Global markets rose as investors digested the latest tariff announcements from President Trump, with the Dow Jones (+0.49%), S&P 500 (+0.61%), and Nasdaq (+0.94%) all closing higher. Nvidia briefly surpassed a $4 trillion valuation, closing 1.8% higher with year-to-date gains exceeding 20%, while bond markets rallied with 10-year Treasury yields falling to 4.34% following a well-received $39 billion auction. European equities extended gains for a third consecutive session with the Stoxx Europe 600 rising 0.8%, led by banks after UniCredit doubled its Commerzbank stake to 20%, though miners faced pressure from Trump's announced 50% copper tariff and WPP plunged 19% on a revenue outlook cut.

- Bitcoin reached a new all-time high of $112,000 on July 9, 2025, in part driven by record institutional adoption with BlackRock's IBIT ETF now holding over 700,000 BTC (3.33% of total supply) and generating more annual fee revenue than their S&P 500 ETF.

- The global crypto market cap increased 2.68% in the past 24h to $3.46tn while the 24h volume increased 42% to $139bn.

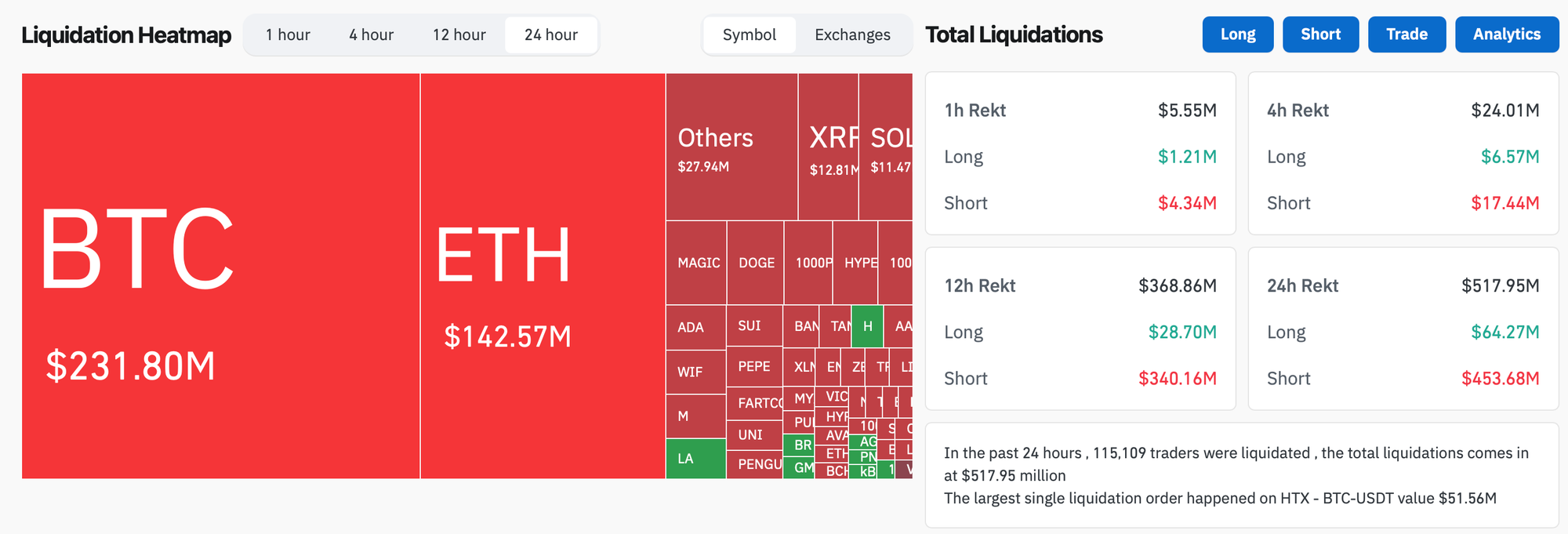

- In the past 24 hours, crypto liquidations increased by 272% and totaled $517.94m, with 88% of them short positions. BTC liquidated positions made up 44.8% of all liquidated positions.

