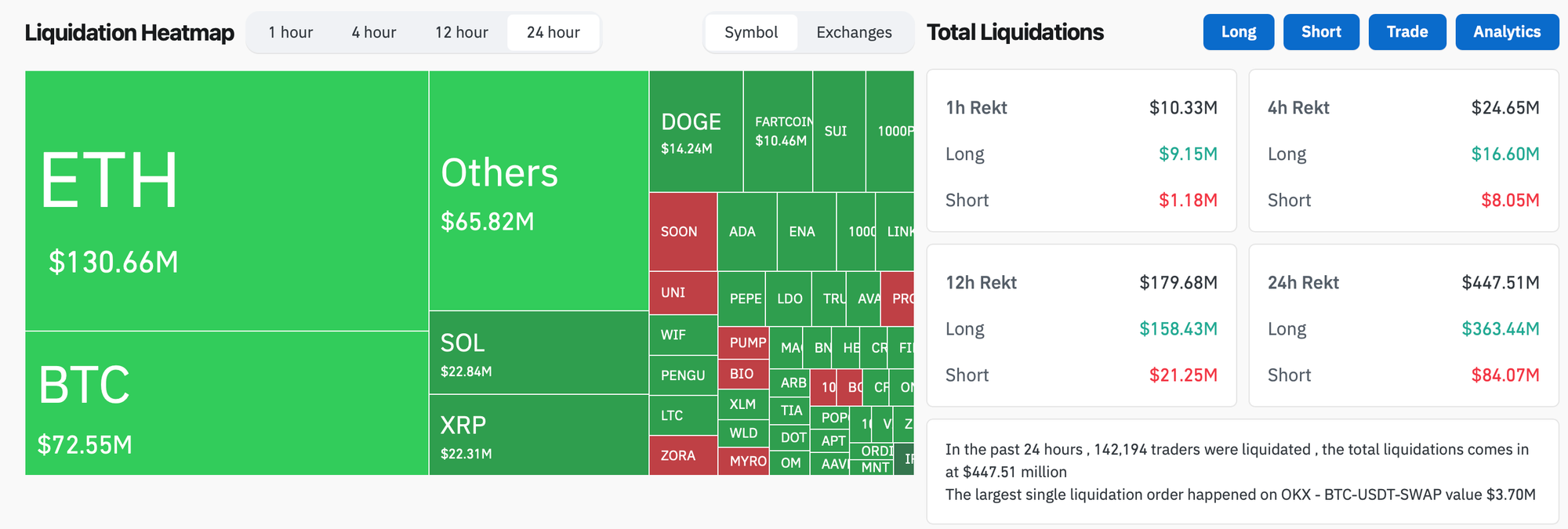

- In the past 24 hours, crypto liquidations increased by 27% and totaled $447.5m, with 81.2% of them long positions. Notably, the value of long positions liquidated amounted to $363.4m, a 174% increase, while short positions liquidated declined by 62% to $84m. In terms of market share, ETH positions dominated at $130.66m, making up 29.2% of all liquidated positions.

