Global markets retreated on Friday as the Dow Jones (-0.2%), S&P 500 (-0.64%), and Nasdaq (-1.15%) all closed lower, driven by heavy tech sector selling despite core PCE inflation meeting expectations at 2.9% annually and keeping September rate cut odds at 90%. Technology weakness was led by Nvidia falling 3.3% on Alibaba chip competition concerns and data-center spending worries, while European markets mirrored the decline with the Stoxx 600 down 0.6% as German inflation surprised higher and UK banks faced windfall tax concerns. Commodities were mixed with oil declining as Brent fell 0.7% to $68.12 while gold rallied 0.9% to $3,448 on safe-haven flows, and cryptocurrencies weakened with Bitcoin falling 3.8% to $107,748 and Ether down 2.6% to $4,344. Despite Friday's pullback, the S&P 500 secured its fourth consecutive monthly gain of 1.9% in August, with traders now focused on Friday's non-farm payrolls report that will shape Fed policy expectations.

The global crypto market cap decreased 3.1% over the weekend to $3.74tn.

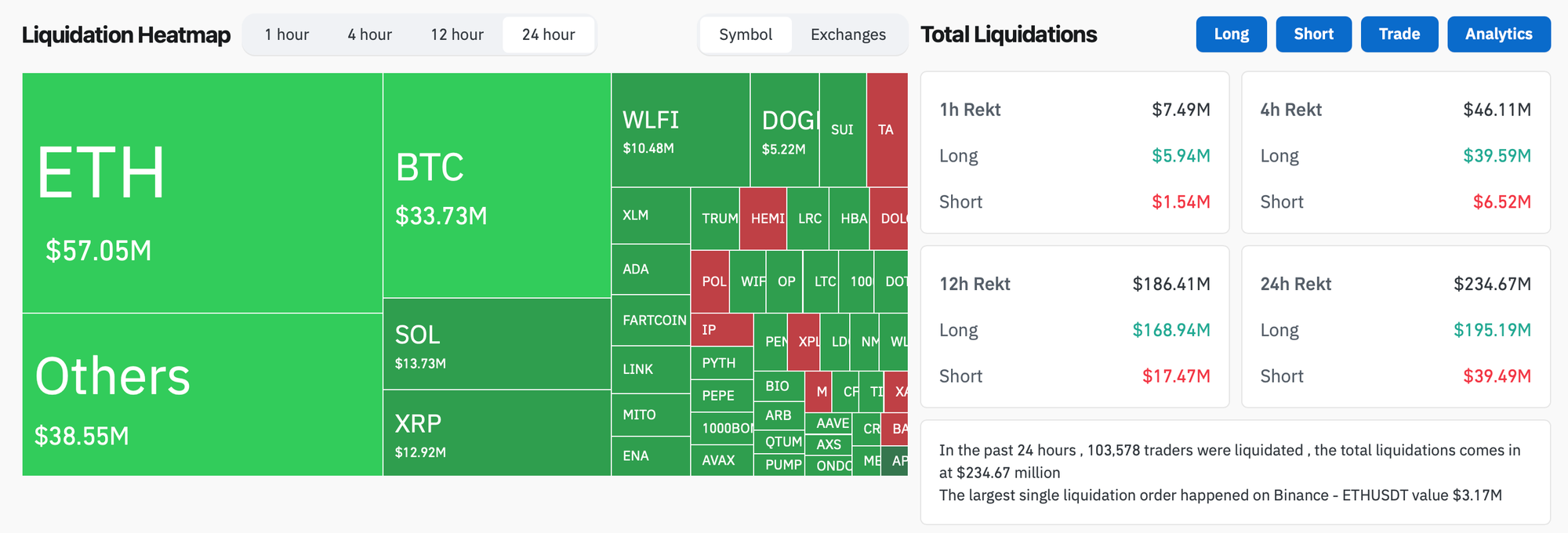

- In the past 24 hours, crypto liquidations increased by 90% and totaled $235m, with 83% of them long positions.