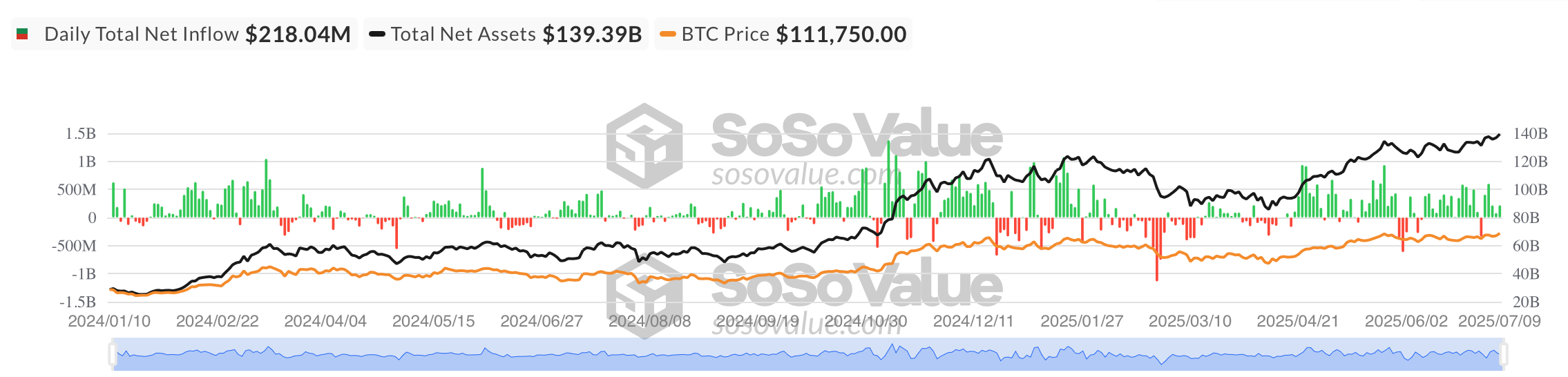

- According to data from SoSo Value, Bitcoin ETFs recorded strong inflows of $218.04 million on July 9, 2025, representing a 172% increase from the previous day's $80.08 million, led by BlackRock's IBIT with $125.58 million and Ark's ARKB contributing $56.96 million, pushing total net assets to $139.39 billion amid robust trading volume of $4.35 billion as most funds traded at premiums reflecting continued investor appetite for Bitcoin exposure.

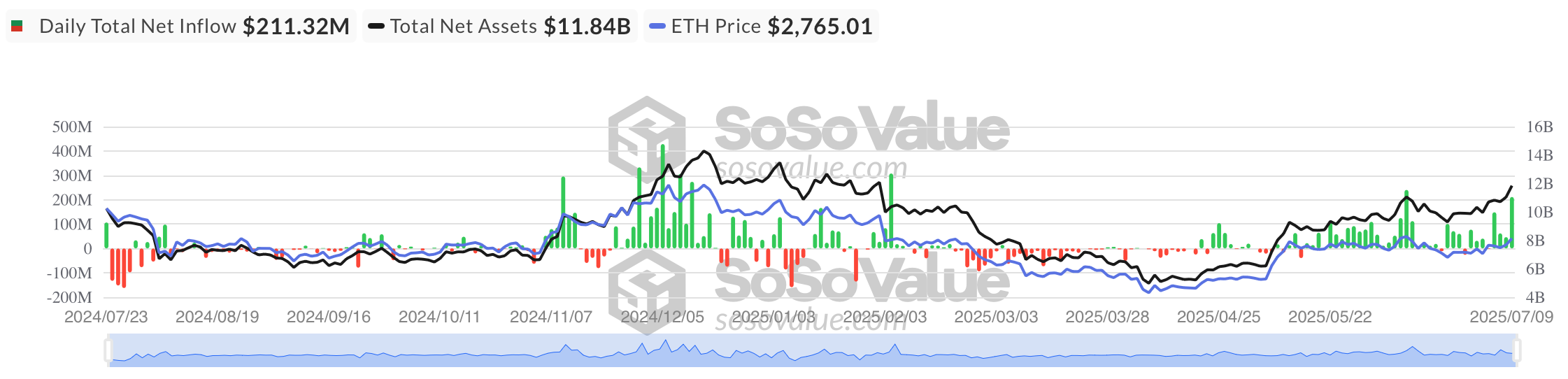

- According to data from SoSo Value, Ethereum ETFs recorded the strongest inflows since June 11 amounting to $211.32 million on July 9, 2025, representing a 353% surge from the previous day's $46.63 million, driven primarily by BlackRock's ETHA with $158.62 million and Fidelity's FETH contributing $29.53 million, pushing total net assets to $11.84 billion amid increased trading volume of $1.26 billion as most funds traded at premiums reflecting heightened investor interest in Ethereum exposure.

- Opensea has acquired Rally to go mobile and plans to unify NFT and token trading, while also expanding its services into decentralized finance, perpetuals, and AI-powered tools to diversify its offerings in the digital assets market.

- OKX has partnered with Circle to offer zero-fee conversions between Circle's USDC stablecoin and the US dollar, enhancing the usability of USDC and aiming to increase its adoption through this new collaboration.

- Major international airline Emirates has partnered with Crypto.com to introduce crypto payments and launch promotional campaigns.

- Bybit will host Pumpfun's Pump token sale from July 12 to July 15, which will open on Saturday at 14:00 UTC but will exclude users in Europe due to regulatory restrictions.

- Rapper Snoop Dogg sold out nearly one million NFTs on Telegram in just 30 minutes Wednesday, generating $12 million in sales and potentially signaling renewed interest in the digital collectibles market, which has seen volumes plunge 61% in Q1 2025 compared to the previous year.