Bitcoin Long Term Chart

I haven’t updated the last chart because I said ‘Look for an acceleration on a break-out the channel. The next target to the downside is the wave iii low at 80553 followed by 76000.’ Yesterday's low was 74540 just below our initial target. So we need to look to the short-term chart for any signs that the sell-off is complete.

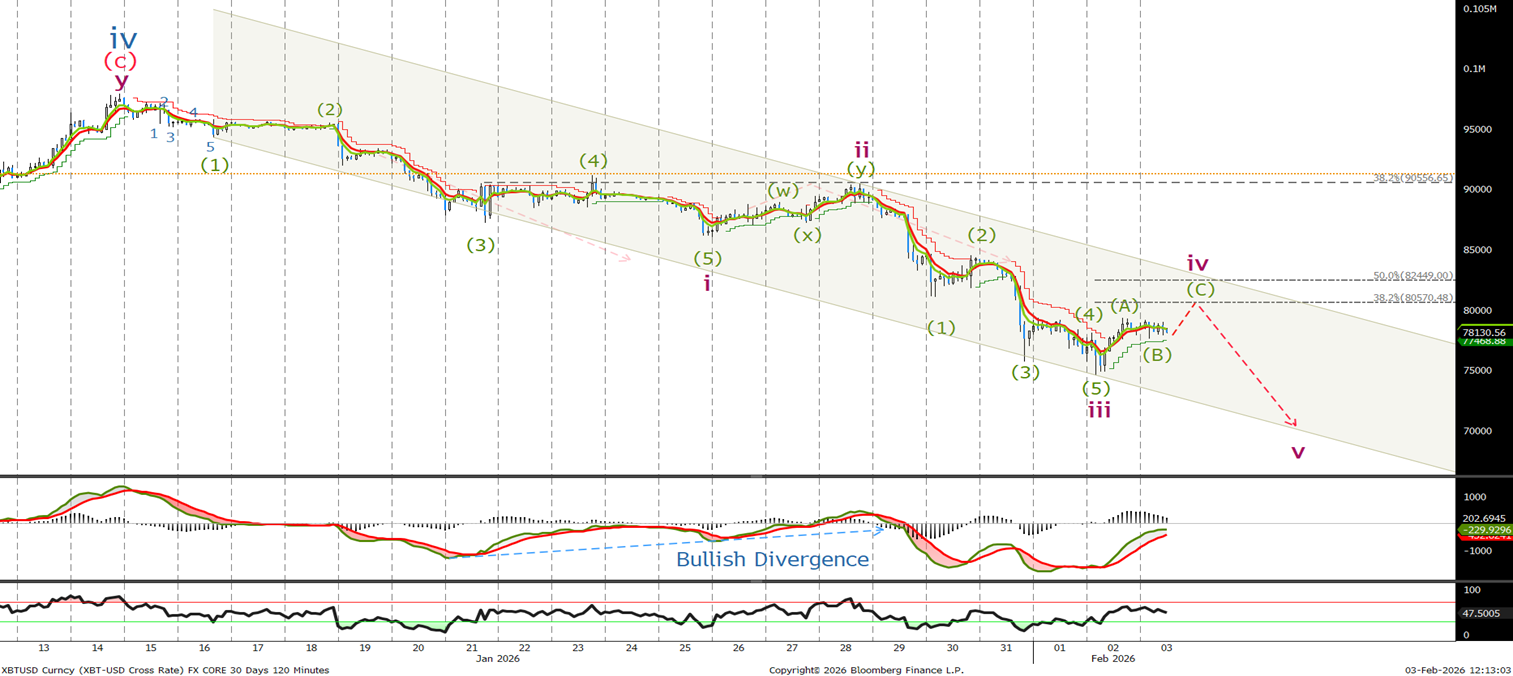

Bitcoin Short Term Chart

Last time we said ‘We should now retrace in 3 waves in to the 88.8K-90.5K level , the area of the previous wave (4). I am happy to sell there and lower stops to 97922 level, looking for lower still in the coming weeks.' We traded up to 90460 and stopped at the 38.2% retracement, enabling us to sell. Since then we have traded down in 5 waves to complete wave iii. We should now correct higher in wave iv and it looks as if 2 of them have already been completed. Look for a rally to the 80570 followed by the top of the channel and the 50% retracement level at 82450. Sell there with stops above the wave ii high for push toward the 70k level.