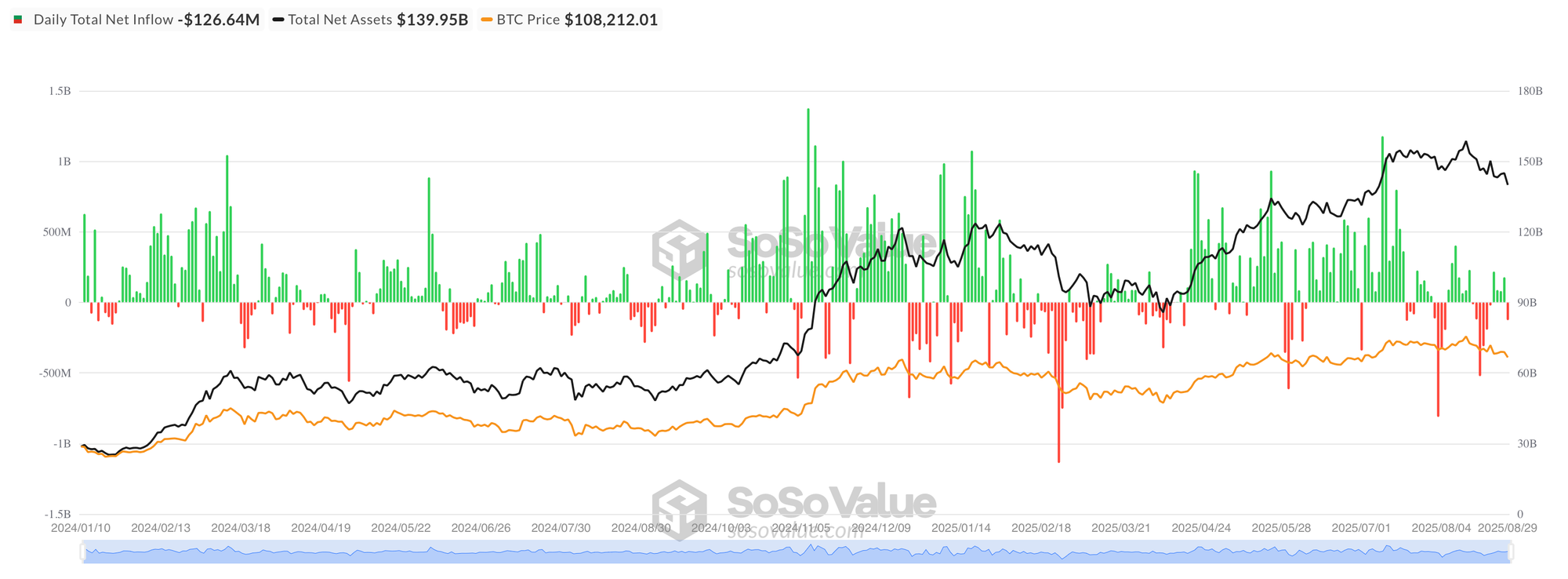

- According to SoSo Value data, US Spot BTC ETFs saw outflow of $126.6m on Friday. Despite the outflow, the week ended on a net inflow of $440.71m, a reversal from the previous week's $1.17bn outflow.

- According to data from SoSo Value, US Spot ETH ETFs saw a net outflow of $164.6m on Friday. The weekly net flow remained above $1bn at $1.08bn.

- Solana's Alpenglow protocol upgrade, which would slash transaction finality from 12.8 seconds to 150 milliseconds, is on track to pass with over 99% of votes in favor and two days remaining before voting closes Tuesday at 1 pm UTC.

- Bitcoin's daily transaction fees have collapsed over 80% since April 2024 with nearly 15% of blocks now "free" according to a Galaxy Digital report, raising concerns about long-term network security as miners face reduced revenue following the halving.

- pump.fun has spent over $62 million on buying back 16.5 billion of its own pump tokens in an effort to reduce sell pressure and stabilize token value.