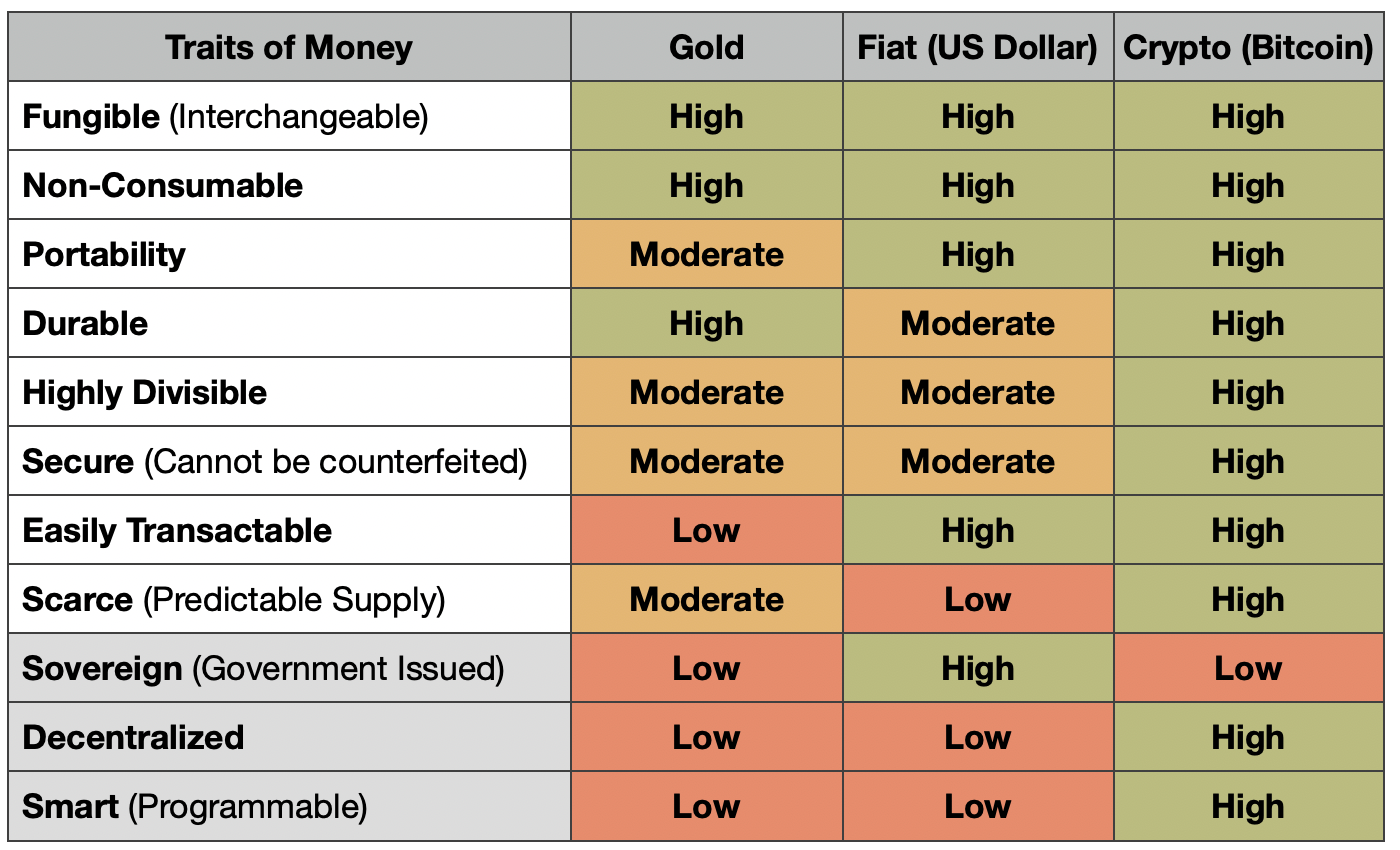

Bitcoin has revolutionised the 21st-century investment landscape by introducing a decentralized digital currency, a ground-breaking asset in the modern era of investing.

There are several reasons to consider the inclusion of Bitcoin in an investment portfolio:

- Diversification: Bitcoin has a low correlation to other asset classes, such as stocks, bonds, and real estate. This means that adding Bitcoin to a portfolio can help to reduce overall risk.

