Global markets were steady, with the Dow Jones (+0.43%), S&P 500 (+0.27%), and Nasdaq (+0.09%) all closing higher, as investors weighed President Trump's tariff announcements against potential trade deals. Trump threatened new tariffs on Canada and Brazil, announcing a 35% tariff on Canadian imports starting August 1. The alternative indicators for June showed a decline in job openings and manufacturing production, but the market remained calm, brushing off Trump's tariff threats. The global cryptocurrency market capitalization surged 6% to $3.68 trillion, approaching the record highs reached in Dec 2024/Jan 2025, while trading volume exploded 58% to $219 billion over the past 24 hours.

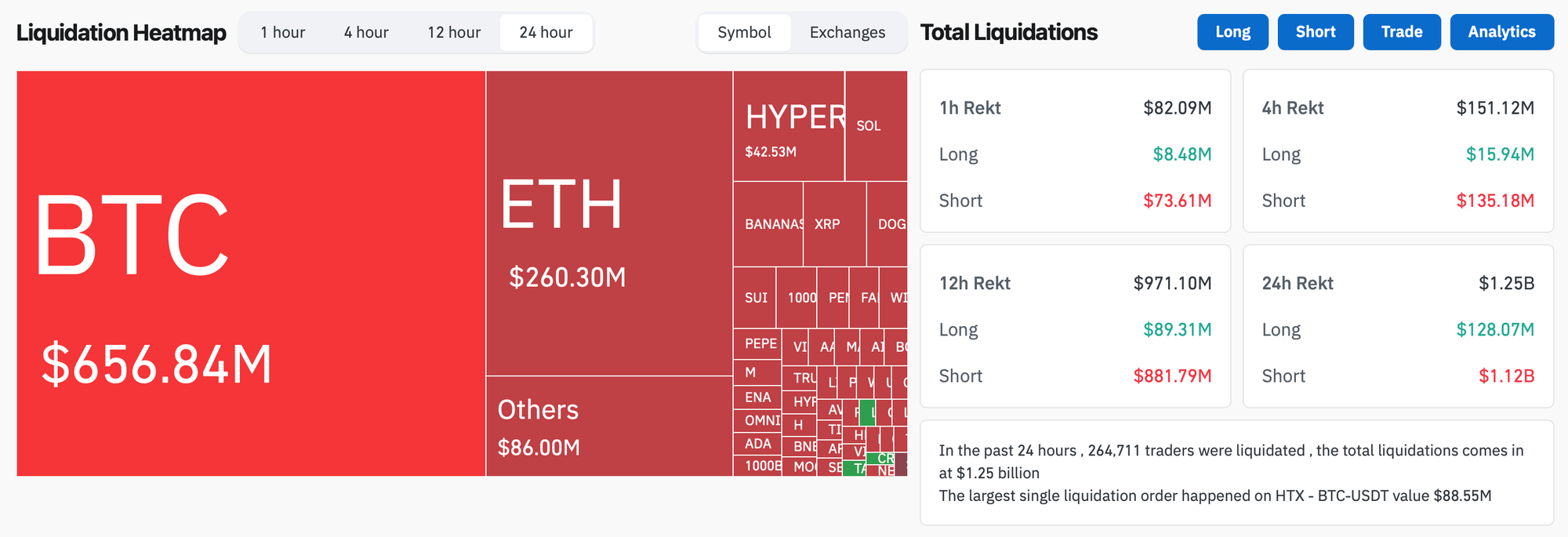

- In the past 24 hours, crypto liquidations increased by 142% and totaled $1.35bn, with 89.6% of them short positions. BTC liquidated positions made up 52.5% of all liquidated positions after it reached yet another ATH, currently trading around $118,185 (+6.28% over the past day).