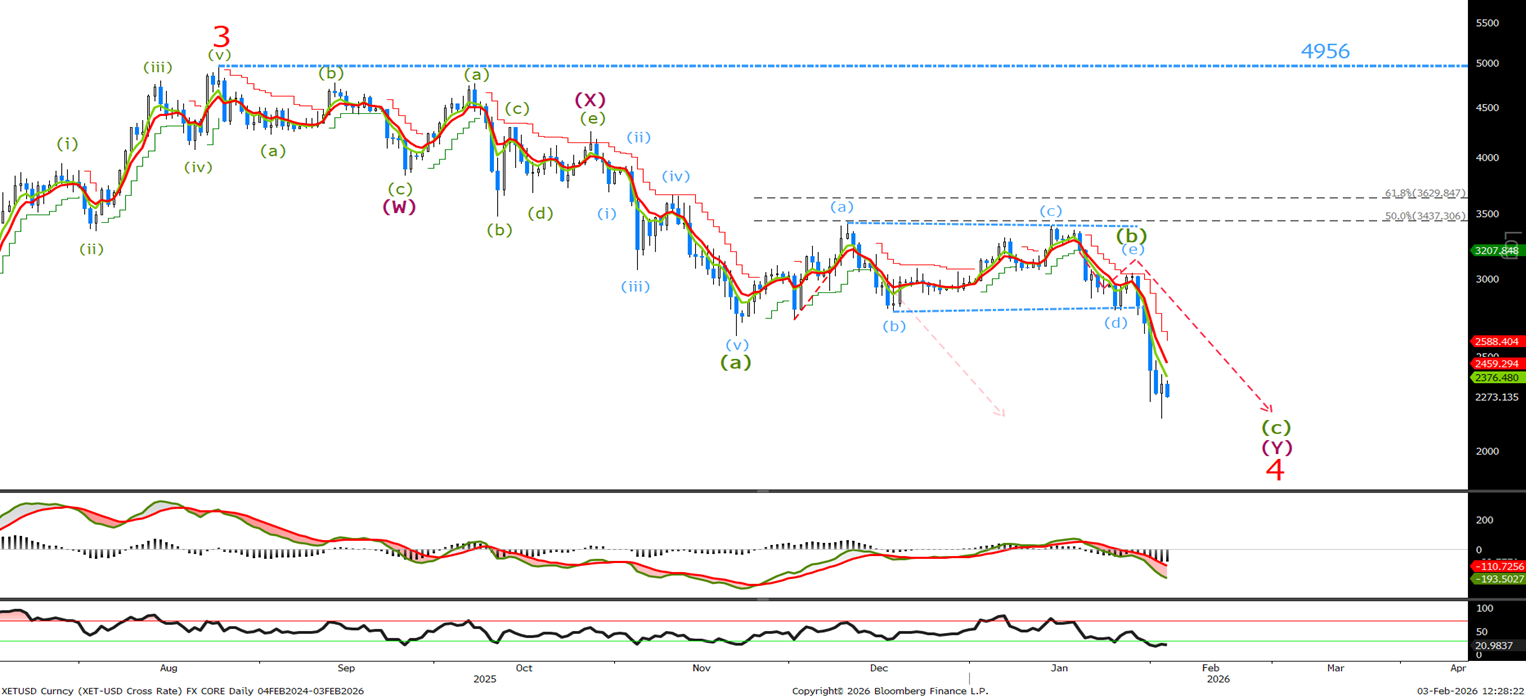

Ethereum Long Term Chart

Last time I said, ‘I believe this is the start of wave (d). We should stay above 2774 in wave (d) with the current low 2784, I expect to see a minor recovery in wave (e) to complete the bearish triangle toward the 3100 level before the sell-off resumes.' We traded down to 2784 in wave D before rallying int 3041 to complete the wave (b) triangle. The break below wave (d) saw an acceleration lower in line with expectations. So what is the target for the wave (c)?.