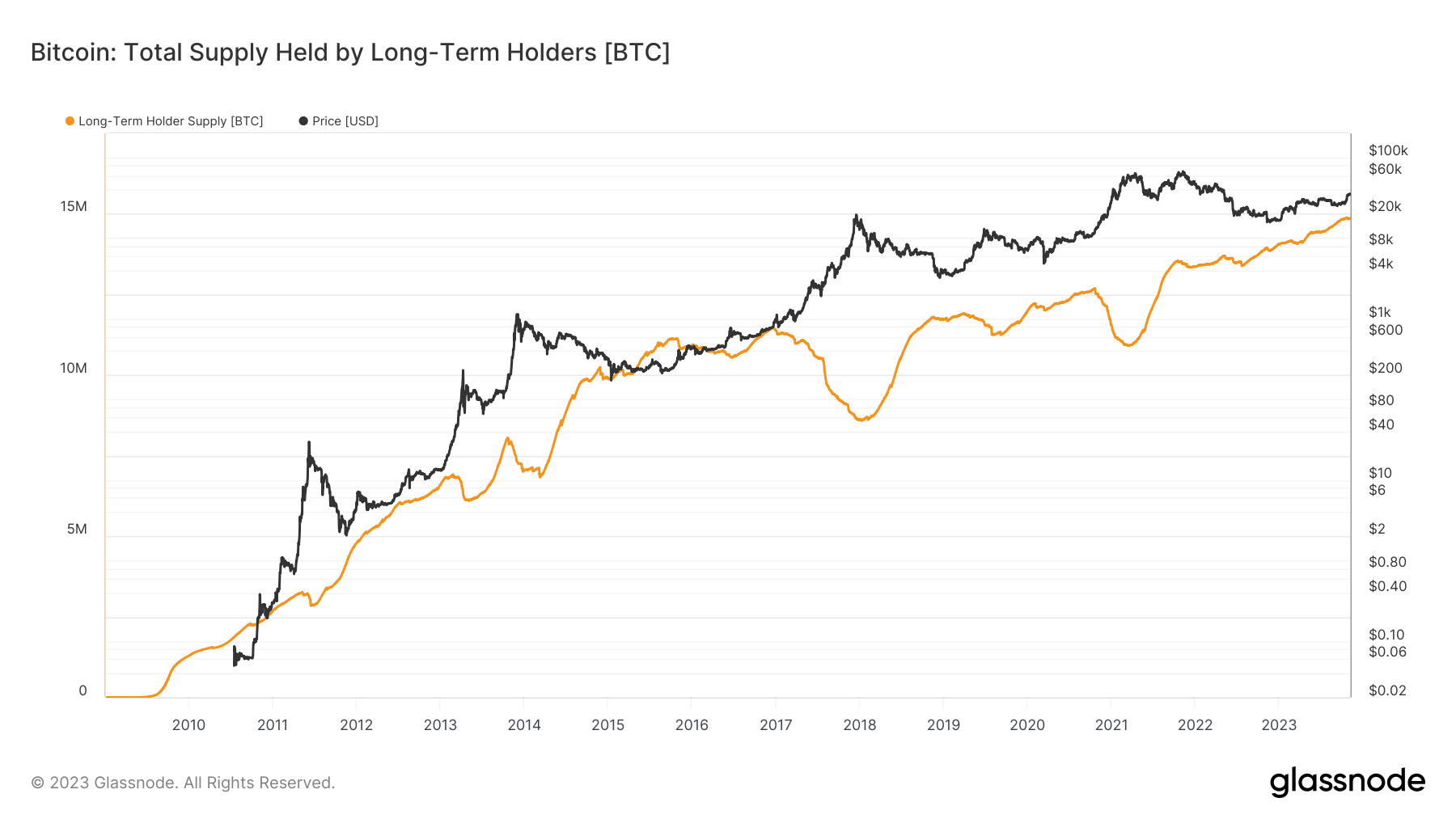

- Aspirational Store of value : Bitcoin has a limited supply of 21 million coins, which makes it attractive as a store of value. Over time, Bitcoin's value is expected to rise as demand increases and supply remains limited.

