Global markets rose as the US and China agreed to a framework deal to restore their trade truce, with the Dow Jones (+0.25%), S&P 500 (+0.55%), and Nasdaq (+0.63%) all closing higher. The World Bank sharply cut its global growth outlook due to trade turbulence, forecasting the slowest growth rate since 2008. Meanwhile, the US Court upheld Trump's tariffs, and the European Union unveiled fresh sanctions on Russia. Inflation fears receded in May, with the one-year outlook dipping to 3.2%, and CEO recession expectations declined, with less than 30% expecting a slowdown over the next six months.

- The global crypto market cap increased 1% over the past 24 hours to $3.45tn. The total crypto market 24h volume increased 7.7% to $141.6bn.

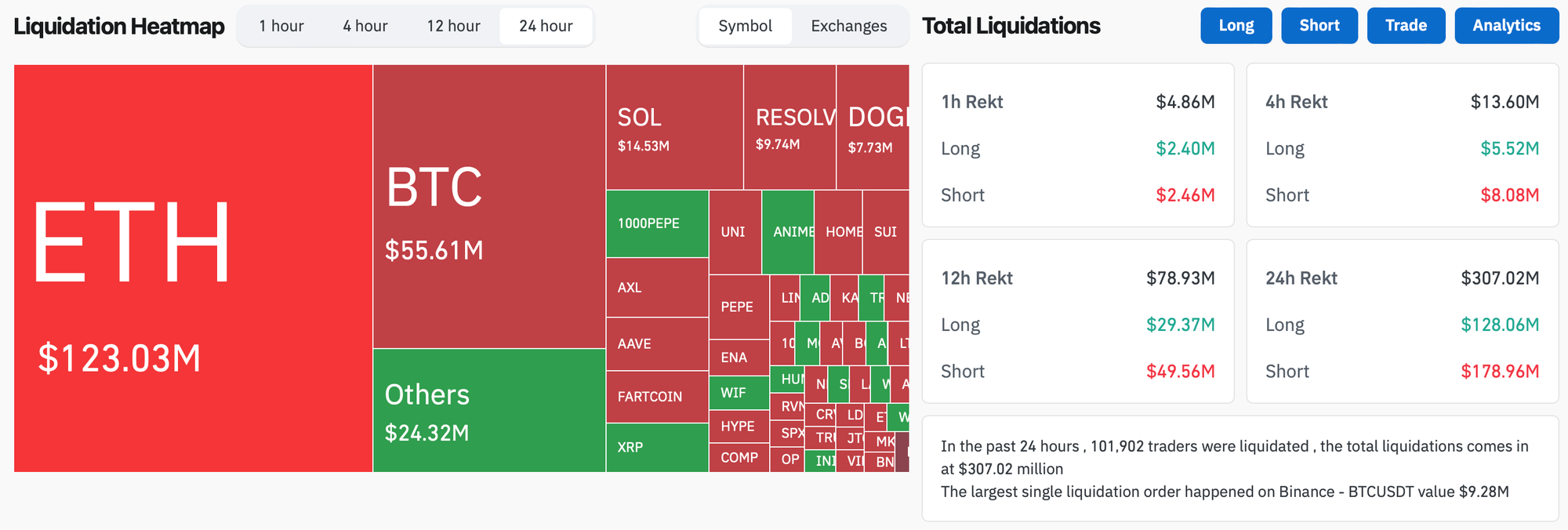

- In the past 24 hours, crypto liquidations decreased 32% and totaled $307m, with over 58% of them short positions. ETH positions made up 40% of all liquidated positions.