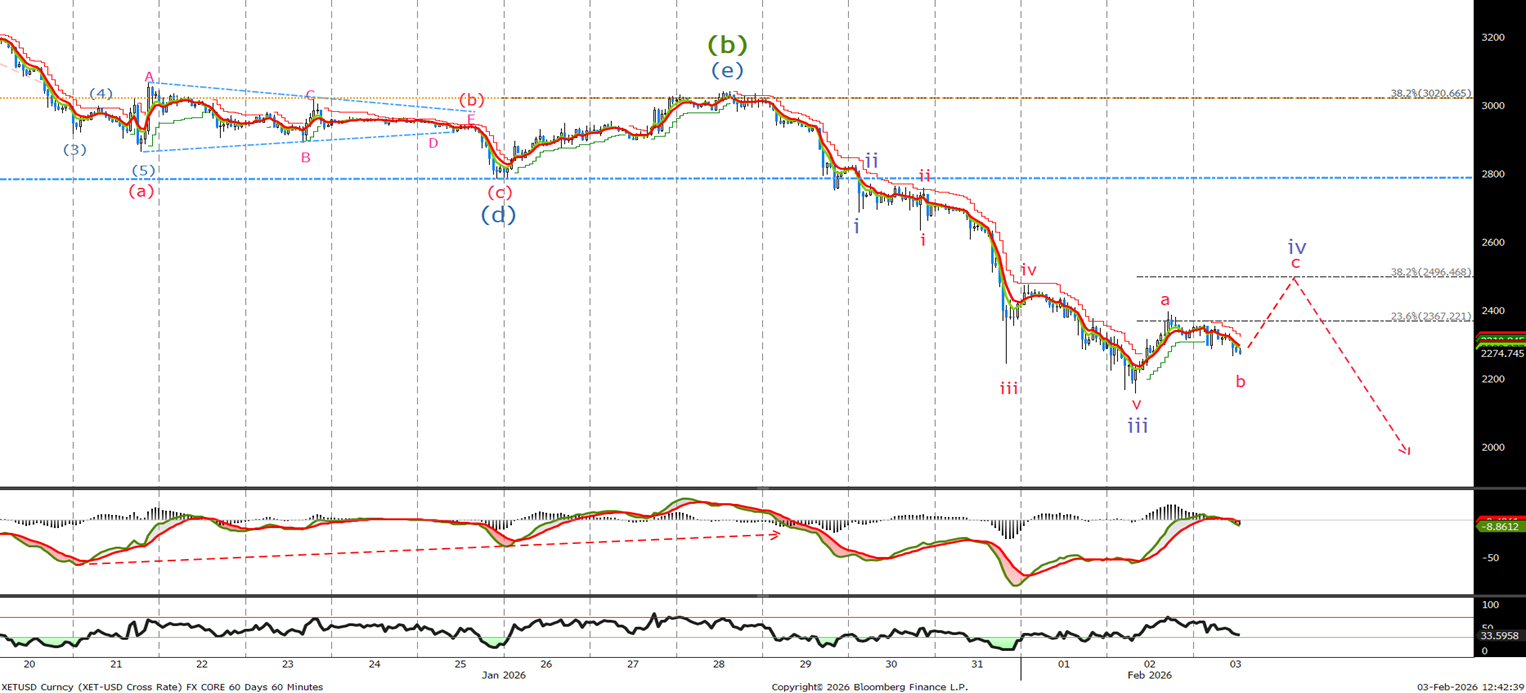

Ethereum Short Term Chart

Last time I said ‘I am looking for a zigzag rally toward the retracement levels to complete wave (e) before the sell-off resumes. Look to sell at 3020-3090-3165 with stops above 3445.’ We traded to 3036 enabling us to sell and since then we have sold off in 3 waves. Looking at the divergence in the MACD we expect another leg higher towards the 2480-2520 area before the sell off resumes. A move back above 2800 would negate this current view.