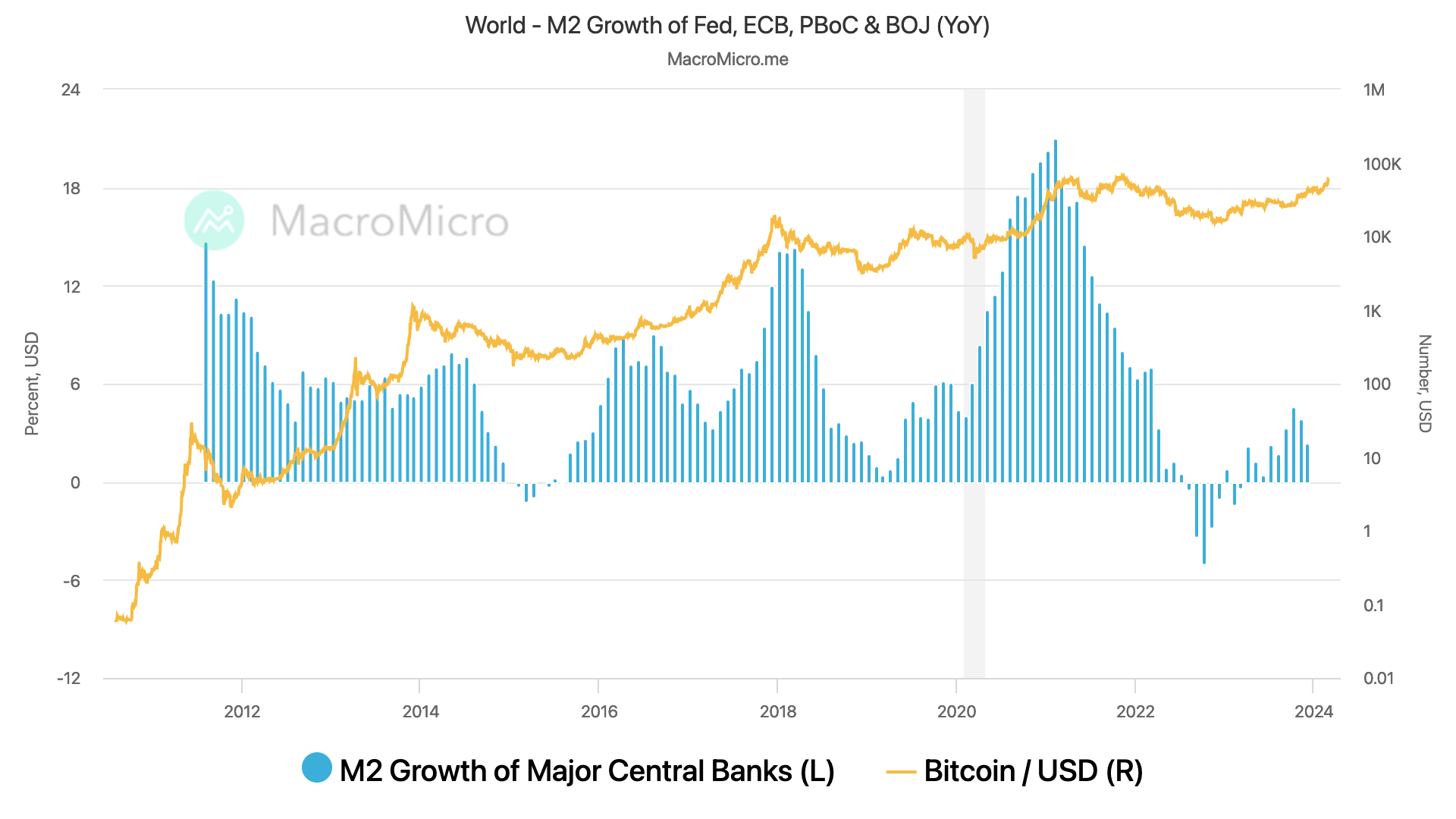

- It could become a hedge against inflation: Bitcoin has a decreased inflation over the time, as its supply is fixed it's de facto a scarcity asset. This makes it a good hedge against inflation, which can erode the value of fiat currencies over time.

- The more the dollar is debased, the stronger Bitcoin becomes.

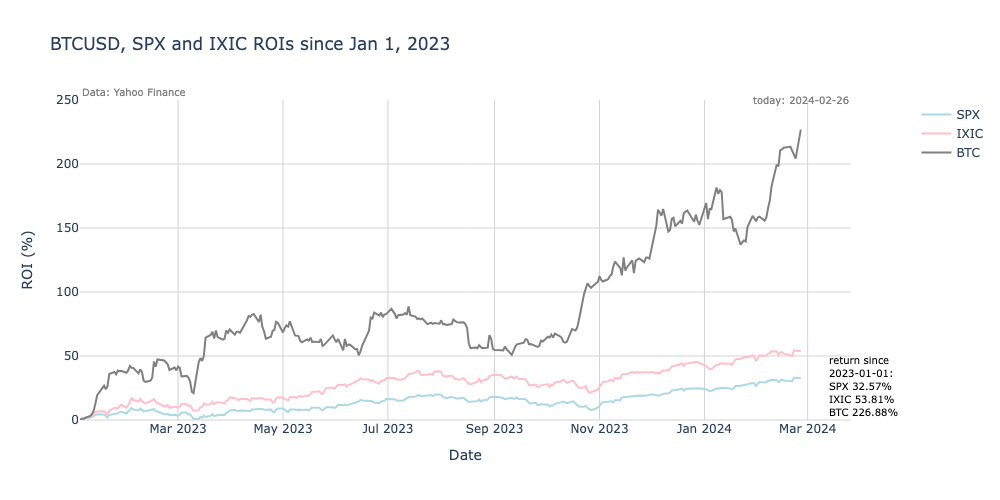

- Potential for high returns: Bitcoin has historically generated high returns, although it is also a volatile asset. Investors who are willing to accept the risk of Bitcoin's volatility have the potential to earn significant returns.

While equity markets exhibit steadier growth, Bitcoin's trajectory showcases its exceptional return capability, albeit paired with significant price swings. This stark contrast in market behaviour reinforces the idea that Bitcoin can play a pivotal role in diversifying an investment portfolio, potentially enhancing overall returns for those who are strategically positioned to manage its inherent volatility.

Some additional arguments in favour of including Bitcoin in a portfolio:

- Bitcoin is a global asset: Bitcoin can be sent and received anywhere in the world without the need for intermediaries. This makes it a convenient and efficient way to transfer money across borders.

- Bitcoin is a censorship-resistant asset: Bitcoin transactions are not subject to government or financial institution censorship. This makes it an attractive asset for people who live in financially unstable countries with central banks restricting capital outflows or simply individuals or entities who value financial privacy.