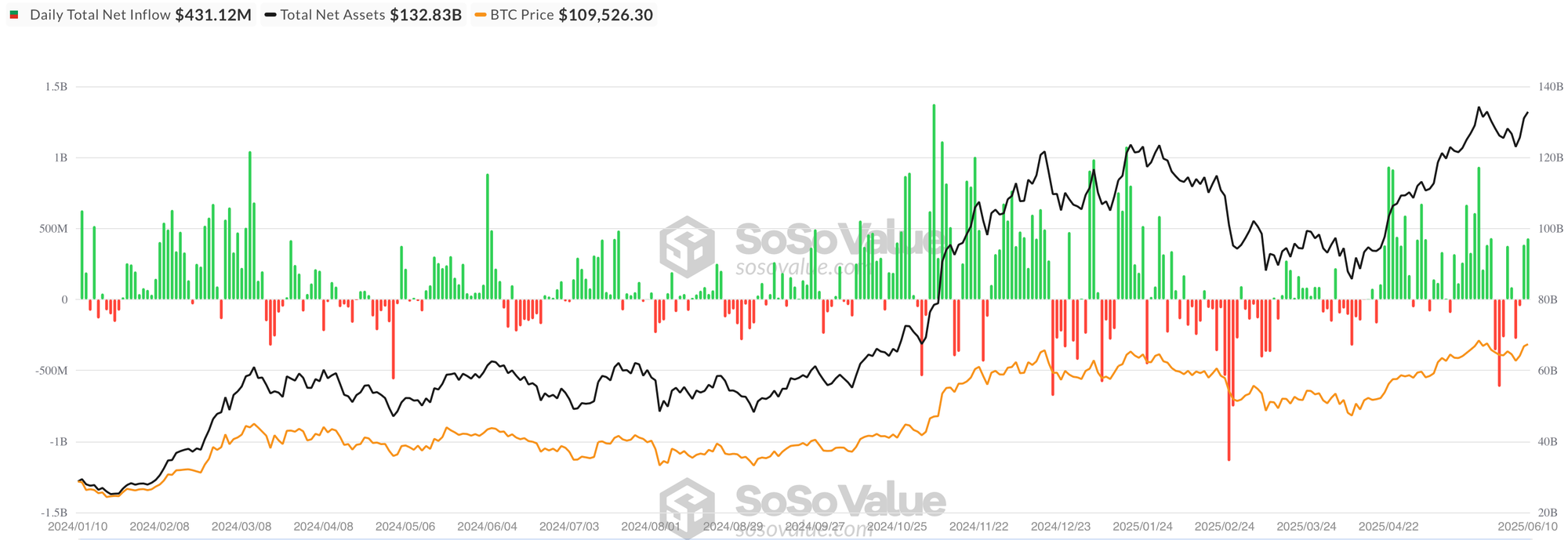

- Spot Bitcoin ETFs pulled in $431M on June 10, marking the strongest daily inflow since early June. BlackRock’s IBIT led with a $336.7m net intake, followed by Fidelity’s FBTC with $67.1m. In contrast, Bitwise's BITB posted a modest net outflow of $597.27k. Total net assets across all funds rose to $132.83bn, while cumulative net inflows reached $45.06bn. Trading activity remained solid, with $2.63bn in value exchanged on the day.