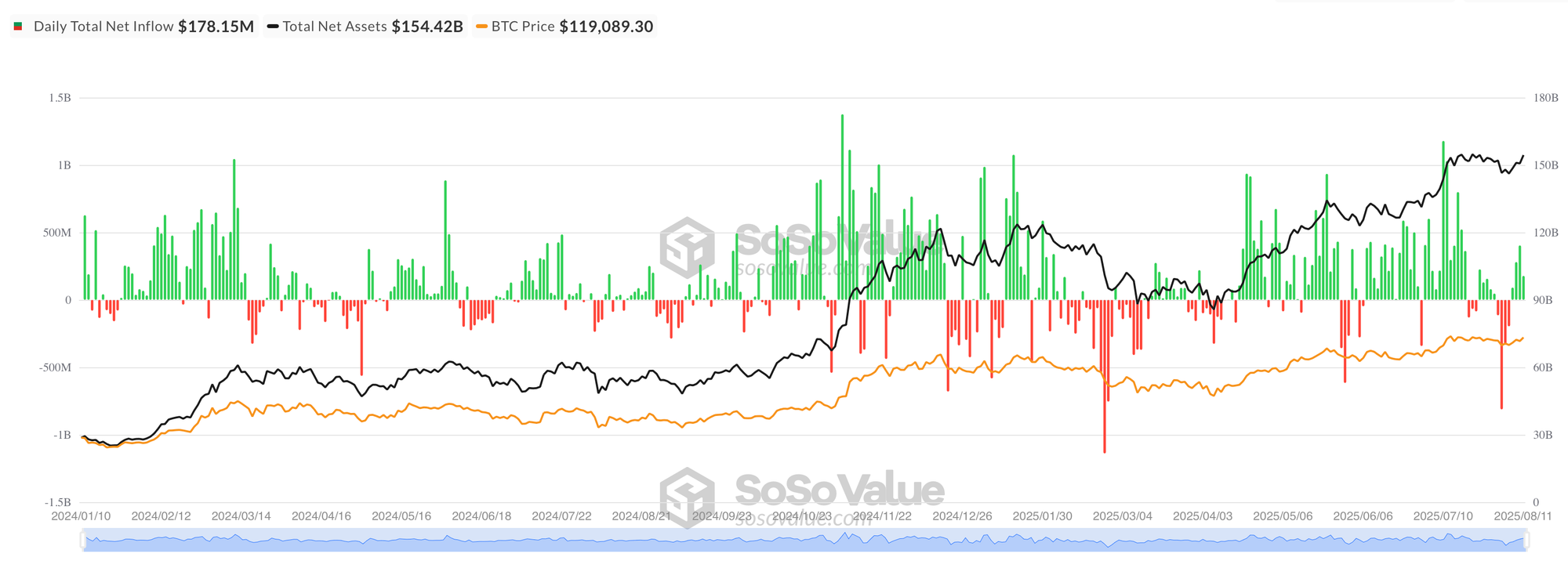

- According to data from SoSo Value, US Spot BTC ETF market slowed down on August 11, 2025, with a daily net inflow of $178.15m, representing a 55.9% decrease from the previous session. Still, this influx of capital pushed total assets to $154.42bn, representing 6.48% of BTC's market cap, with daily volume reaching $3.66bn. While the recent daily inflows have been volatile, with a significant outflow on August 5, the market has shown signs of recovery despite Monday's slower pace, with the past few days showing substantial inflows, including the $403.9m inflow on August 8. Overall, the market appears to be experiencing a period of increased investor interest, with the top ETFs by AUM, such as IBIT and FBTC, seeing significant daily volumes and asset growth.