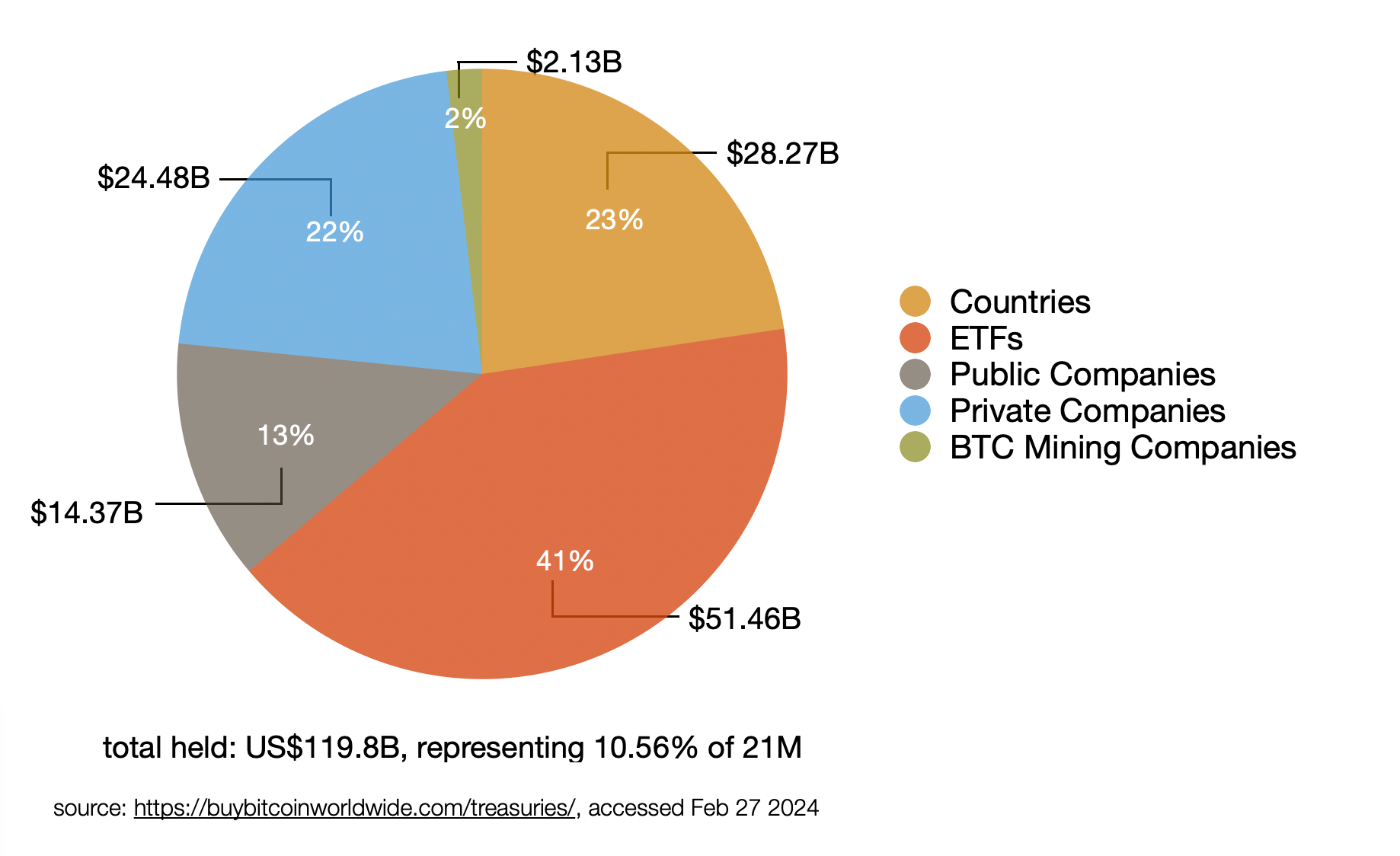

- Bitcoin's adoption is on the rise: The Bitcoin ecosystem is constantly evolving, with increased adoption by countries, public and private companies, and the recent introduction of Bitcoin Exchange-Traded Funds (ETFs).