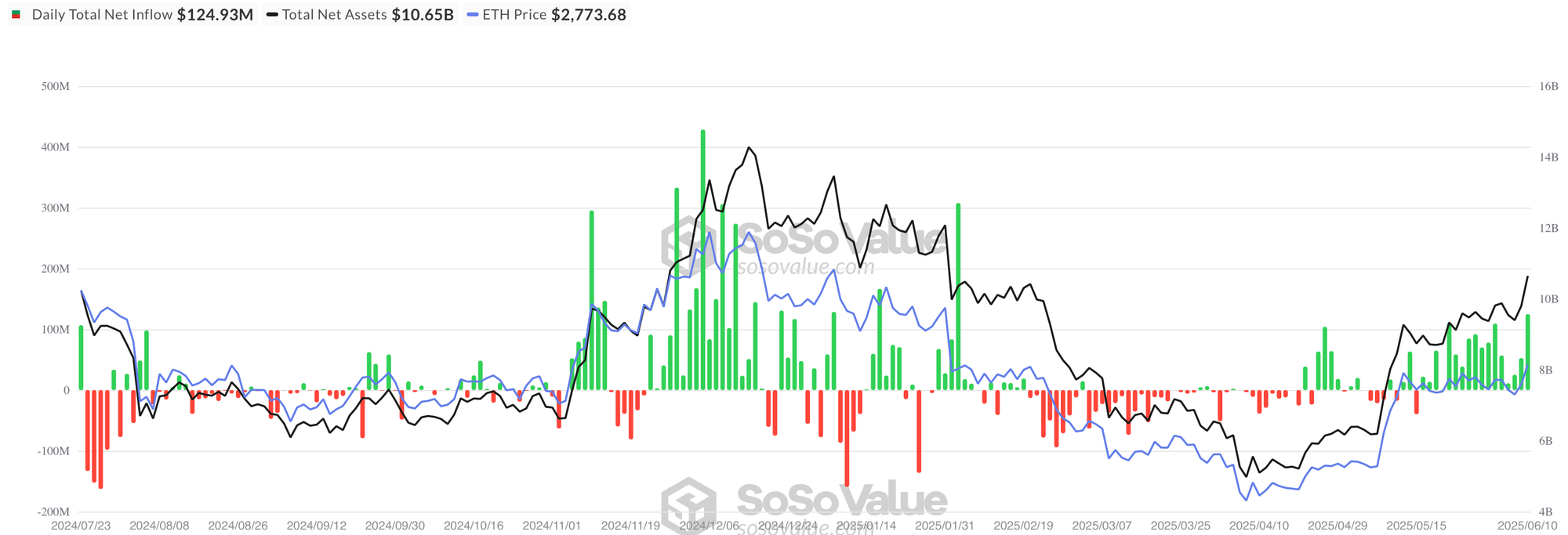

- Ethereum ETFs saw $124.9m in net inflows on June 10, the largest daily haul since February, lifting cumulative inflows to $3.5bn and total assets to $10.65bn. BlackRock’s ETHA led with $80.6m in new money, followed by Fidelity’s FETH with $26.3m and Grayscale’s ETH with $9.7m. Trading volume surged to $849m as ETH prices rallied over 7%, boosting market prices across all funds.

- American Bitcoin, backed by Eric Trump and Donald Trump Jr., has amassed over $23 million in Bitcoin while preparing to go public through a merger with Gryphon.

- A $300 million leveraged bitcoin long investment has been made, following Wynn's second $100 million leveraged bitcoin position being liquidated, which resulted in a nearly $25 million loss.

- Decentralized exchange aggregator 1inch has implemented an update that it claims will provide users with up to 6.5% better swap rates, enhancing the efficiency and cost-effectiveness of transactions on its platform.

- The US House Agriculture Committee voted to advance the Clarity Act for digital assets as lawmakers in the House Financial Services Committee debated an amendment for developers, marking a significant step towards regulatory clarity in the digital asset sector.

- Bitcoin’s upcoming software update will raise the OP_RETURN data limit from 80 bytes to 4 megabytes, sparking controversy within the community over blockchain bloat and Bitcoin’s purpose. Scheduled for release on Oct. 30 as part of Bitcoin Core 30, the change—proposed by developer Peter Todd and supported by 31 contributors—aims to expand Bitcoin’s use cases beyond financial transactions. Critics, including conservative Bitcoiners and industry figures like Reforge’s Alexander Lin, argue the update undermines Bitcoin’s role as sound money. Developer Gloria Zhao defended the move, saying open-source users should decide how to use the network. Backlash has already impacted Bitcoin Core’s node dominance, which has dropped from 98% to 88% since the proposal’s introduction in April.

- Bitcoin is seeing renewed demand from US investors, with the Coinbase Premium—an indicator of US buying activity—reaching its highest level since February, according to CryptoQuant. On Friday, the price gap between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs hit $109.55, signaling strong US interest.