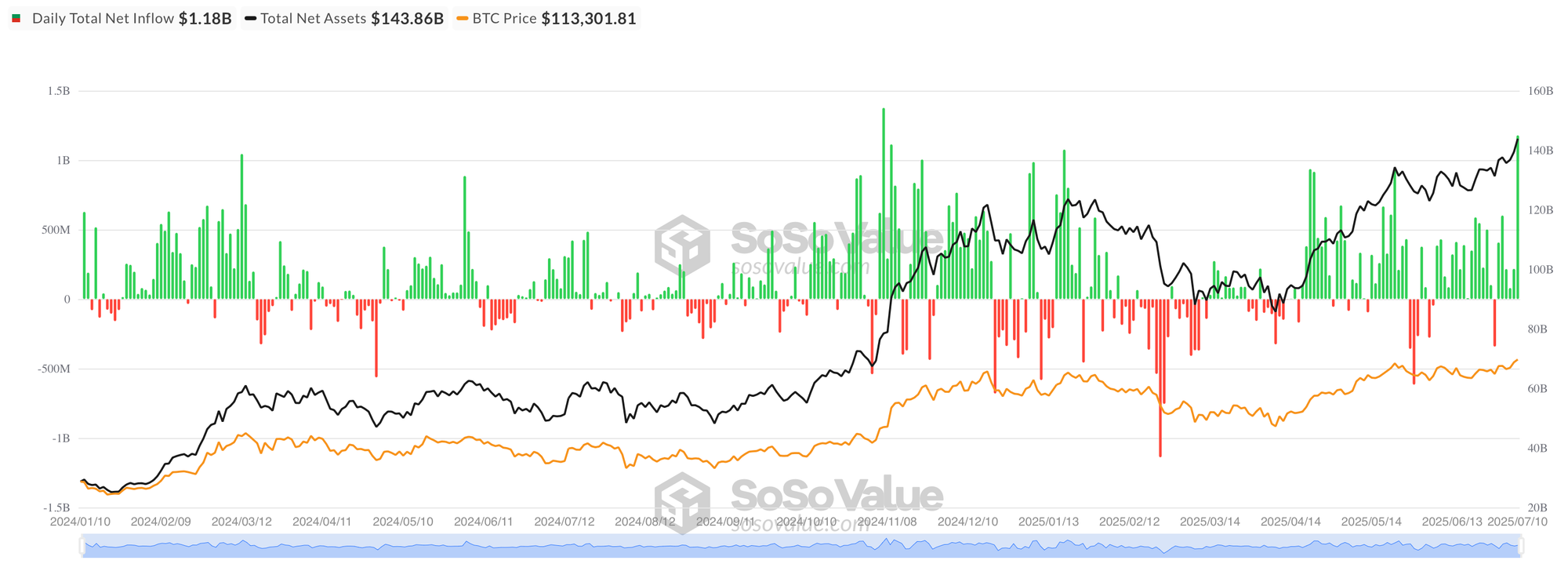

- According to data from SoSo Value, Bitcoin ETFs recorded their second-largest daily inflow on record with $1.18 billion on July 10, 2025—surpassed only by the $1.38 billion inflow on November 7, 2024, a massive 441% surge from the previous day's $218.04 million, driven by BlackRock's IBIT leading with $448.49 million, followed by Fidelity's FBTC at $324.34 million and Ark's ARKB contributing $268.70 million, while trading volume exploded to $6.31 billion as total net assets reached $143.86 billion, with only Grayscale's GBTC posting an outflow of $40.17 million amid the otherwise overwhelming institutional demand for Bitcoin exposure.