Halving

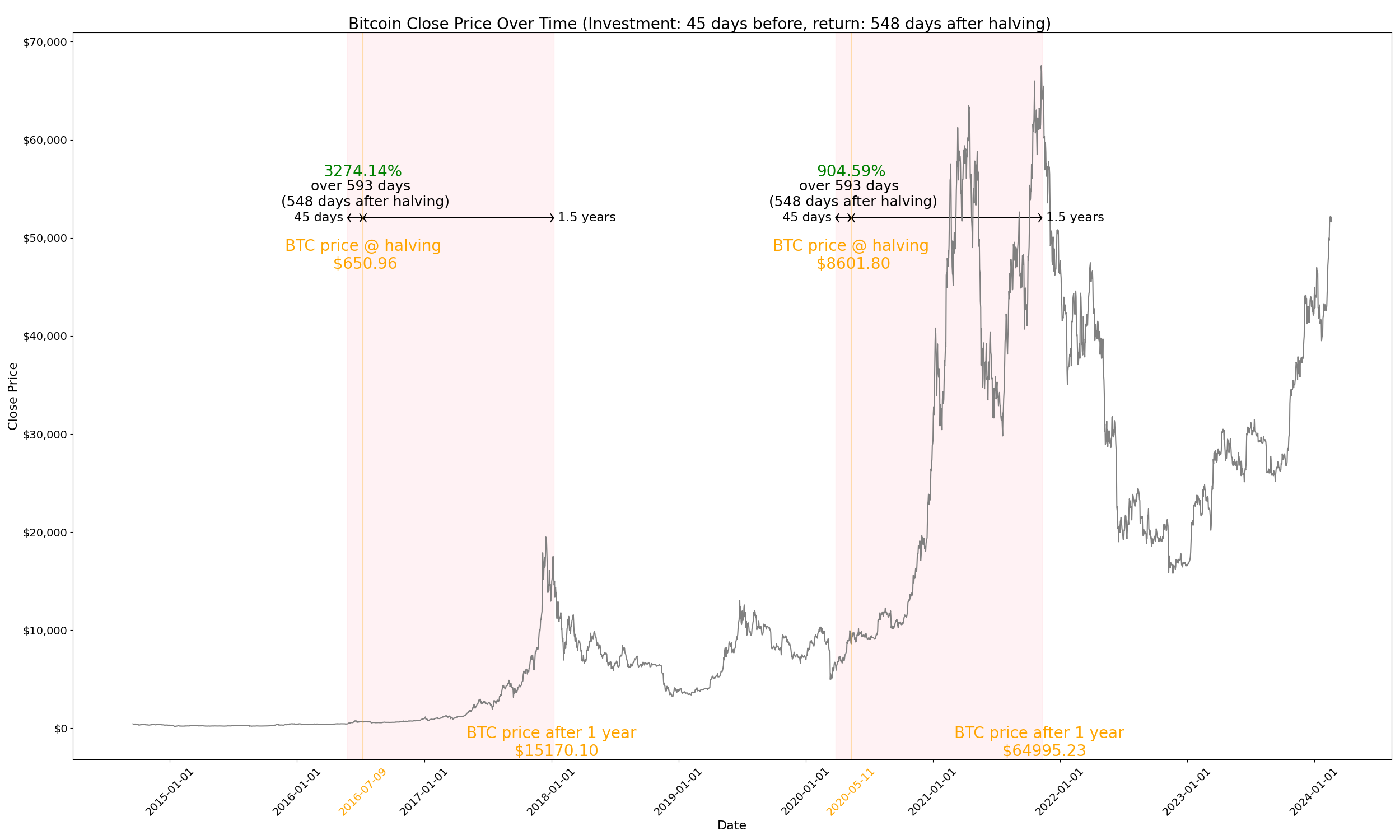

Bitcoin Halving is an event that occurs approximately every four years, reducing the reward for mining new blocks by half, thereby diminishing the rate at which new Bitcoins are created.

The new Halving will take place around Friday Apr 19, 2024, and will reduce the Bitcoins emission per block (~10min) to 3.125 BTC.

Bitcoin price action prior and post Halving (click to play video)

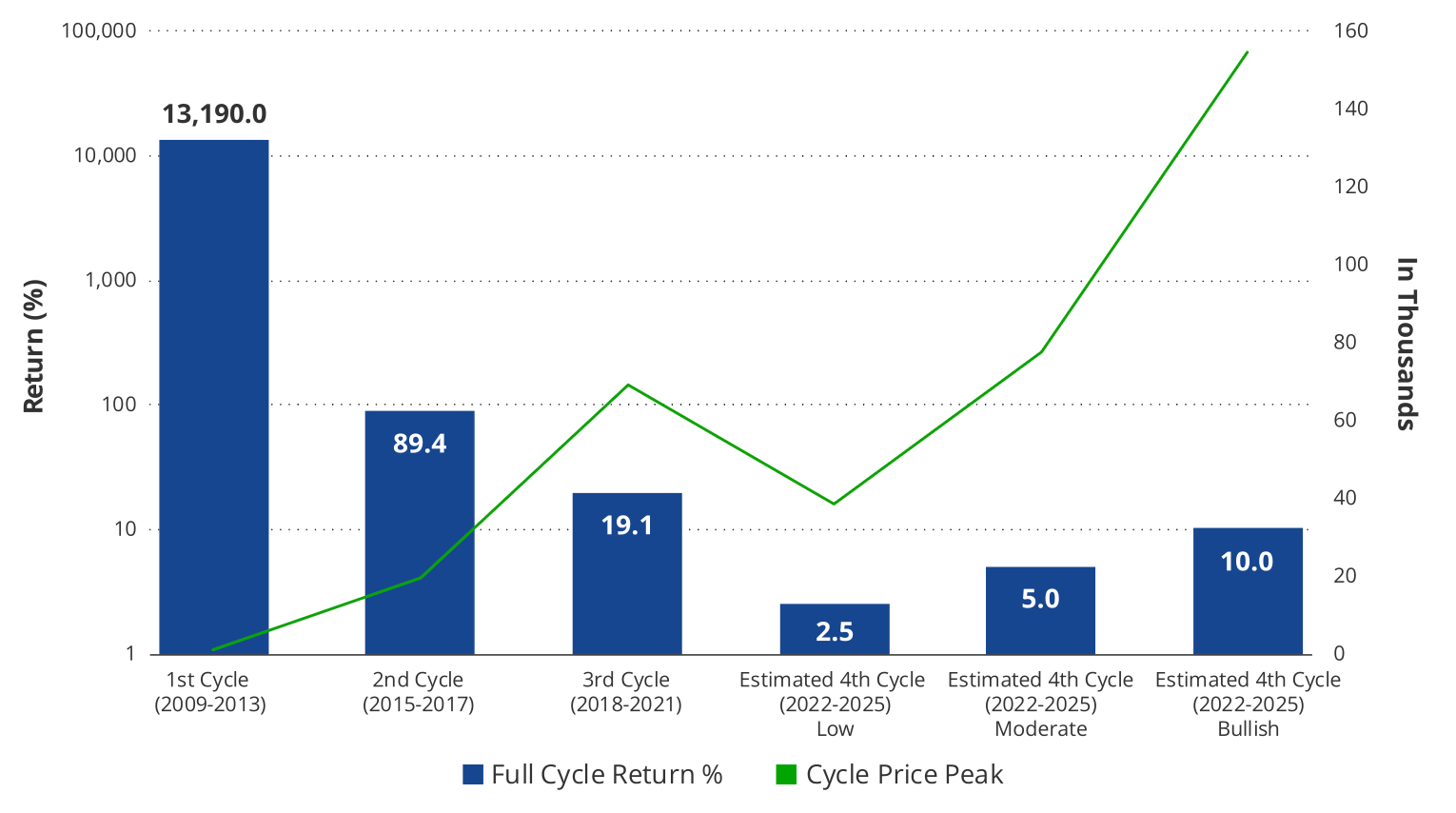

In the three-year period after Bitcoin’s Halvings :

- For the 2016 Halving, initiating an investment 30 days before the event and exiting 18 months later resulted in a substantial price surge of approximately 2540%.