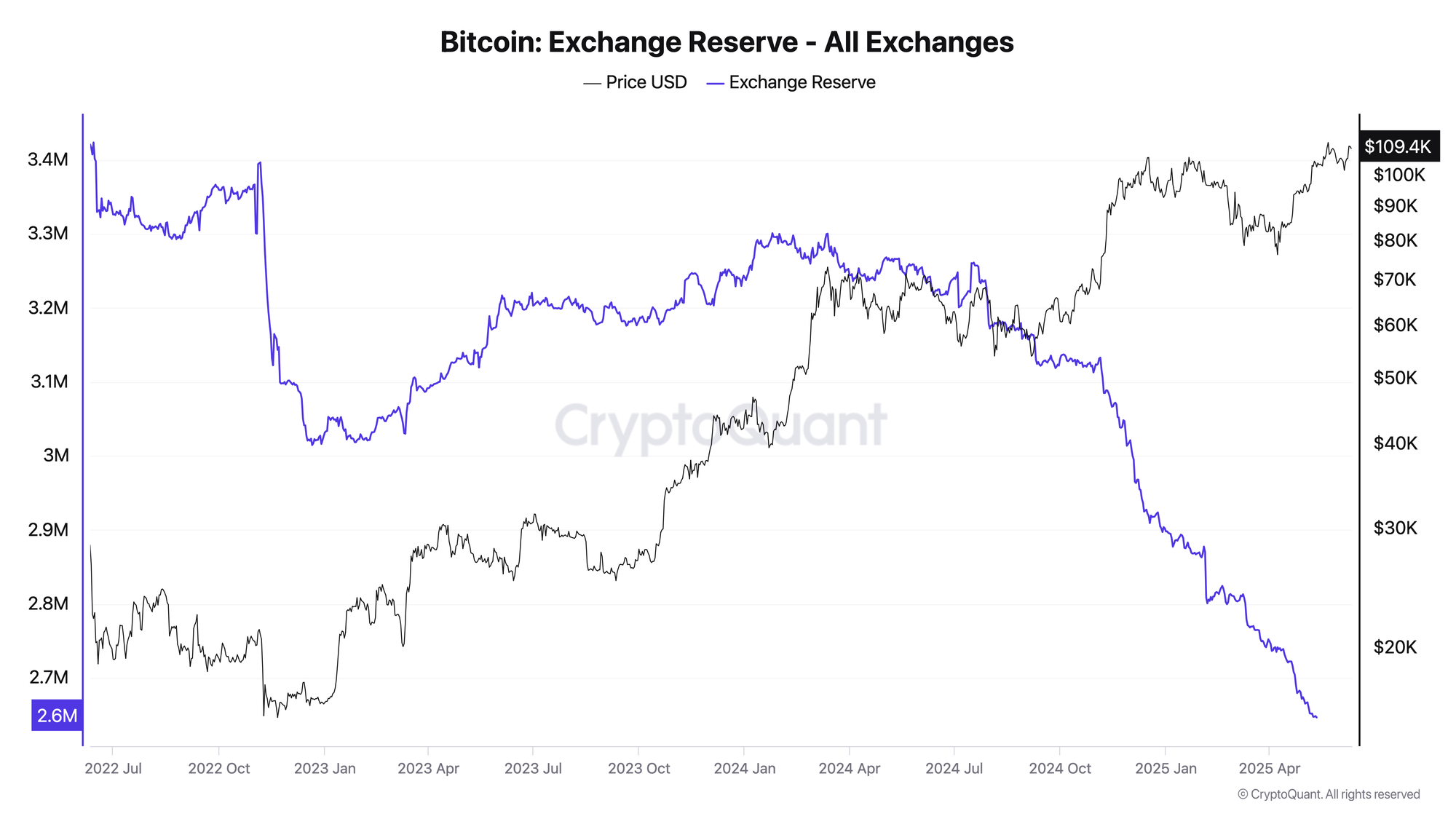

- According to CryptoQuant, spot exchange reserves have dropped by 550,000 BTC over the past year, indicating sustained accumulation. Despite the uptick, analysts note no signs of market overheating and anticipate continued strength through the end of 2025.

- Nearly 30% of 100 executives at a Fortune 500 firm said their company has plans or is interested in stablecoins, up from 8% last year, indicating a significant increase in interest in stablecoins among major corporations.