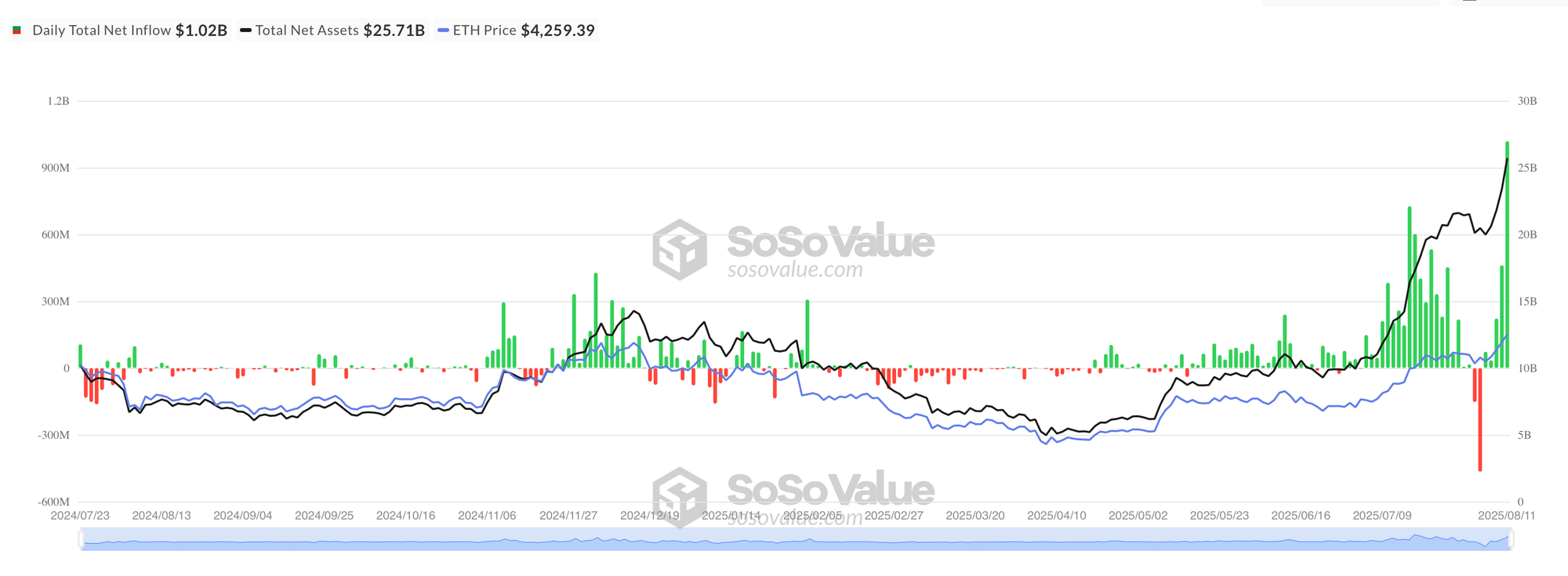

- According to data from SoSo Value, Ethereum Spot ETFs saw a massive surge in activity on August 11, 2025, with a daily net inflow of over $1.02 billion, marking a 120.9% change from the previous day and setting a new record for the largest single-day inflow since ETH ETFs launched, surpassing the previous high of $726.74 million on July 16. This influx of capital pushed total assets to $25.7 billion and daily volume to $2.8 billion. Notably, this significant inflow follows the market's largest outflow of $465.06 million recorded on August 4, highlighting the extreme volatility in ETH ETF flows. The top ETFs by assets under management, led by ETHA with $13.7 billion, also saw substantial daily trading volumes, with ETHA's daily volume reaching $639.8 million. Overall, the market's performance on August 11 suggests a renewed wave of investor interest in ETH ETFs.

- Short-term Ether holders are increasing profit-taking as ETH hovers near $4,300 after a 45% monthly rally, with Glassnode reporting $553 million daily in profit realization driven primarily by traders holding for less than 155 days, while the cryptocurrency remains about 12.7% below its November 2021 all-time high of $4,891.

- Corporate ether holdings have surged to $13 billion as the price of ether broke $4,300, with companies like Bitmine, Sharplink, and The Ether Machine leading the investment charge in this significant increase in ether's value.

- Michael Saylor's strategy marked the fifth anniversary of its Bitcoin buying strategy by adding another $18 million in Bitcoin last week, bringing its total holdings to 628,946 BTC.

- Tether and Rumble have jointly offered to acquire all shares of Northern Data, an AI infrastructure operator, in a $1.17 billion deal that would make Tether Rumble's top shareholder upon completion of the transaction.

- Chainlink partnered with NYSE-parent Intercontinental Exchange to bring forex and precious metals data from ICE's Consolidated Feed—which aggregates market data from over 300 global exchanges—onchain through Chainlink Data Streams to enhance accuracy for DeFi platforms and institutional blockchain applications.

- In July, South Korean traders invested $259 million in Bitmine, an Ether-hoarding firm, making it the country's most-purchased overseas stock for the month.

- Steak 'n Shake attributed an 11% quarter-on-quarter sales rise to its adoption of Bitcoin as a payment method in May, indicating a positive impact of cryptocurrency adoption on the company's sales performance.