- During the 2020 Halving, adopting a similar investment strategy yielded a price increase of around 847%.

- Observing the period from 18 to 36 months after the 2020 Halving, there was a noticeable price decline of 60%. The lowest price point in this cycle occurred on November 21, 2022, when it dipped to $15,787, marking a -76.4% retraction from the all time high ($68'789).

Historical patterns suggest that Halving could lead to a decrease in market supply thus potential price appreciation. Together with the approval of the Bitcoin spot ETFs, the effect may be heightened due to the storing of Bitcoin by the issuers, further siphoning liquidity away from the readily available supply.

Bitcoin ETF flows since launch (January 11, 2024)- BlackRock leads best ETF launch in 30 years with its spot Bitcoin ETF (IBIT).

- The 9 new Bitcoin ETFs have broken all time volume record on February 26, 2024 with $2.4B, IBIT accounting for $1.3B.

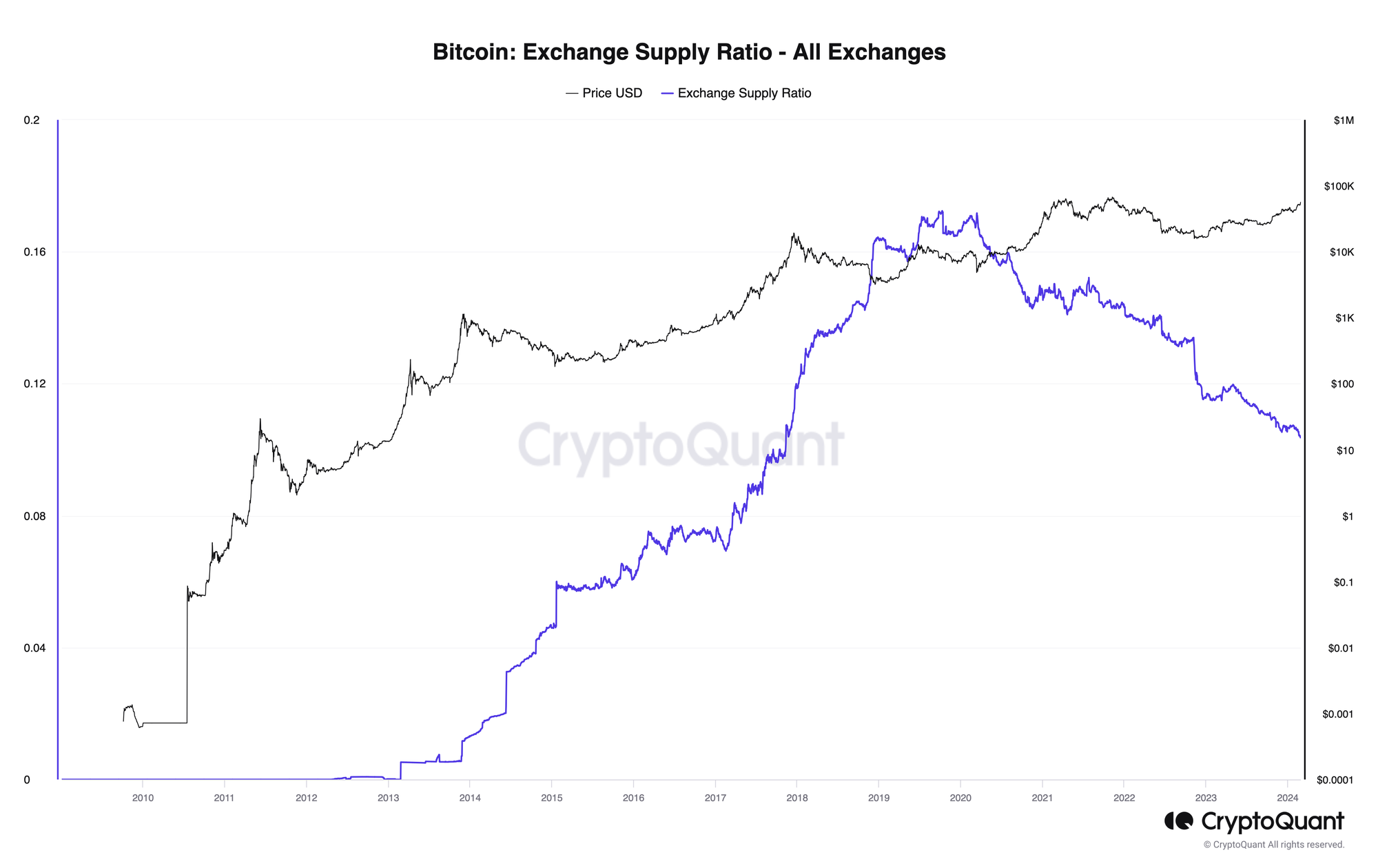

The exchange supply ratio, which measures the ratio of Bitcoins reserved in exchange wallets relative to the total available supply, has decreased since the introduction of Bitcoin ETFs.

The Bitcoin supply on spot exchanges is anticipated to experience significant fluctuations, potentially leading to a supply shock.

High demand might push prices to levels above the all time high.

Different Investment Strategies

Spot Investment

Spot investing involves investing a significant sum of money into Bitcoin at one time, rather than spreading it out over several periods like in dollar-cost averaging.

- Market Timing: This strategy requires a bit more market knowledge or speculation, as you're trying to enter the market at a time when Bitcoin's price is perceived to be low or at a point before anticipated growth.