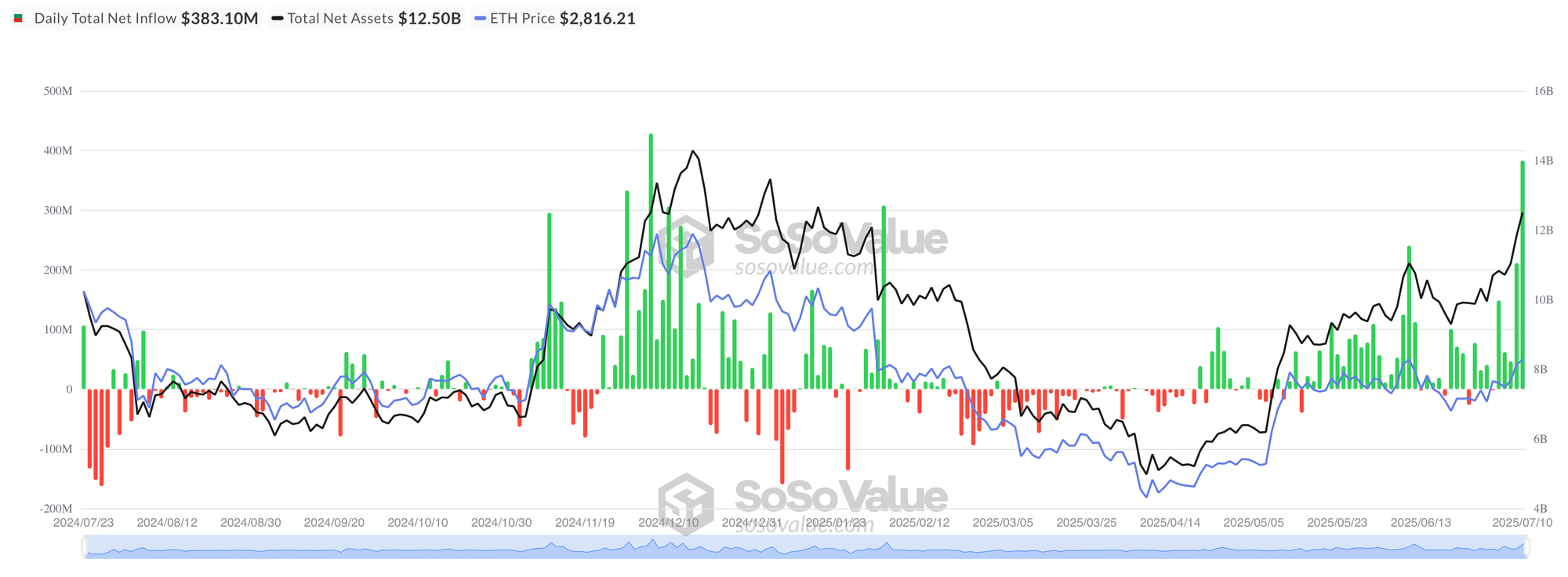

- According to data from SoSo Value, Ethereum ETFs also recorded their second-largest daily inflow on record with $383.10 million on July 10, 2025—trailing only the $428.44 million inflow on December 5, 2024, an 81% surge from the previous day's $211.32 million, driven overwhelmingly by BlackRock's ETHA with $300.93 million and supported by Fidelity's FETH contributing $37.28 million, while even Grayscale's typically outflow-prone ETHE posted a positive $18.89 million inflow, pushing total net assets to $12.50 billion amid $1.23 billion in trading volume as institutional appetite for Ethereum exposure reached near-record levels.

- Bit Mining's stock price surged 350% in pre-market trading after the company announced a strategic pivot into the Solana ecosystem.

- Coinbase announced a partnership with AI search engine Perplexity to integrate real-time cryptocurrency market data into the platform's responses, starting with COIN50 index prices in a two-phase rollout that could eventually enable AI chatbots to execute trades and manage crypto portfolios directly through the interface.

- Nicholas Truglia, a crypto scammer who used SIM-swapping attacks to steal $24 million from investor Michael Terpin in 2018, had his sentence extended from 18 months to 12 years in prison after failing to pay over $20 million in court-ordered restitution despite possessing assets worth more than $61 million.

- Jonathan Gould has been nominated by US President Donald Trump to serve a five-year term as Comptroller of the Currency at the Office of the Comptroller of the Currency, pending confirmation, to oversee the regulation and supervision of national banks and federal savings associations.

- Japanese real estate investment firm Gates Inc. announced it will tokenize $75 million worth of central Tokyo properties on the Oasys blockchain in one of Japan's largest real estate tokenization projects to date, with plans to eventually tokenize over $200 billion in assets representing about 1% of Japan's real estate market.

- Memecoin creation platform Pump.fun made its first-ever acquisition by purchasing wallet-tracking platform Kolscan ahead of its planned $1 billion ICO on Saturday, aiming to gamify onchain trading and build social features as it faces growing competition from rival platform LetsBonk.

- Coinbase International Exchange has integrated with Copper's ClearLoop network to offer institutional clients off-exchange settlement capabilities using multiparty computation technology, allowing traders to manage collateral and settle trades in near real-time without moving funds onto the exchange amid high institutional demand for reduced counterparty risk and improved capital efficiency.