- Potential for Higher Returns: If timed correctly, Spot investing can lead to higher returns compared to dollar-cost averaging, especially if the investment is made at a point of significant market undervaluation.

- Risk Factor: This approach carries a higher risk, especially in volatile markets like cryptocurrency. Investing a large amount at the wrong time can lead to significant losses if the market value decreases shortly after the investment.

- Capital Requirement: Spot investing requires having a substantial amount of capital available upfront, which might not be feasible for all investors.

- Suitable for Experienced Investors: Due to the risks associated with market timing and the larger capital requirement, Spot investing is often more suitable for experienced investors who have a better understanding of Bitcoin market trends and dynamics.

- Long-Term Perspective: Like dollar-cost averaging, Spot investing can be more beneficial when held over a long-term period, allowing the investment to potentially recover and grow despite short-term market fluctuations.

- Emotional Discipline: It requires a strong emotional discipline to resist the urge to sell when the market is down, especially since the potential loss on a lump-sum investment can be significant.

Dollar-cost averaging (DCA)

The choice between Spot investing and dollar-cost averaging often depends on individual factors such as risk tolerance, investment experience, market understanding, and the amount of capital available. Spot investing might offer greater potential returns but comes with higher risk and requires more market insight. It's important to carefully consider your own financial situation and investment goals before choosing a strategy.

Dollar-cost averaging (DCA) is a popular investment strategy, particularly when it comes to assets like Bitcoin which are known for their volatility. Here are some advantages of using the DCA strategy for buying Bitcoin:

- Reduces Impact of Volatility: Bitcoin's price can be highly volatile. By spreading out the purchase over time, DCA helps to mitigate the impact of short-term fluctuations in price. This means you avoid the risk of investing a large amount at a peak price.

- Simplifies Decision Making: DCA takes the guesswork out of trying to time the market. Instead of trying to predict the best times to buy, you invest a fixed amount at regular intervals. This disciplined approach can lead to a more stress-free investment experience.

- Encourages Long-Term Investing: By focusing on regular investments over time, DCA encourages a long-term view. This is beneficial with assets like Bitcoin, where holding for the long term has historically been more rewarding than short-term trading.

- Cost Averaging: Over time, the average cost per Bitcoin may end up being lower than the average market price during the same period. This is because you buy more Bitcoin when prices are low and less when prices are high.

- Accessibility for all investors: DCA is particularly useful for investors who might not want to invest a large amount of capital at once. It allows for participation in the Bitcoin market with more manageable amounts of money.

However, it's important to note that while DCA can offer these benefits, it does not guarantee a profit and does not protect against losses in declining markets. As with any investment strategy, it should be used in the context of individual financial goals and risk tolerance.

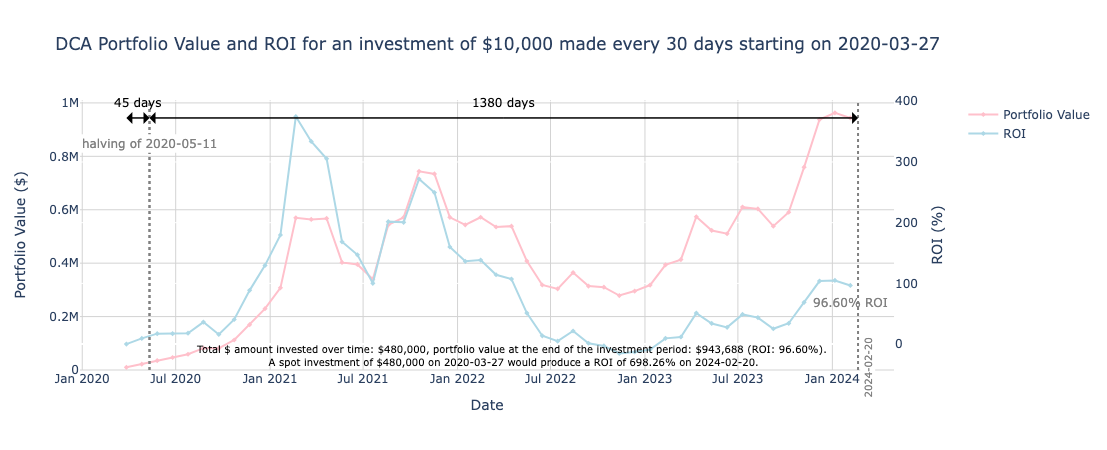

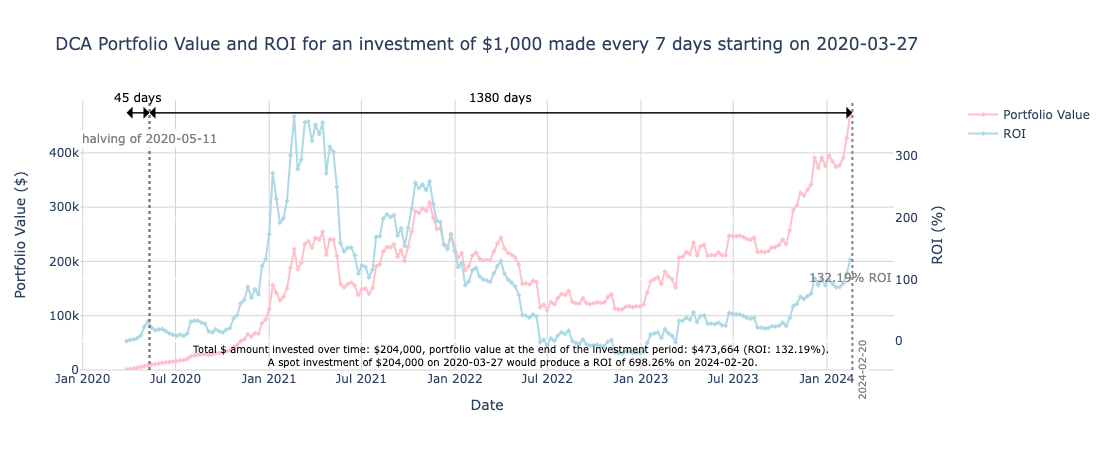

Considering two DCA strategies initiated 1.5 months before the last Halving in 2020, we have:

Nearly 4 years after the 2020 Halving, the DCA strategy of a monthly investment of $10k has resulted in a significant ROI of 96.60%.

Although much lower than the ROI on a Spot investment of the same dollar amount, this ROI demonstrates how a systematic DCA approach can provide substantial growth in cryptocurrency investments, where despite short-term volatility, the portfolio value demonstrates resilience and profitability over the investment period.

Similarly, with a DCA strategy of a weekly investment of $1k, the ROI would have been 132.19%.

Bitcoin Allocation in Classical Portfolio Diversification

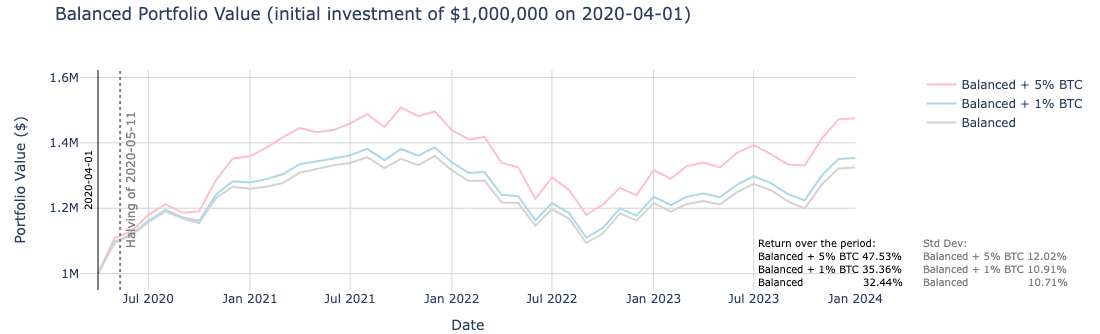

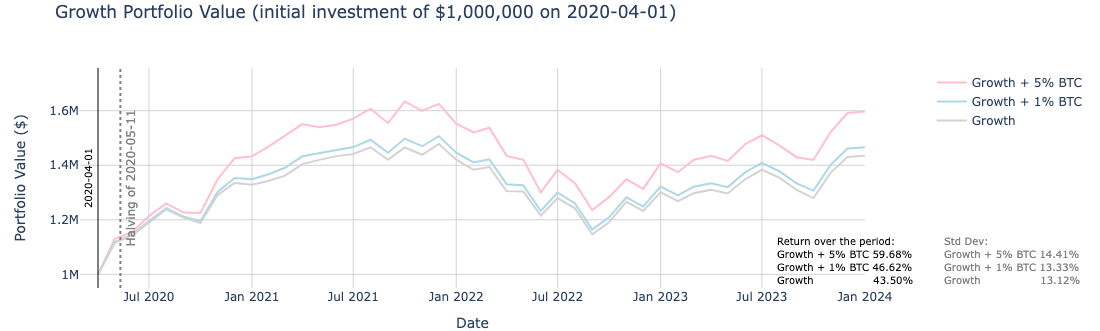

The inclusion of BTC in balanced or growth portfolios over periods spanning from 1.5 months prior to the 2020 Halving until today.

Balanced Portfolios (5% US Treasury Bills, 45% Global Bonds, 45% Global Equities, 5% Hedge Funds) compared to:

- Balanced + 1% BTC Portfolio (5% US Treasury Bills, 45% Global Bonds, 44% Global Equities, 5% Hedge Funds, and 1% Bitcoin)

- Balanced + 5% BTC Portfolio (5% US Treasury Bills, 45% Global Bonds, 40% Global Equities, 5% Hedge Funds, and 5% Bitcoin)

- Starting from an initial investment of $1m on April 1, 2020, 1.5 months before the 2020 Halving, the inclusion of Bitcoin in a balanced portfolio shows a noticeable improvement in portfolio value over time.

Growth Portfolios (2.5% US Treasury Bills, 30% Global Bonds, 65% Global Equities, 2.5% Hedge Funds) compared to:

- Growth + 1% BTC Portfolio (2.5% US Treasury Bills, 30% Global Bonds, 64% Global Equities, 2.5% Hedge Funds, 1% Bitcoin)

- Growth + 5% BTC Portfolio (2.5% US Treasury Bills, 30% Global Bonds, 60% Global Equities, 2.5% Hedge Funds, 5% Bitcoin)

- Starting from an initial investment of $1m on April 1, 2020, 1.5 months before the 2020 Halving, the inclusion of Bitcoin in a growth portfolio also shows a noticeable improvement in portfolio value over time.

In either case, the increased returns do come with higher volatility. Despite the higher risk, incorporating a Bitcoin allocation has the potential to substantially enhance portfolio performance, particularly in a favourable market for cryptocurrencies.

However, it's important to note that while these different strategies can offer benefits, they do not guarantee a profit and do not protect against losses in declining markets. As with any investment strategy, they should be used in the context of individual financial goals and risk tolerance.